Ethereum Price Surges 7% to Key Resistance of $3,930

Ethereum (ETH) price has increased 7% to reach the critical resistance level of $3,930 amid a broader crypto market recovery. ETH has been trading within a range of $3,500 to $4,000 as investors anticipate a potential breakout to a new all-time high.

Several factors contributed to today's ETH price movement. US CPI inflation numbers met expectations, fostering bullish sentiment across the crypto market. Bitcoin rose 3.5%, surpassing $100K, while altcoins, particularly Ethereum, experienced greater gains.

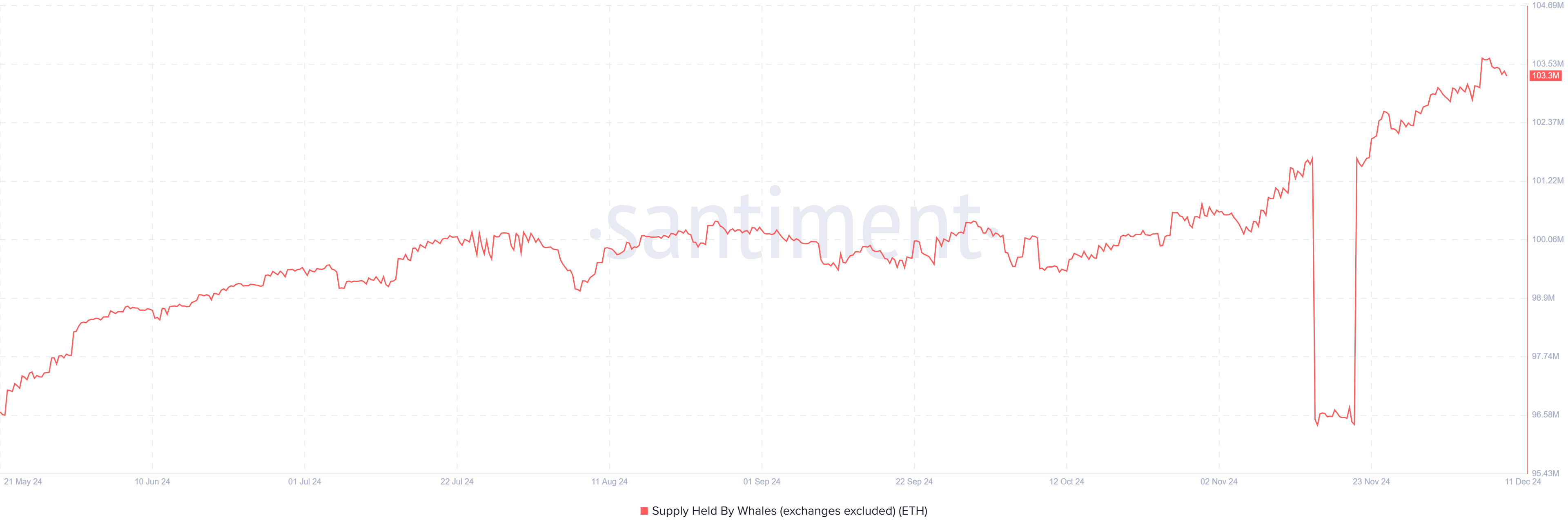

Additionally, Ethereum found support at $3,550 earlier this week, prompting institutional investors and whales to purchase ETH at lower prices, according to on-chain analytics. Over the past week, more than 130,000 ETH have been withdrawn from exchanges during the price drop.

During this period, whale holdings increased by over 340,000 ETH, indicating that bullish investors viewed the price dip as an opportunity to accumulate Ethereum at discounted levels.

Source: Santiment

Moreover, inflows into spot Ethereum ETFs remain robust. Over the last nine trading sessions, US Ether ETFs have recorded net inflows nearing $2 billion since inception. The BlackRock Ethereum ETF (ETHA) leads with $2.9 billion in inflows, while Fidelity's FETH follows closely with over $1.35 billion. This indicates rising institutional demand for Ethereum investment products.

Ethereum Price Eyes $5K amid Golden Cross Pattern

Ethereum has formed a bullish "golden cross" pattern, signaling potential upward momentum. Analysts forecast a possible rise to $5,000 for ETH.

$ETH Bullish Golden Cross

$5k ETH and AltSeason are coming 🚀 pic.twitter.com/GFt9LvxKOW

— Elja (@Eljaboom) December 12, 2024

In the near term, Ethereum must first close above the resistance of $3,930 to confirm the uptrend, having faced multiple pullbacks from this level previously. Subsequently, it must overcome the $4,093 resistance, where strong selling activity has occurred. A failure to do so could lead ETH back to support levels around $3,550; however, analysts suggest seller exhaustion at these levels may be occurring.