12 4

Ethereum Experiences 8.9% Pullback After Hitting New All-Time High

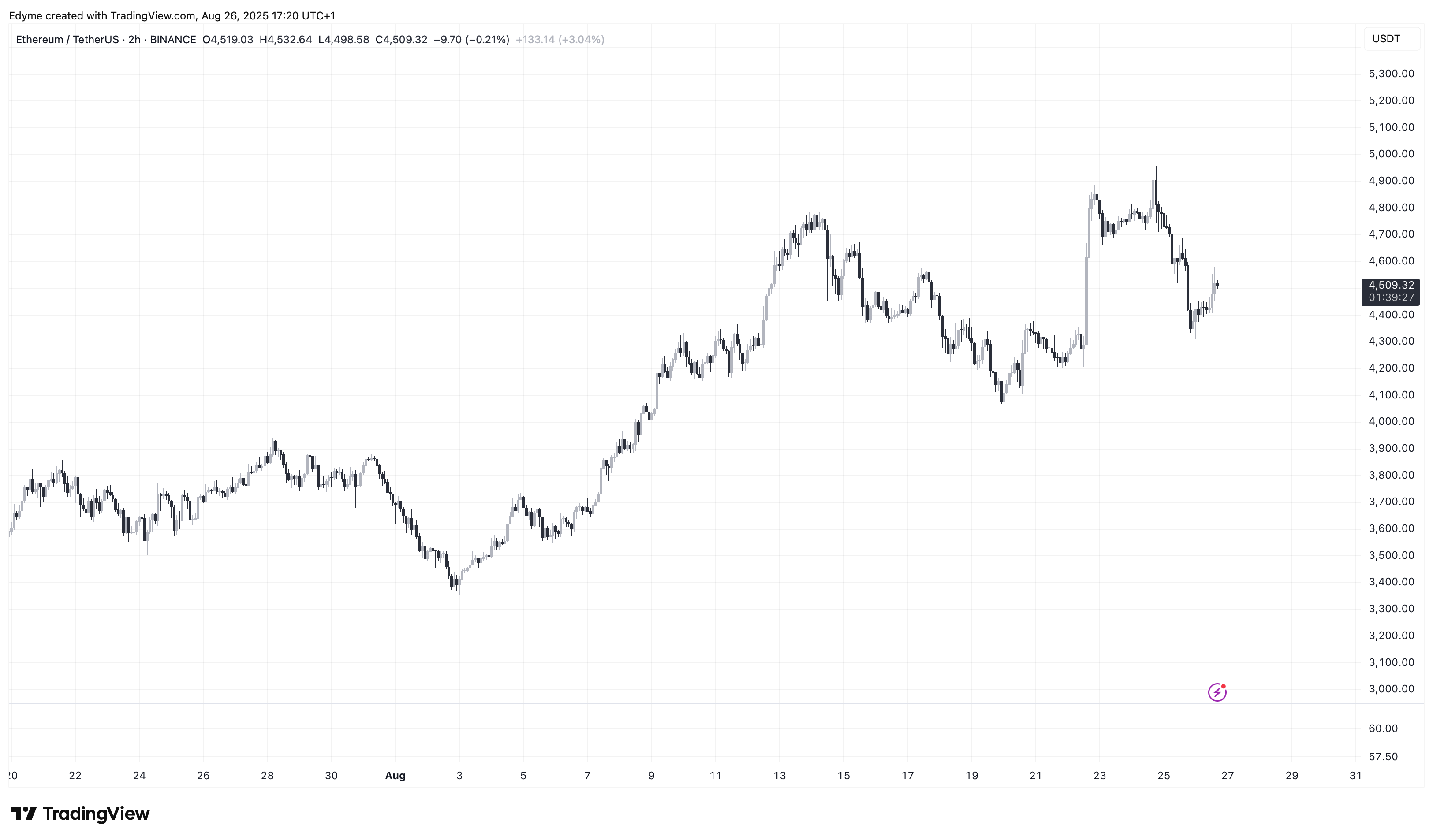

Ethereum (ETH) reached a new all-time high above $4,900 before correcting to $4,520, an 8.9% pullback but still up 7.6% over the past week. The surge follows strong momentum returning ETH to levels not seen since the 2021 bull market.

Market Dynamics

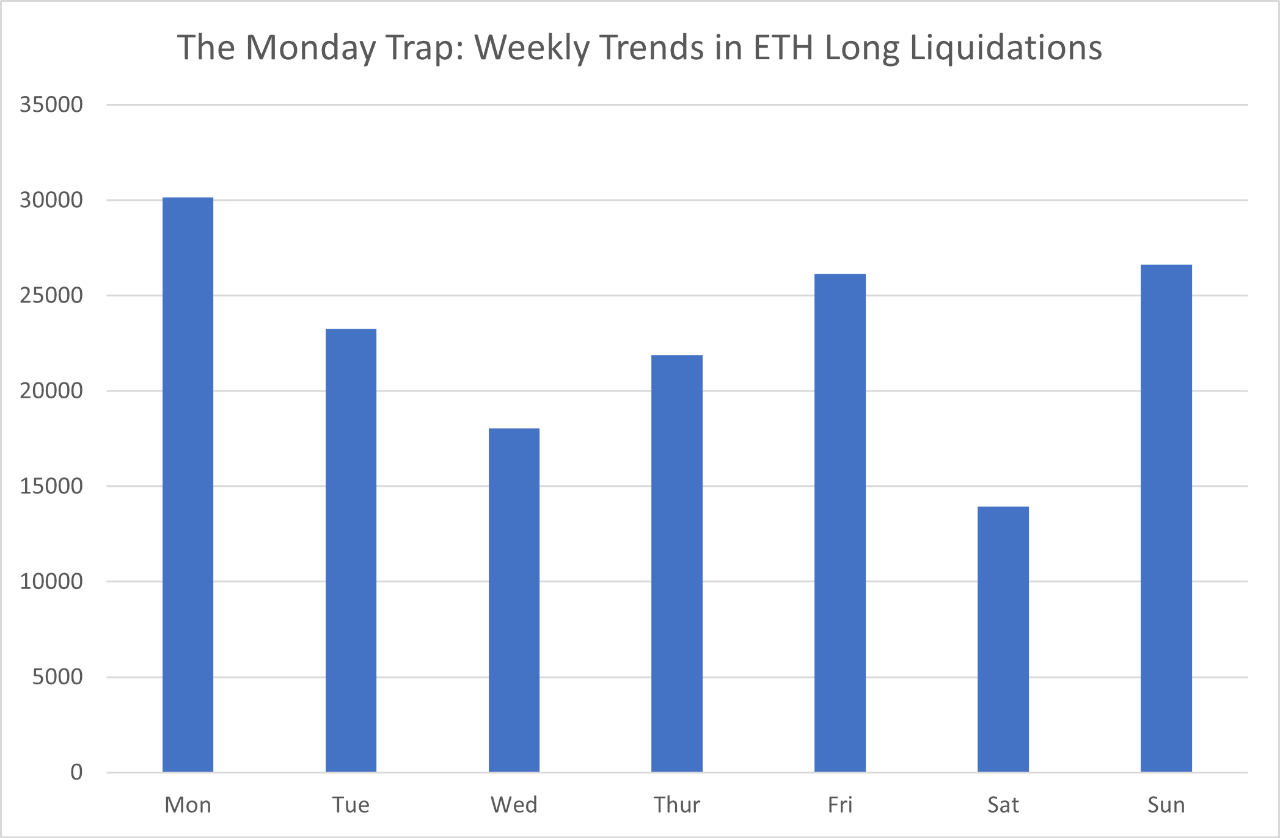

- XWIN Research Japan indicates recurring liquidation cycles influence ETH's price, particularly at the week's start.

- A pattern known as the “Monday Trap” reveals that leveraged long positions face heightened liquidation risks due to increased trading volume early in the week.

- During April and June 2025, liquidations exceeded 300,000 ETH in a single day during downturns.

- Liquidation volumes are highest on Mondays, followed by Sundays and Fridays, with Saturdays recording the lowest.

Technical Analysis

- Ethereum's price correction is under close observation, with support identified between $3,900 and $4,000.

- Holding this level could signal potential upward movement toward $6,000-$8,000.

- A breakdown below $3,900 may lead to further declines to $3,500 or $3,200.

Price analysis indicates a recent drop from $4,957 to $4,400, with strong support noted.

— Crypto Patel (@CryptoPatel)

Current netflow data shows ETH outflows from exchanges, indicating investor confidence and a trend toward self-custody rather than immediate selling. Institutional demand remains robust, driven by ongoing discussions of staking integration in regulated financial products such as ETFs.