13 February 2025

1 0

Ethereum Realized Price Indicates Undervaluation Amid Institutional Accumulation

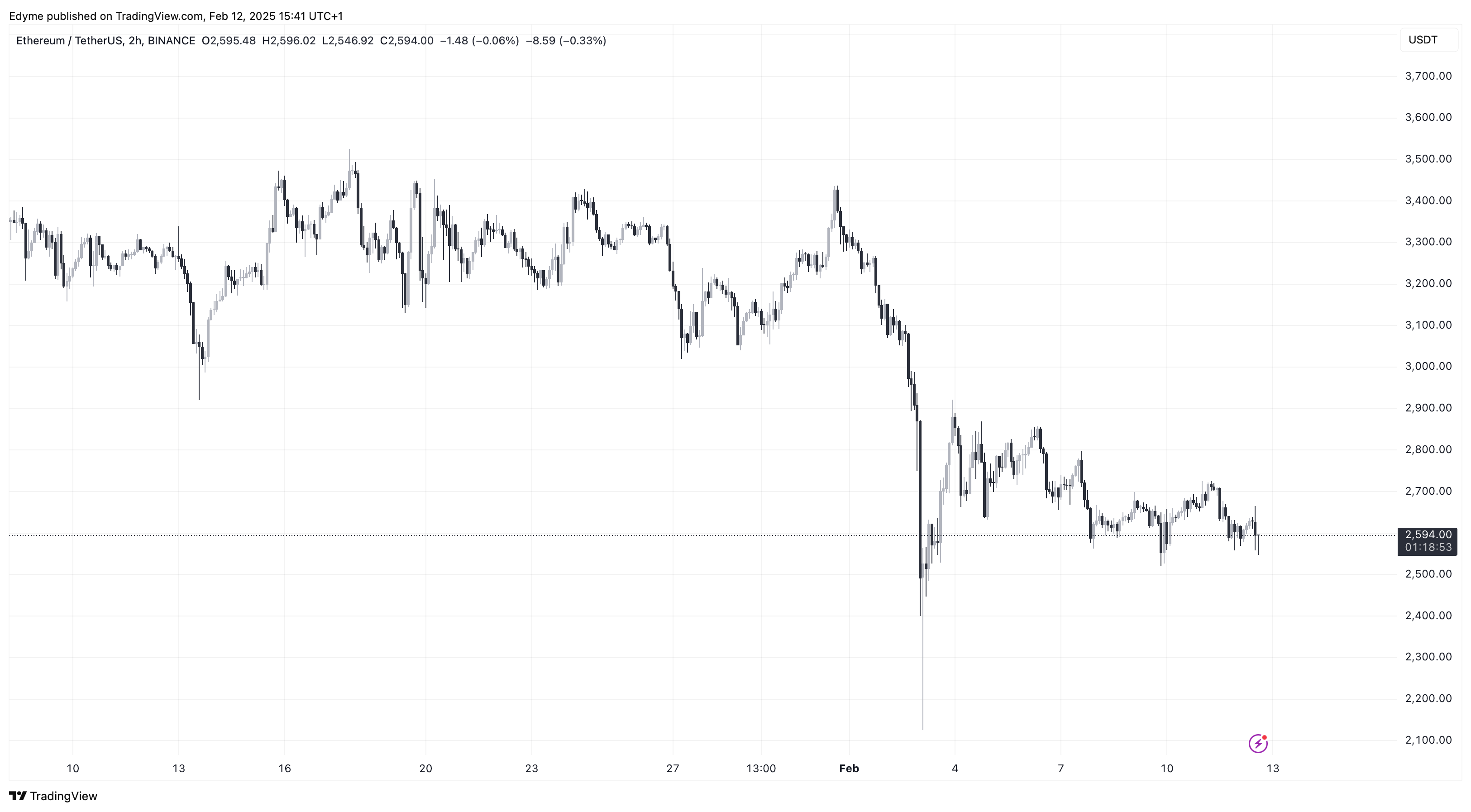

Ethereum's price has remained stable amid bearish sentiment in the broader crypto market, entering a prolonged consolidation phase. Recent analysis highlights the challenges facing Ethereum's "ultrasound money" narrative, with total supply reaching record highs and a decreased staking ratio.

Key Insights

- Ethereum appears undervalued with a realized price around $2,200 compared to the market price of approximately $2,600.

- Market value to realized value (MVRV) ratio is slightly above 1, suggesting potential support for prices.

- Long-term holders are accumulating ETH, stabilizing the market despite some larger investors selling.

- Selling pressure in the futures market has eased, indicating potential buying power influx.

- Institutional players, including BlackRock, have significantly increased their ETH holdings during the downturn.

The analysis notes that while challenges persist due to increased supply and macroeconomic uncertainties, the combination of undervaluation, strong holder participation, reduced sell pressure, and institutional accumulation suggests a positive medium- to long-term outlook for Ethereum.