0 0

Ethereum Faces Recovery Challenges Amid Weak US Institutional Demand

- Ethereum's price has pulled back from $3,300 to the $3,100 area, indicating ongoing struggles in establishing a sustainable recovery.

- The market shows weakening bullish momentum near key technical thresholds, creating a cautious tone among investors.

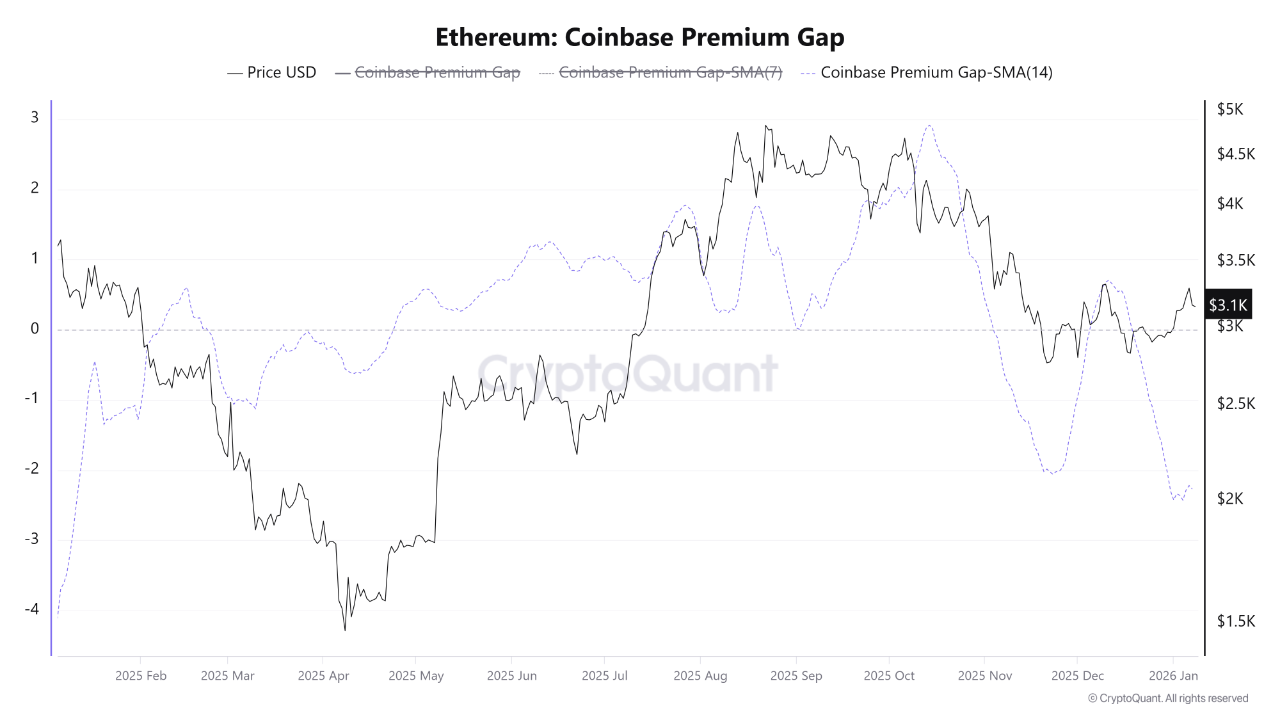

- On-chain data reveals that Ethereum's Coinbase Premium Gap is sharply negative, suggesting reduced US institutional demand compared to global activity.

- A negative Coinbase Premium indicates that US-based investors are either not buying or distributing rather than accumulating.

- This divergence between price stabilization attempts and weak US demand presents a structural challenge for bulls.

- Ethereum remains below critical resistance levels, with moving averages capping upside attempts and highlighting persistent selling pressure.

- The broader price structure reflects a corrective phase, with volume moderation during advances suggesting limited buying conviction.

- The $2,900–$3,000 range is crucial support; a break below could lead to a deeper retracement towards the mid-$2,600s.

- To regain bullish momentum, Ethereum must reclaim $3,300 and hold above declining moving averages.

Investors should remain cautious as current data suggests potential downside risks despite short-term stabilization efforts.