29 January 2025

1 0

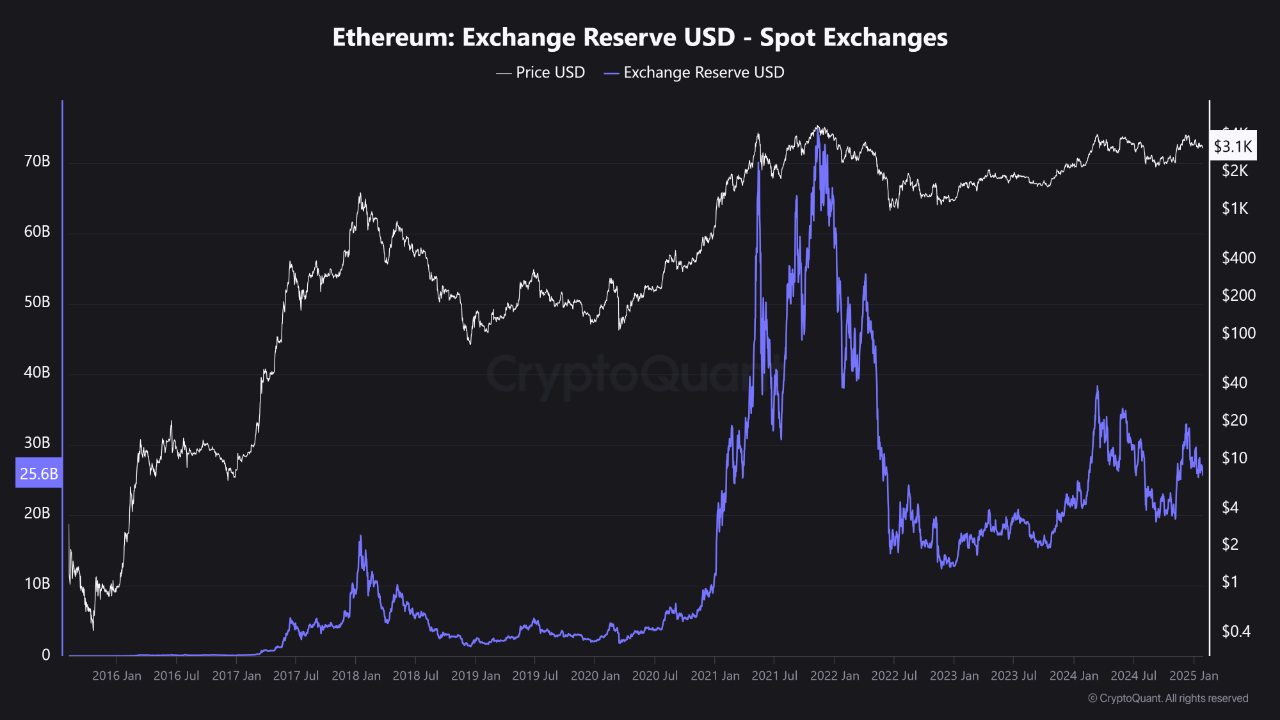

Ethereum Reserves Decline to Multi-Year Lows Amid Price Recovery

Ethereum's price has risen above $3,100, reflecting a 2.3% increase in the last day, though it is down 3.3% for the week. Analysts are examining Ethereum's on-chain metrics amidst a bearish trend.

Key Points

- Declining spot exchange reserves indicate long-term holder behavior.

- Reserves peaked during the 2017-2018 and 2020-2021 bull markets, followed by significant withdrawals starting late 2021.

- By 2023, reserve levels reached a low point, suggesting a potential supply shortage.

- Reduced reserves may create upward price pressure, leading to stabilization at higher levels since 2022.

- Technical analyses show bullish patterns, with some analysts believing Ethereum is undervalued and could reach new all-time highs.

- There is a divergence in market behavior between Bitcoin and Ethereum, with Ethereum showing lower performance against Bitcoin.

- Next support level for ETH/BTC may be between 0.028 and 0.026, which could spark renewed interest in Ethereum.