Ethereum Researcher Discusses Ether’s Role as Decentralized Money

Debate continues regarding whether ETH should be considered "money" like Bitcoin. In a recent Devcon talk, Ethereum Foundation researcher Mike Neuder presented his case for ether as both a permissionless and programmable asset, highlighting its potential as a decentralized currency with intrinsic property rights, censorship resistance, and self-sovereignty within the Ethereum ecosystem, including rollups.

Neuder discussed Ethereum’s "permissionlessness," referencing Hayek and Friedman, and emphasized that ETH holders enjoy unique ownership that is transferable, storable, and programmable. He contrasted this with centralized stablecoins such as USDC and USDT, which can have their funds frozen by issuers, marking ETH as distinct in on-chain finance.

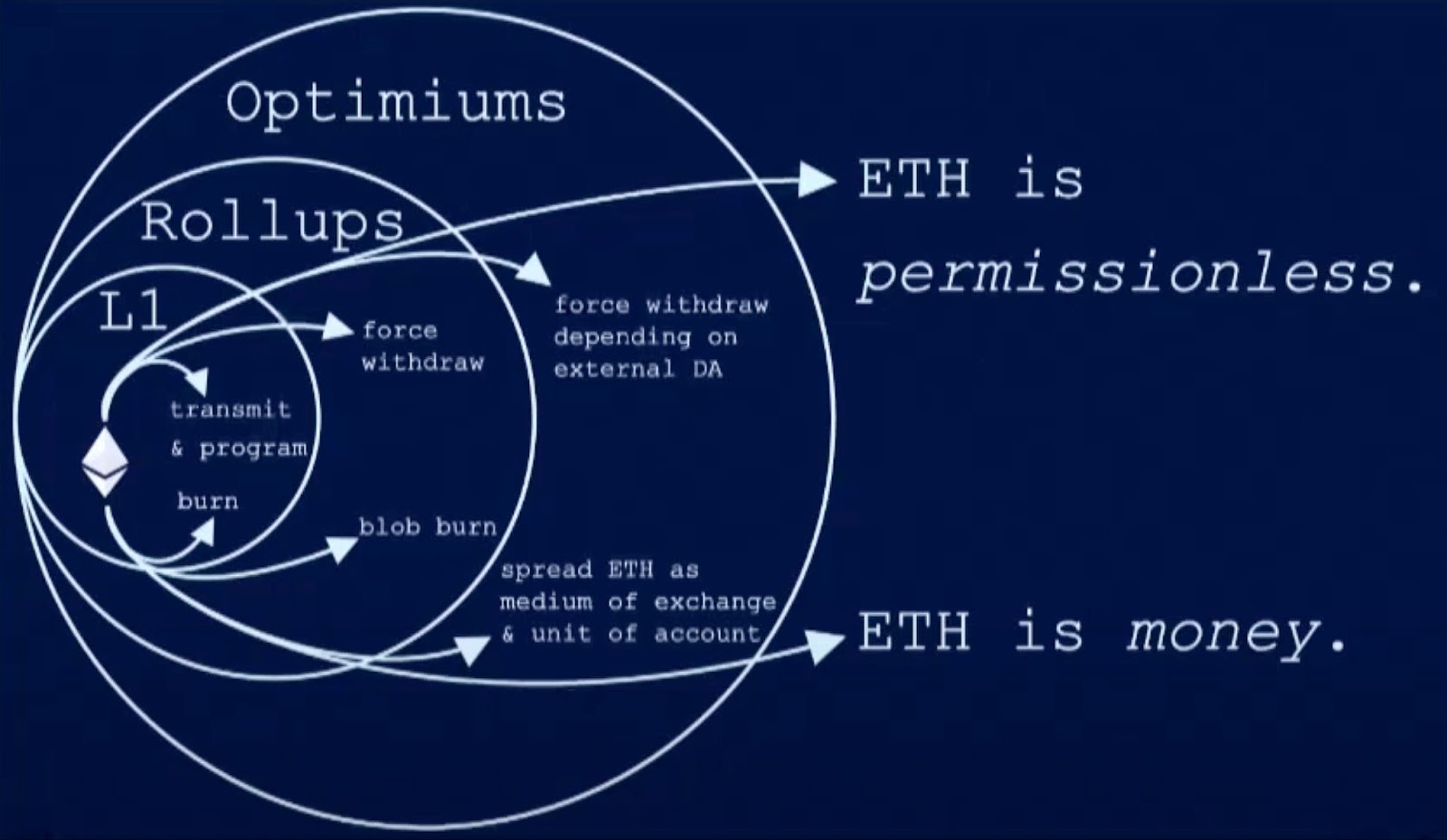

A significant part of Neuder's presentation focused on the expanding property rights of ETH across layer-2 rollups. However, he noted that rollups have not yet attained Stage 2 decentralization classification, which would allow users to bridge ETH in and out while preserving property rights. The ability to force withdrawals ensures users reclaim their assets even if a rollup's sequencer attempts to disrupt transactions, a core feature of layer-2 networks like Arbitrum One and OP Mainnet, which have reached Stage 1.

Neuder also compared Ethereum's inflation model to Bitcoin's, noting that since transitioning to proof-of-stake in the 2022 Merge, Ethereum's supply growth has slowed to an inflation rate near 0.9%. This is similar to Bitcoin's current 0.8% until its next halving in 2028. Ethereum's adaptive model, involving issuance, staking rewards, and an ETH burn mechanism, helps absorb inflationary pressures during high transaction volume periods.

Neuder argued that Ethereum's model is crucial for long-term security, contrasting it with Bitcoin’s fixed supply cap, which may challenge future network security once block rewards cease. He acknowledged the ongoing debate about the stability of the ether issuance curve and cautioned that frequent adjustments could undermine confidence in stability and impact "credible neutrality," a key value for Ethereum's resilience.

An important aspect of Ethereum's deflationary mechanics is the blob burn effect from layer-2 activity. Rollups post transaction data to the Ethereum mainnet in "blobs," which incur fees, a portion of which is burned, contributing to the overall ETH burn. This mechanism allows Ethereum to manage increased L2 transaction activity without overwhelming the base layer, thereby maintaining lower gas fees.

As layer-2 usage increases, so does the blob burn effect, enhancing Ethereum’s deflationary pressure during periods of high activity. In early November, the total dollar value of ETH burned surged to nearly $15 million due to elevated network activity, leading to a burn ratio of 182%, resulting in a net reduction of ETH supply.

Some in the Ethereum community downplay or dismiss ether's role as "sound" money. Ethereum co-founder Vitalik Buterin emphasizes the network's programmability and decentralization over viewing ETH as merely a monetary asset. Neuder highlighted the need for balance, reaffirming Ethereum’s commitment to credible neutrality and censorship resistance, positioning ETH as digital money rooted in self-sovereignty.