3 0

Ethereum Spot ETFs Report $186 Million Weekly Outflows Amid Market Decline

The Ethereum Spot ETFs faced a challenging week in 2025, resulting in notable net outflows. The Ethereum market mirrored these struggles, with the altcoin decreasing by 10% over the past week.

Ethereum ETFs Net Assets Decline Below $12 Billion

- Ethereum Spot ETFs recorded a weekly net outflow of $185.89 million.

- Fidelity’s FETH had the largest outflow at $276.13 million.

- Grayscale’s ETHE, ETH, and Bitwise’s ETHW saw minor withdrawals totaling $33.77 million.

- BlackRock’s ETHA was the only ETF with a net inflow of $124.11 million.

- Total net assets for Ethereum ETFs decreased to $11.61 billion, down 10.89%.

- Cumulative total net inflows to these funds reached $2.45 billion.

- Grayscale’s ETHE leads with $4.57 billion in net assets; BlackRock’s ETHA follows with $3.68 billion.

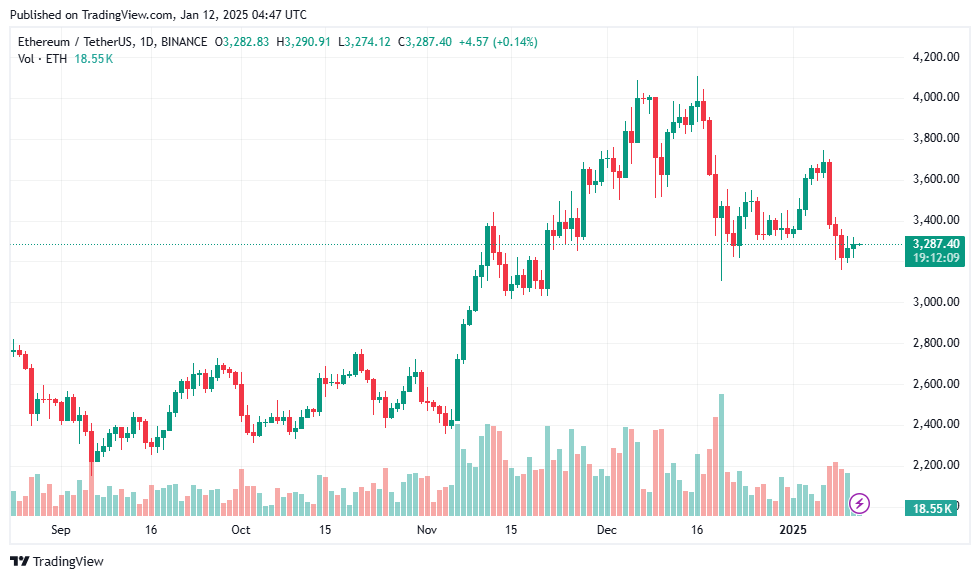

Ethereum Price Drops by 10%

- Ethereum's price fell by 10.06% this week, consistent with broader market declines.

- $1.4 billion in exchange outflows occurred as investors sought lower purchasing prices.

- Current trading price is $3,287, with a slight increase of 0.58% in the last 24 hours.

- Trading volume decreased by 55.98%, now at $11.75 billion.

- Resistance level at $3,350 needs to be surpassed for a potential rally towards $3,700.