0 0

BULLISH 📈 : Ethereum stabilizes above $2,000, eyes $3,000 breakthrough

Ethereum recently defended the $1,700 support level and reclaimed the $2,000 range, sparking bullish sentiment in the derivatives market.

- Exchange reserves for Ethereum have hit multi-year lows, indicating a potential supply shock as institutional demand stabilizes.

- Traders are targeting the $2,850 resistance zone, which could push prices rapidly toward $3,000 if breached.

- The Relative Strength Index (RSI) on the daily chart is stable, suggesting a pause in previous declines.

- Grayscale’s ETHE outflows have dried up, potentially reducing sell-side pressure. Positive net inflows for three days may lead to price repricing.

Possible Scenarios for Ethereum

- Bull Case: Flipping $2,250 resistance into support could lead ETH to $3,200.

- Base Case: Price consolidates between $2,550 and $2,750, allowing moving averages to align.

- Invalidation: A daily close below $2,000 risks retesting liquidity pools at $2,100.

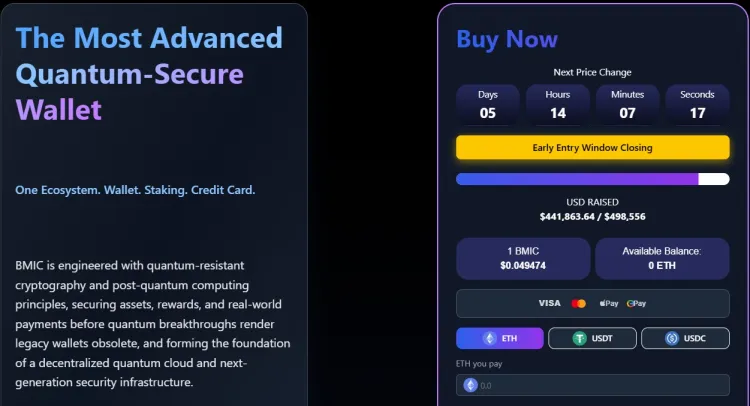

BMIC's Role in Quantum-Secure Finance

- BMIC focuses on mitigating threats from quantum computing, offering quantum-secure finance solutions including wallets, staking, and payments.

- The project raised over $441K, with tokens priced at $0.049474.

- Features include a 'Burn-to-Compute' model and AI-enhanced threat detection.

- Risks involve higher volatility and regulatory uncertainty compared to established Layer-1s.