6 0

BEARISH 📉 : Ethereum faces structural pressure amid massive open interest drop

Ethereum struggles below the $2,000 level, indicating ongoing selling pressure and fragile market sentiment. Traders remain cautious amid elevated volatility, with liquidity and derivatives positioning closely monitored for future trends.

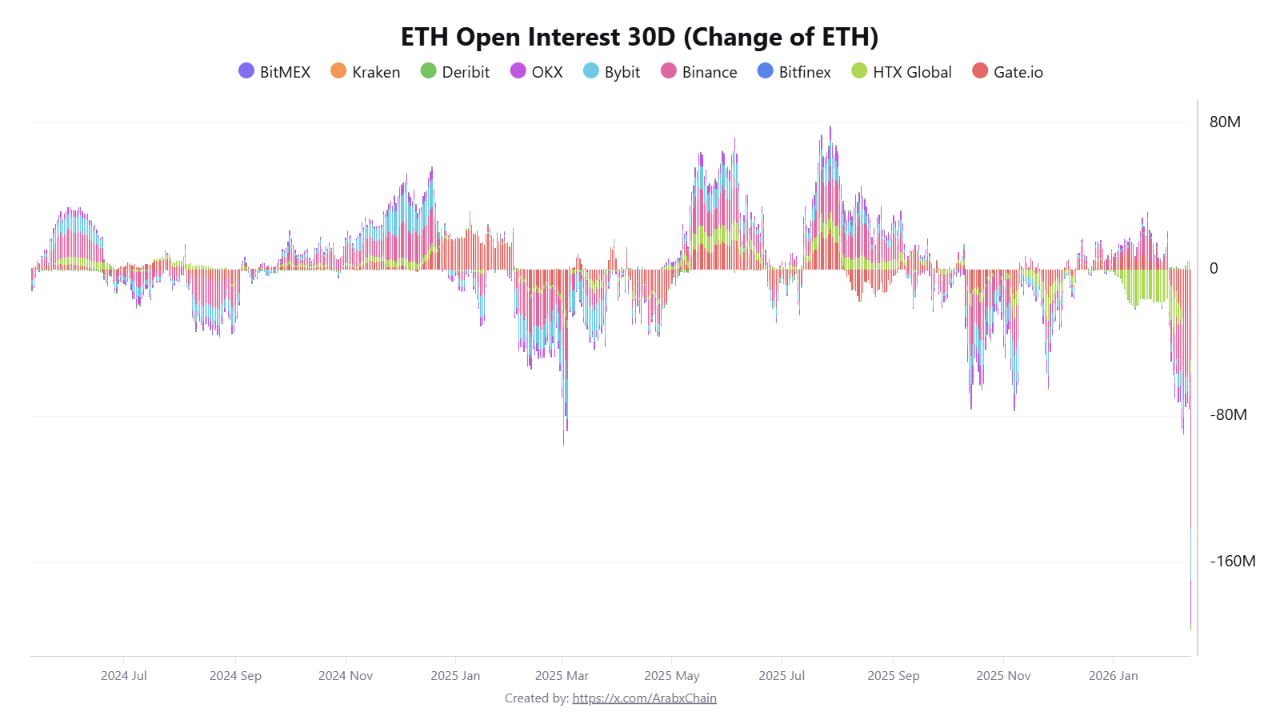

- A CryptoQuant report highlights a significant contraction in Ethereum futures open interest, suggesting deleveraging and risk adjustment across major exchanges like Binance, Gate.io, OKX, and Bybit.

- Binance recorded a drop of 40 million ETH in open interest, Gate.io over 20 million ETH, OKX nearly 6.8 million ETH, and Bybit about 8.5 million ETH, totaling around 75 million ETH.

Broad Deleveraging Suggests Market Reset

- Total contraction exceeds 80 million ETH across all exchanges, indicating a structural shift in the Ethereum derivatives ecosystem.

- The reduction in open interest suggests traders are reducing leverage rather than initiating new positions, reflecting caution due to recent volatility and price declines.

- Such contractions can stabilize market conditions by removing weaker leveraged positions, potentially setting a firmer price base as liquidity and sentiment stabilize.

Structural Pressure Below Key Support

- Ethereum faces downside pressure after losing the $2,000 support level, with several moving averages now acting as resistance.

- The price action shows rejection from the $3,000–$3,500 region, followed by lower highs, indicating a corrective phase.

- The next support area is near the $1,600–$1,700 range; holding this level is crucial for maintaining the broader long-term framework.

- Recovery depends on renewed demand and stabilization above key technical levels, influenced by macro liquidity and market sentiment.