BEARISH 📉 : Ethereum struggles to hold key $2,700 support level amid pressure

Ethereum's price has dropped below $2,800 and is struggling to maintain the $2,700 level amidst weak market conditions. Despite limited follow-through on rebounds, on-chain data suggests continued accumulation by long-term buyers.

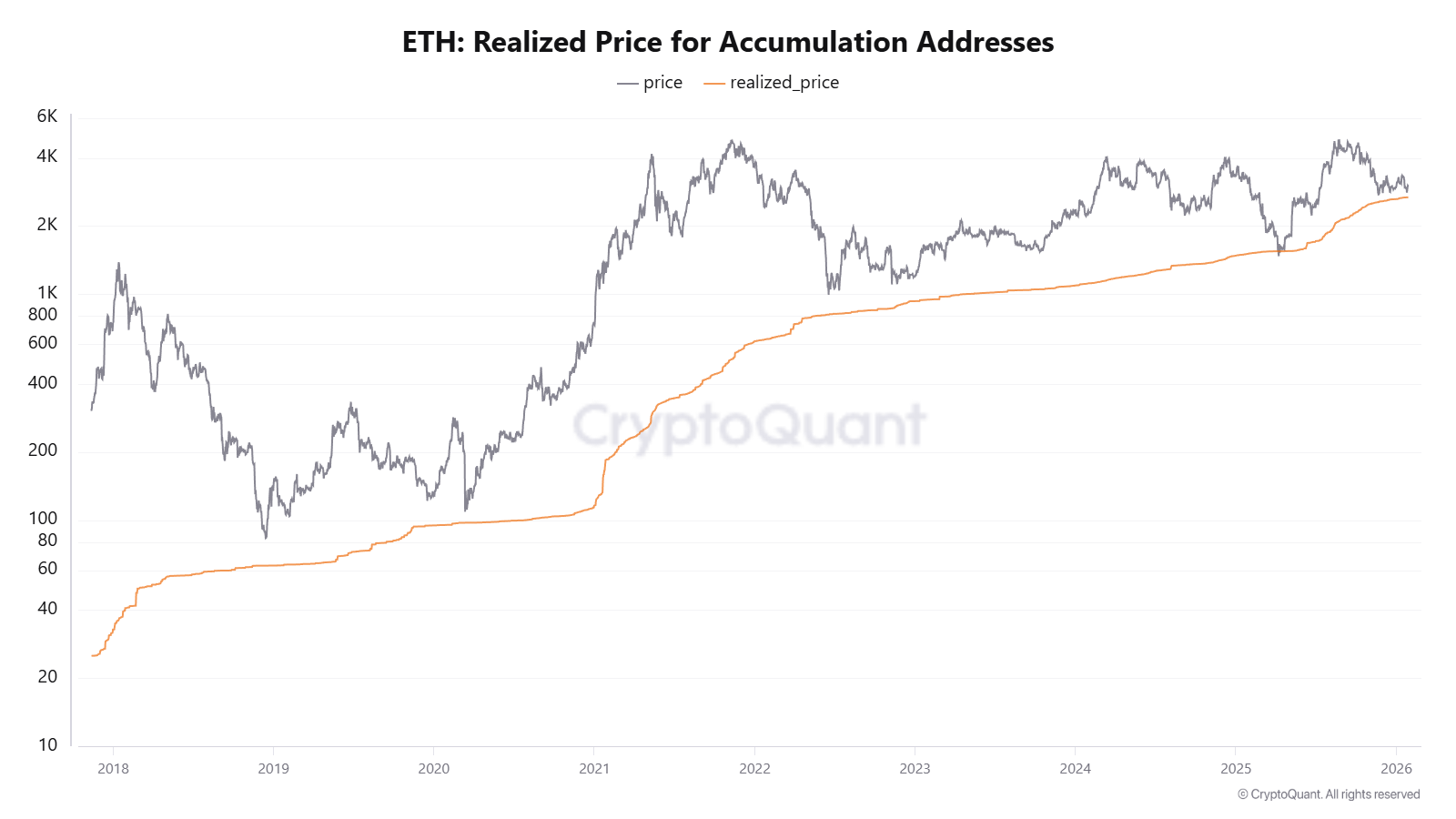

- The realized price for ETH accumulation addresses is rising, approaching the current market price, indicating active accumulation despite the downturn.

- This zone has historically been a strong support level, showing stabilization rather than downside acceleration during previous tests.

Whale Cost Basis as Key Support

Ethereum's decline to around $2,682 aligns with the realized price of accumulation addresses, marking a key support zone. This level indicates where committed long-term buyers stand.

- Historical data shows this realized price acts as structural support, transitioning from speculative selling to absorption by long-term holders.

- Whales continue accumulating ETH near these levels, reinforcing their confidence in this cost basis.

Ethereum Tests Long-Term Demand

ETH remains under pressure, trading in the $2,700–$2,750 range after failing to stay above $3,000. The trend shows lower highs and lows since November, indicating a corrective phase.

- ETH is below its short- and medium-term moving averages, with dynamic resistance at the 50-day and 100-day averages.

- The 200-day average above $3,500 highlights lost long-term momentum and suggests a consolidation-to-distribution phase.

- Volume declines indicate moves are not driven by panic selling but lack aggressive buyer follow-through.

As long as ETH holds above $2,650–$2,700, it may remain range-bound. A breakdown below this could lead to deeper retracement, while stabilization supports base-building.