11 1

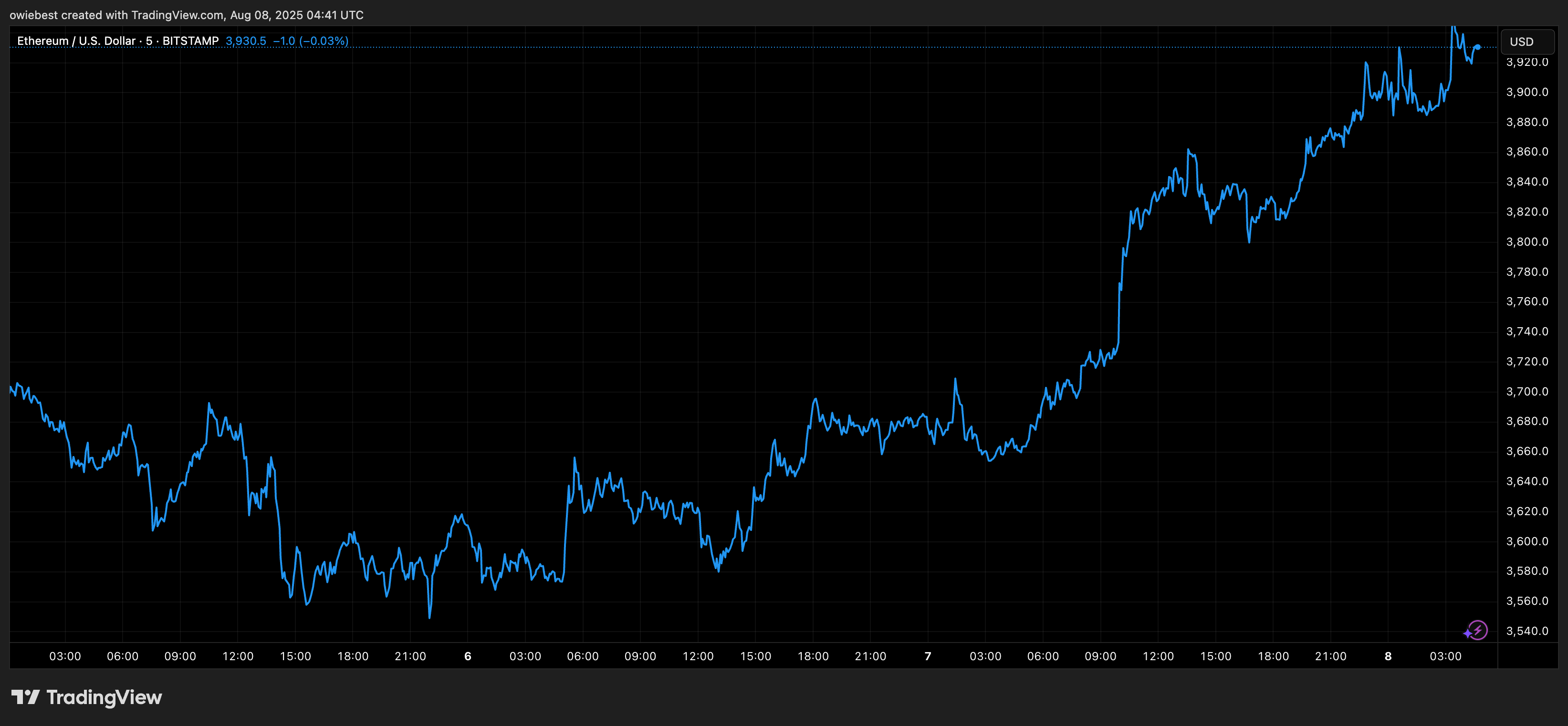

Ethereum Struggles to Break $4,000 Due to Hedge Fund Pressure

The Ethereum price has struggled to surpass the $4,000 mark despite a 40% increase in May and July. This resistance level is critical for maintaining an upward trend. Market insights suggest hedge funds are intentionally keeping prices below $4,000 to protect short positions.

Impact on Options Traders

- Hedge funds benefit from premiums by suppressing Ethereum’s price.

- Options buyers are betting on price increases above $4,000.

- Every time Ethereum approaches $4,000, it experiences a pullback to maintain hedge fund profits.

Consequences of Surpassing $4,000

- If Ethereum crosses $4,000, hedge funds will incur losses while options buyers profit.

- A repeated proximity to this resistance increases the likelihood of a breakout.

- Long-term, breaking above $4,000 could lead to significant price gains.