2 0

BEARISH 📉 : Ethereum struggles to maintain $2,000 amid sell-off pressure

Ethereum Market Update:

- Ethereum is struggling to maintain the $2,000 level amid ongoing selling pressure.

- Recent volatility and cautious investor sentiment persist due to a prolonged downtrend in major digital assets.

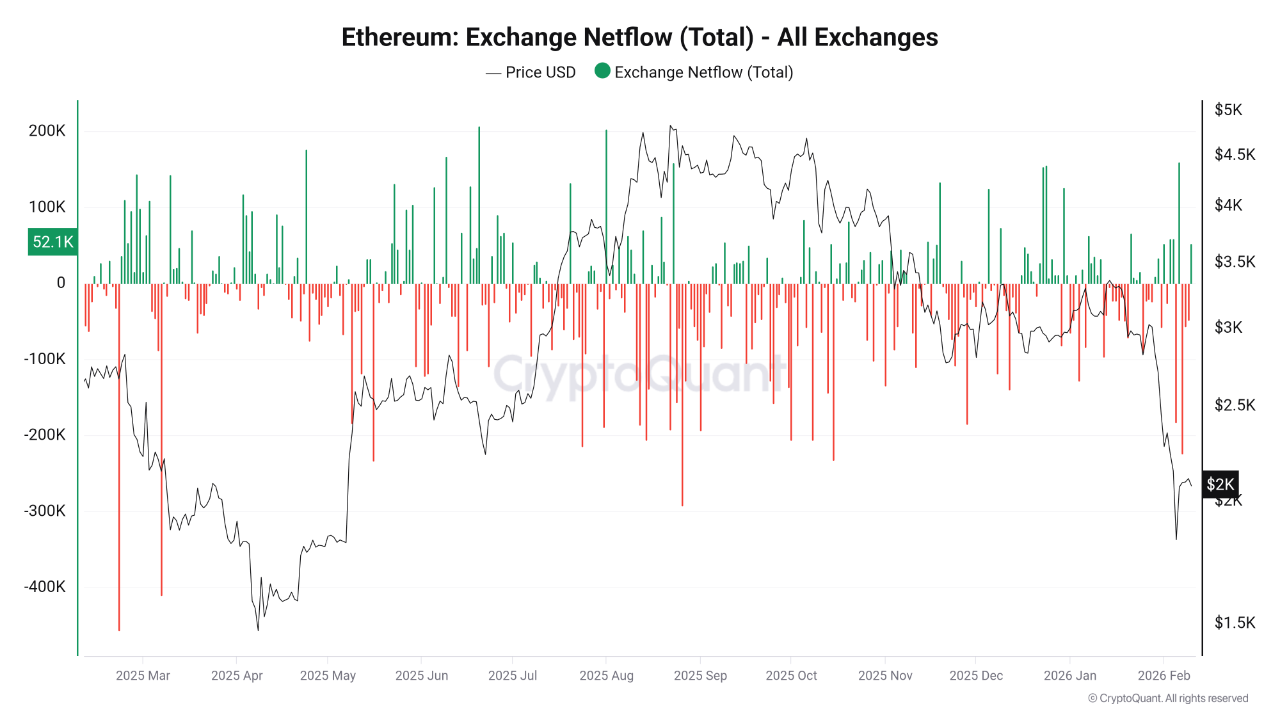

- CryptoQuant reports a significant increase in Ethereum withdrawals from exchanges, exceeding 220,000 ETH, indicating possible shifts in market positioning.

- Withdrawals generally imply a transfer to private wallets or long-term storage, suggesting either defensive behavior or early accumulation signs.

- Binance saw substantial daily net outflows of approximately -158,000 ETH, suggesting institutional activity rather than retail-driven movements.

Technical Analysis:

- Ethereum recently broke down from the $2,800–$3,000 range, confirming a bearish shift.

- The price is testing the critical $2,000 support level, which historically acts as both resistance and support.

- Volume spikes during the drop suggest forced selling or risk reduction from leveraged positions.

- Ethereum remains below key moving averages, pointing to potential continuation of the downtrend unless it reclaims the $2,400–$2,600 area.

- Failure to hold the $2,000 level may lead to further declines toward the $1,600–$1,800 range.

Investors should monitor whether Ethereum can sustain support at the $2,000 mark or if it will turn into resistance.