Ethereum Surges to $3,219 Amid Spike in Whale Transactions

Ethereum has reached a local high of $3,219, experiencing a 35% surge since last Monday. This rise has generated optimism among analysts and investors, who view Ethereum as poised for further gains, particularly as it strengthens against Bitcoin. The rally indicates renewed confidence in ETH, especially with increased activity from major stakeholders.

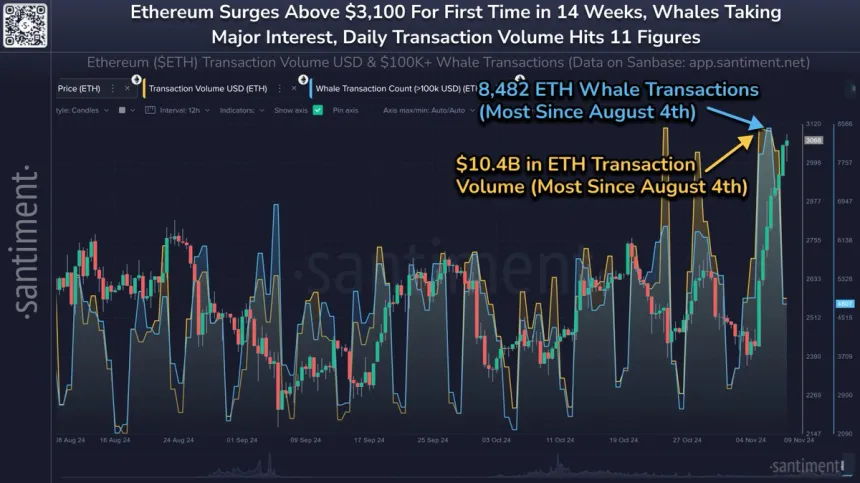

Data from Santiment shows a notable increase in whale transactions, suggesting that large ETH holders are accumulating, which often precedes price appreciation. Analysts are monitoring Ethereum's performance against Bitcoin closely, noting that its recent momentum could signal the start of a sustained uptrend.

Ethereum Bull Phase Starting

Ethereum has entered a bullish phase after breaking key resistance levels and establishing a positive price structure. Recent Santiment data confirms this trend, with strong growth metrics indicating potential further gains. Whale transaction data reveals significant activity from major stakeholders, contributing to Ethereum's highest price in over 14 weeks.

Increased transaction volume has also been observed, reaching approximately $10.4 billion recently. This spike reflects rising demand and interest in ETH, with large transactions indicating confidence from institutional and high-net-worth investors.

Santiment analysts suggest Bitcoin's performance during this bull run could catalyze Ethereum's growth, as profits may shift from BTC to ETH. Historically, this dynamic has benefited Ethereum during strong market cycles, potentially allowing ETH to approach its previous all-time high.

Moreover, robust network activity serves as another indicator of Ethereum's growth potential, supported by heightened stakeholder participation and transaction volume.

ETH Testing Fresh Supply

Ethereum (ETH) is currently trading at $3,170, showing strength after surpassing the 200-day moving average (MA) at $2,955. This breakout signals that bulls are in control as ETH enters new supply zones. Maintaining above the 200-day MA is a positive sign for sustaining the bullish trend.

If ETH pulls back, a decline to the 200-day MA would represent a healthy retracement, possibly setting the stage for further gains. Consolidation at this level could attract more demand, supporting the ongoing uptrend.

The current strong price action and fresh market demand might propel Ethereum higher without significant pullbacks. The momentum ETH is building could facilitate breakthroughs through successive supply levels, aiming for higher targets. Ethereum’s upward trajectory is backed by solid technical indicators and a favorable market environment for continued growth.

Featured image from Dall-E, chart from TradingView