Ethereum Surges Above $1,800 Amid Declining Binance Supply

Ethereum is trading above $1,800 after a 15.3% increase in two weeks, showing resilience despite investor concerns and declining public enthusiasm. Renewed buying interest and positive on-chain indicators suggest potential bullish momentum.

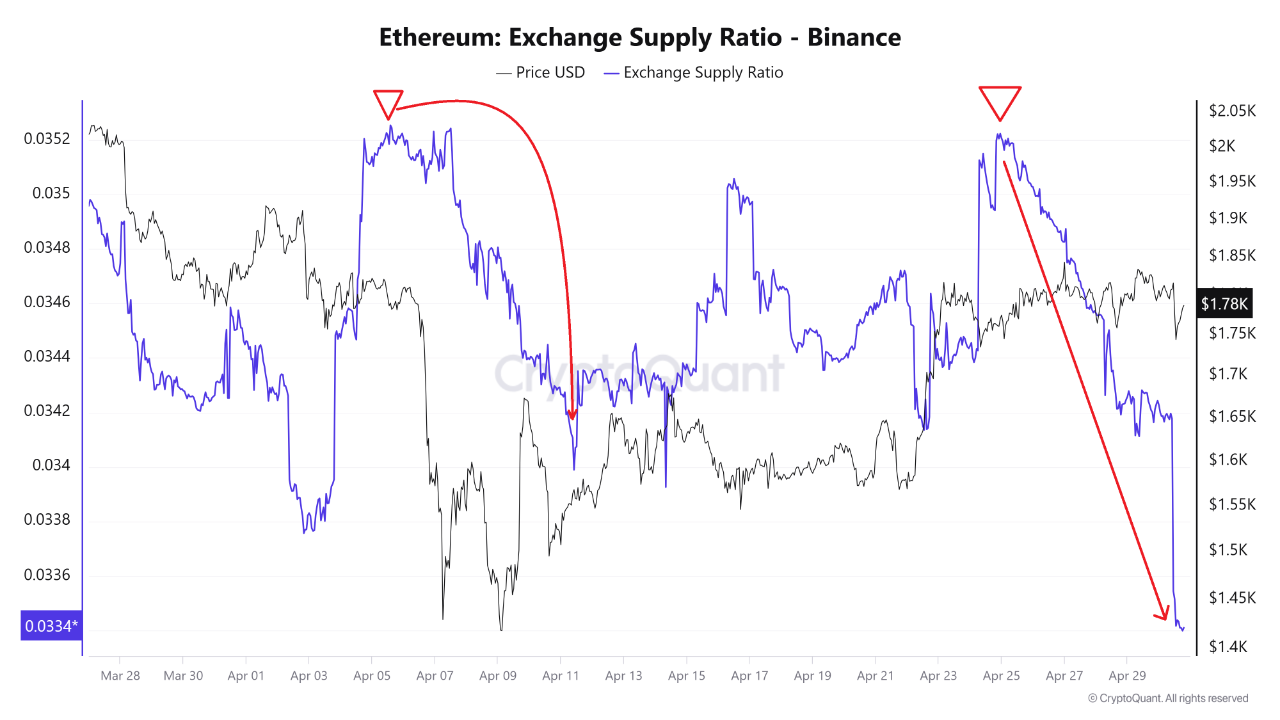

Declining Exchange Supply Signals Reduced Selling Pressure

The Ethereum Exchange Supply Ratio on Binance has reached a multi-week low, indicating more ETH is being withdrawn for cold storage or DeFi protocols. This trend historically correlates with reduced sell-side pressure, as assets are typically withdrawn by users intending to hold or utilize them elsewhere.

A similar situation occurred in April, where a decrease in exchange supply preceded a price rally from below $1,700 to around $1,950, demonstrating the potential impact of current trends.

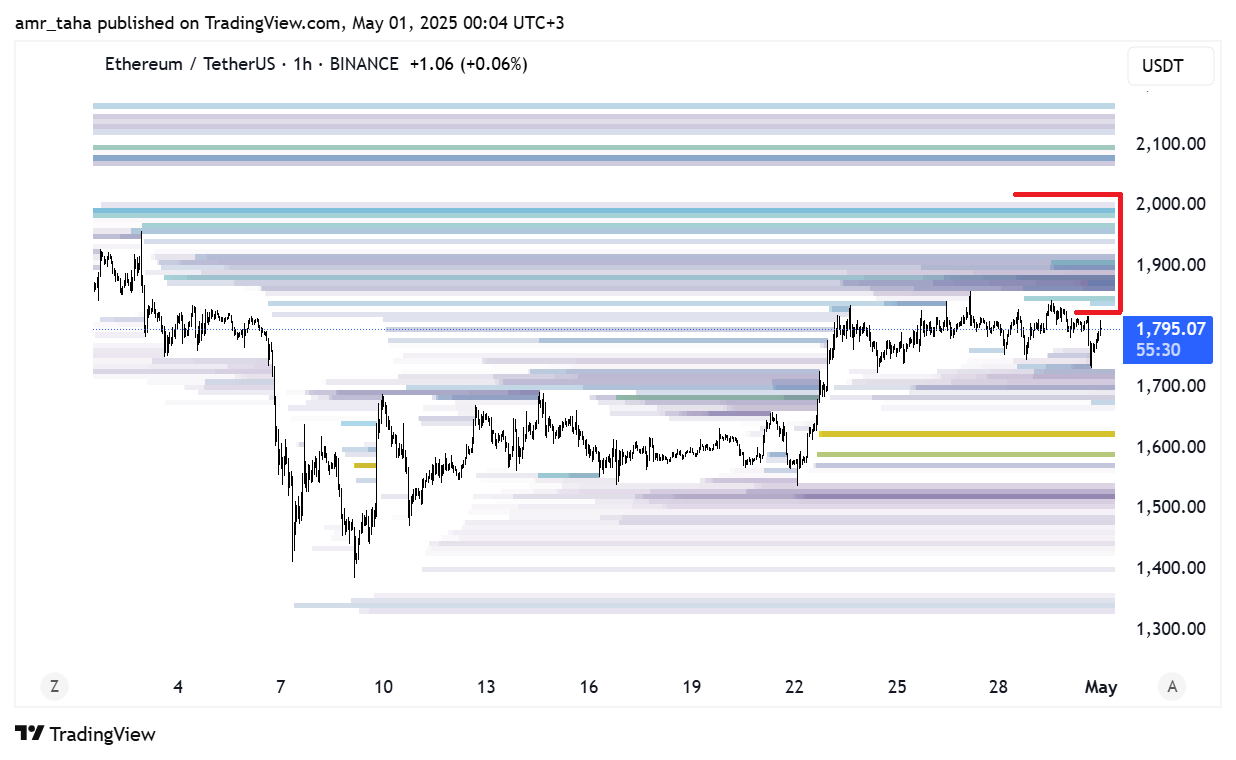

Ethereum Short Squeeze Setup Emerges Around $1,900–$2,000

Heatmaps show a growing cluster of short positions between $1,900 and $2,000. If ETH reaches this range, forced liquidations could create upward price movement. The combination of decreased exchange balances and increased short interest is setting the stage for a “liquidity hunt,” potentially amplifying ETH's upward momentum.

The $1,900 to $2,000 price range is becoming increasingly crucial due to the current price momentum and reduced selling resistance.