1 0

Ethereum Surges to $2,500 Amid Shift in Market Dynamics

Ethereum (ETH) has increased from $2,111 on June 12 to $2,515 on June 25, renewing expectations for a rise beyond $3,000.

Market Dynamics Shift

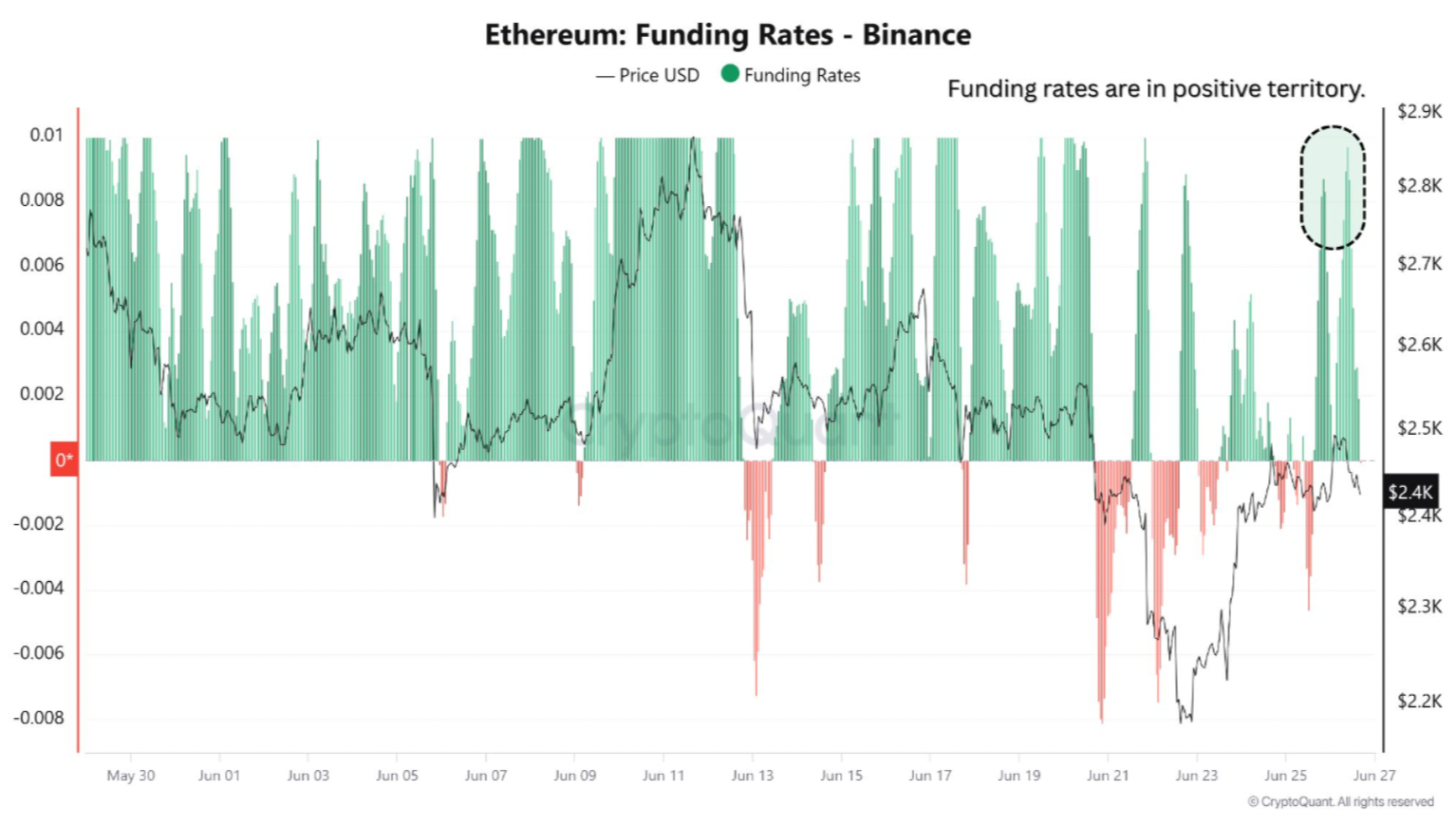

- ETH funding rates have shifted from negative to positive, indicating trader optimism about further price increases.

- A potential short squeeze has occurred as ETH retested the $2,500 level, forcing traders holding short positions to buy back aggressively.

- Data from CoinGlass shows that 68.15% of liquidations in the past 24 hours were long positions, suggesting risks of a price pullback.

- Over three days, 177,000 ETH was deposited into Binance, signaling possible selling pressure or repositioning by major holders.

- A short-term correction is likely, but aggressive speculative activity is driving current price movement.

Outlook for ETH

- Technical analysis indicates a potential breakout above the $2,800 resistance level.

- ETH has formed a golden cross on the daily chart, increasing speculation for new all-time highs.

- However, some analysts predict a possible revisit of lower levels between $1,700 and $1,950.

- Currently, ETH trades at $2,429, down 0.4% over the past 24 hours.