Ethereum Surges Above $2,500 Amid Increased Futures Market Activity

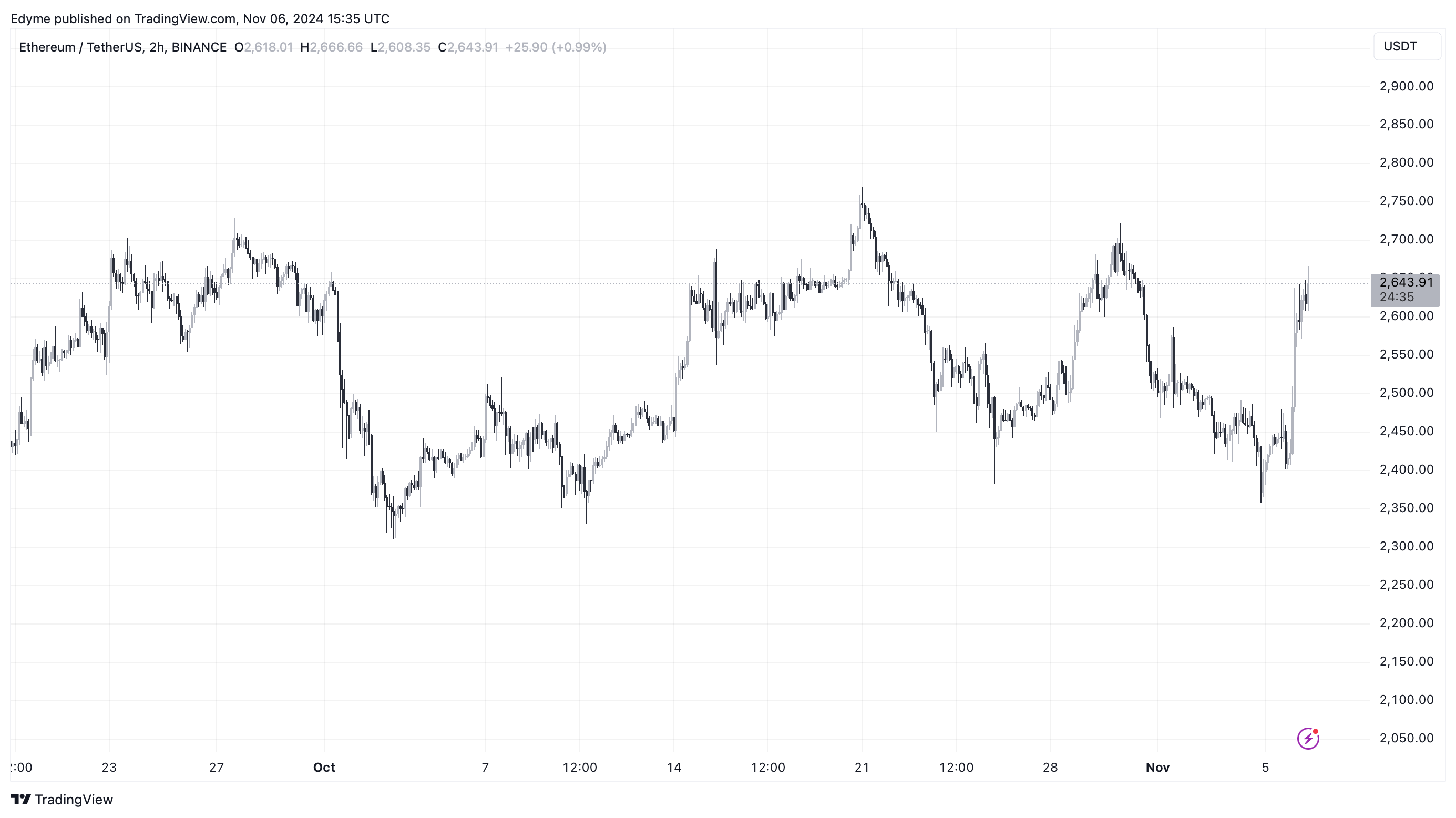

Ethereum broke above the $2,500 resistance, trading at $2,631 post US election 2024. This price movement raises speculation about a potential bull run.

Market analysts express caution despite optimism driven by Ethereum's futures market metrics.

Rising Futures Metrics: A Double-Edged Sword

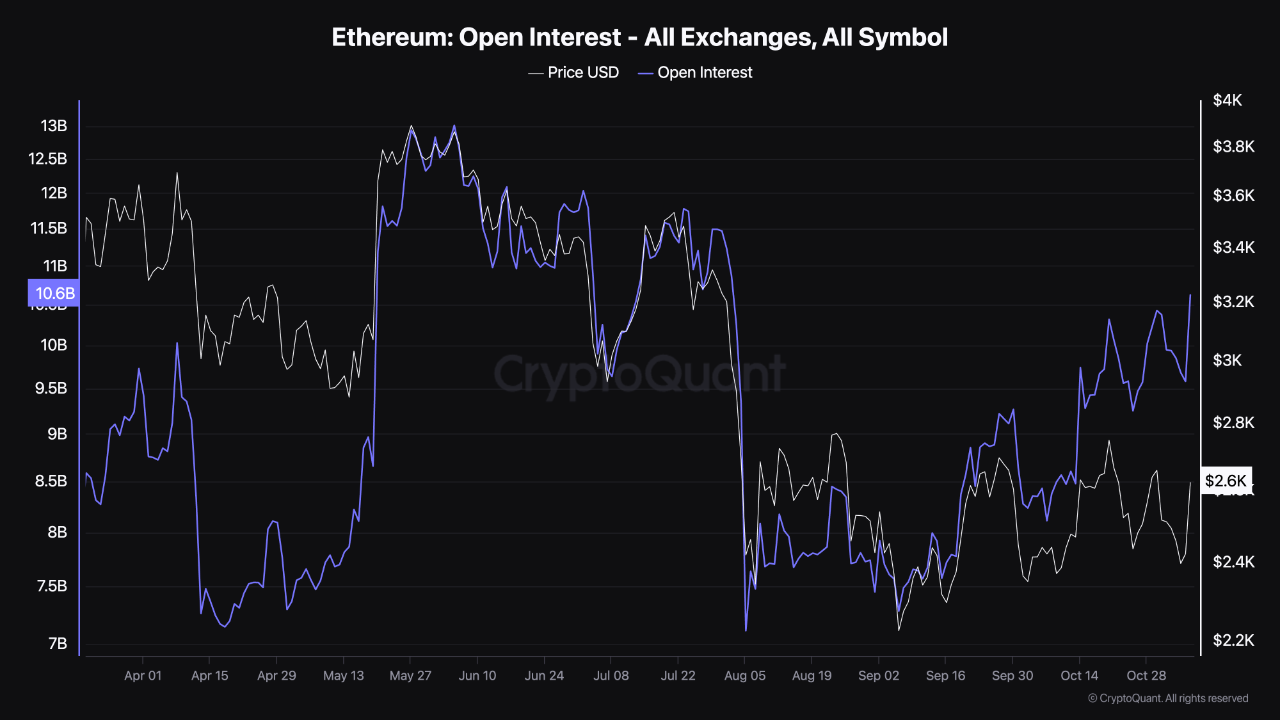

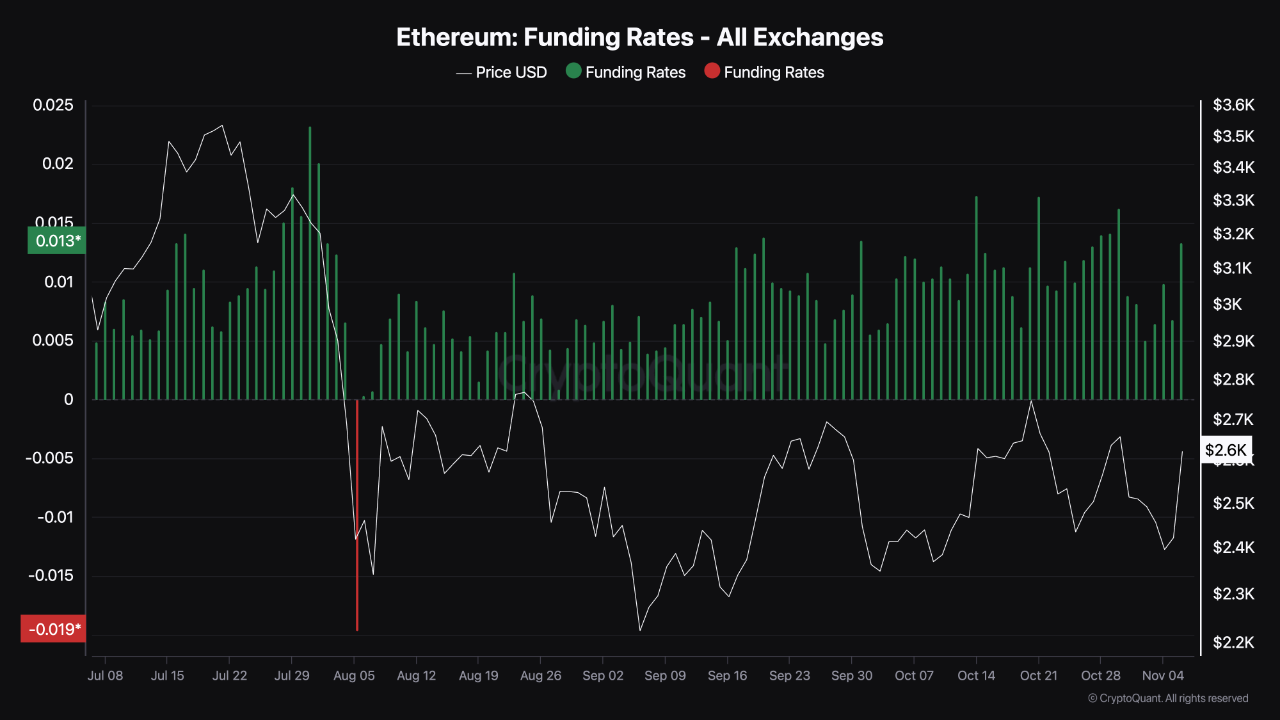

CryptoQuant analyst ShayanBTC reports that key metrics like open interest and funding rates in the Ethereum futures market indicate increased participation and positive sentiment. Open interest reflects outstanding futures contracts, while funding rates reveal the cost of holding positions.

These indicators have risen recently, indicating renewed trading interest. This aligns with price movements, suggesting enthusiasm among futures traders betting on Ethereum's upward momentum.

Increased participation can signal a strong market but carries risks. While current levels are not dangerously high, excessive optimism may lead to volatility. A spike in open interest or funding rates could trigger a "long liquidation cascade," forcing leveraged traders to sell, leading to sharp price declines.

Such liquidations can undermine investor confidence and depress prices. However, current metrics suggest there is still room for growth.

Navigating Potential Ethereum Volatility

Shayan advises Ethereum participants to monitor open interest and funding rates as key indicators of market sentiment. This vigilance can help manage risk exposure and prepare for sudden market changes.

Other analysts remain bullish on ETH. Leon Waidmann from Onchain Foundation noted a potential supply squeeze, which could drive prices higher.

#Ethereum Staking at ATH levels, while ETH on exchanges is hitting record lows.

A supply squeeze incoming!

Bullish #ETH

pic.twitter.com/Vwd1RT2lwP

— Leon Waidmann | Onchain Insights

(@LeonWaidmann) November 6, 2024

Featured image created with DALL-E, Chart from TradingView