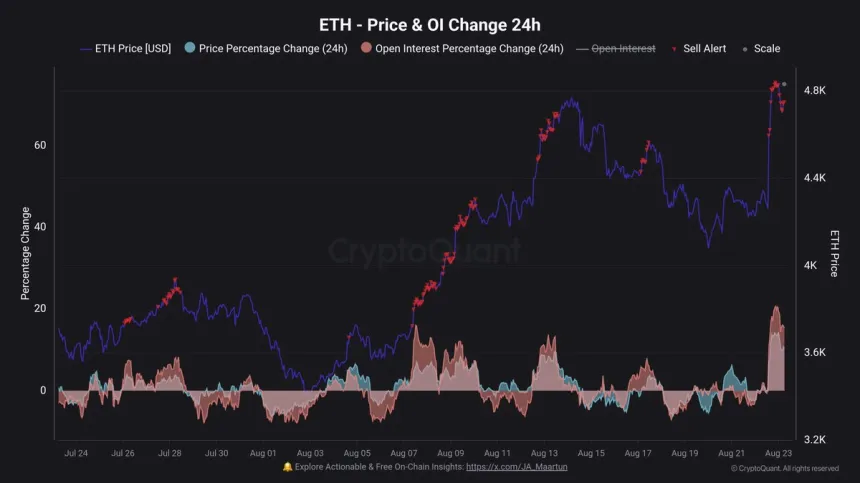

Ethereum Surges to $4,886 Amid Leverage-Driven Market Activity

Ethereum has reached a new peak at $4,886, surpassing its 2021 all-time high but falling short of the $5,000 mark. Analysts are divided on future movements:

- Some predict continued upward momentum.

- Others caution against potential corrections due to leverage-induced volatility.

The Leverage-Driven Pump indicator from CryptoQuant has flashed six times this month, indicating price increases driven by derivatives rather than organic demand. Past signals have had mixed results, with some leading to quick retracements.

Institutional accumulation is strong, with significant purchases from companies like BitMine and SharpLink Gaming reducing available supply on exchanges. This trend supports long-term bullish sentiment despite short-term risks from excessive leverage.

Key developments include:

- Decline in ETH balances on centralized exchanges, indicating a preference for holding or staking.

- A daily trading price of $4,771, maintaining a bullish structure with higher highs and lows since mid-July.

- Support levels around $4,500 and $4,200, with sustained closes above $4,800 needed for bullish confirmation.

The market remains volatile, with traders closely monitoring these dynamics for potential rapid price movements.