Ethereum Surpasses $3,900 as Bulls Aim for $4,631 Target

Ethereum (#ETH) has surpassed the $3,900 mark, approaching its 52-week high of $4,093. The current price of $3,918 reflects a ~4% discount from this peak. The cryptocurrency has experienced a rally over three weeks, resulting in a ~28% price increase. This trend may indicate a potential triple white soldier pattern on the weekly chart.

The market capitalization of Ethereum is now $472 billion, with a 24-hour trading volume of $65.92 billion. Analysts expect the ongoing rally to potentially set a new 52-week high this week, despite whale sell-offs.

Justin Sun Offloads 41,630 ETH Since November

Notable whale activity includes Justin Sun, founder of the Tron blockchain, who recently deposited 20,000 ETH tokens into the HTX exchange, valued at $76.3 million as Ethereum's price exceeded $3,800. His total offloading since early November amounts to 41,630 ETH worth $146 million. Of these, 39,000 ETH valued at $137 million were deposited to HTX, while the remaining tokens worth $8.76 million went to Poloniex. The average selling price was $3,505.

Despite these sell-offs, Ethereum's rally continues, driven by increasing institutional demand for ETFs.

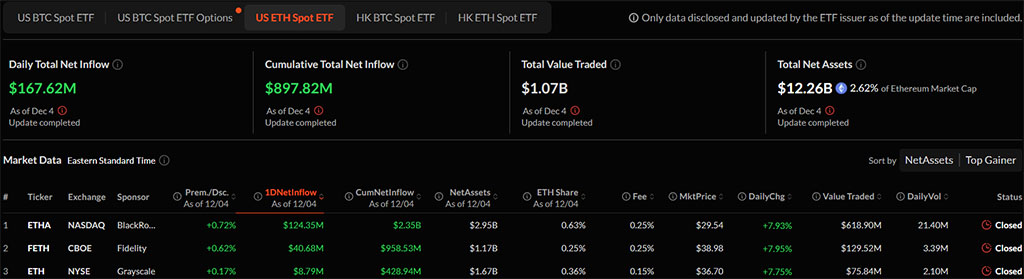

Ethereum ETFs Record $167M in Daily Inflows on December 4

On December 4, Bitcoin (#BTC) surpassed $100,000, contributing to total daily net inflows of $556.82 million, led by BlackRock's Bitcoin ETF with $571.71 million. Amid improving crypto market conditions, Ethereum saw a total net inflow of $167.62 million for US spot ETFs, with BlackRock's Ethereum ETF alone accounting for $124.35 million, indicating rising institutional interest.

Ethereum Rally Targets $4,000 Breakout

The weekly chart indicates a rounding bottom reversal for Ethereum, recovering bullish momentum after Q2 pullbacks and rebounding from the 200-week EMA at $2,355. Over the past 30 days, Ethereum's price has increased nearly 66%, marked by four bullish candles and one minor red candle.

-

Source: Tradingview

The price action has surpassed the key resistance below $3,900 and aims to challenge the Fibonacci level near the 52-week high of $4,093. With a 5.78% increase this week, the momentum suggests a possible all-time high. Technical indicators show a bullish trend, supported by a positive crossover in the 100-week and 200-week simple moving averages.

Projected Fibonacci levels indicate potential price targets of $4,631 and $5,316, suggesting an upside potential of 35% for Ethereum's weekly price action.