Ethereum Tests Key Support Level as Analysts Predict Potential Rally

Ethereum's technical analysis reveals it has been trading within an ascending channel since July 2023, characterized by higher highs and higher lows. Recently, Ethereum tested the lower boundary of this channel, which is critical for its future price direction. Analysts suggest that if Ethereum holds this trendline, it may rally towards the upper bounds of the channel, potentially reaching prices around $6,000. Maintaining support at this lower trendline is essential for sustaining upward momentum and avoiding declines.

The recent decline has brought Ethereum closer to a significant support zone, attracting analyst attention. Ali Martinez highlights this support level as crucial; holding it could enable Ethereum to bounce back and sustain its bullish path. If defended successfully, a rally might push Ethereum up by 150% from current levels. However, Martinez warns that failure to maintain this support could lead to further declines, advocating for strategic stop losses to protect investments and ensure a favorable risk-to-reward ratio.

Crypto analyst Javon Marks notes that Ethereum appears poised for a notable rally, identifying bullish targets with potential increases of 61%, 94%, and even 240%. Achieving these targets would enhance Ethereum's value and could catalyze broader market movements, leading to rallies in other altcoins and possibly marking a new phase in the altcoin market.

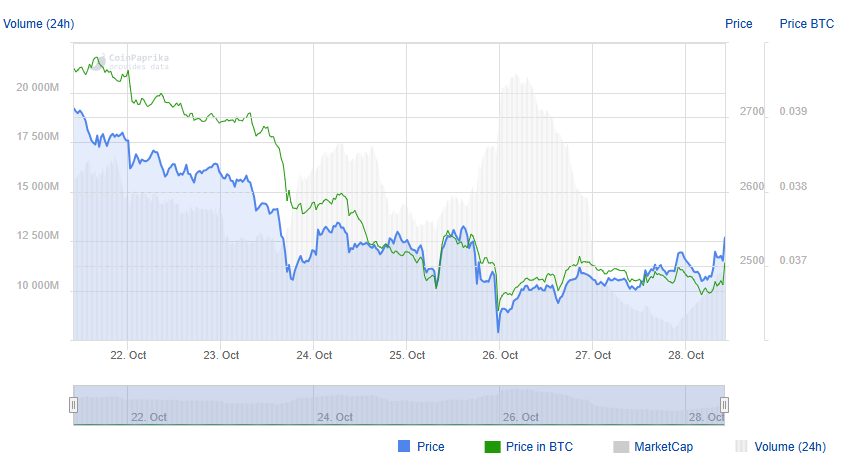

The potential for Ethereum to reach ambitious price levels and compete with Bitcoin's market dominance may hinge on the actions of large investors or "whales." Recent data from on-chain analytics platform Santiment indicates a rise in whale activity, peaking at a six-week high. This suggests that large holders are accumulating Ethereum, providing a solid foundation for the anticipated price rally. Increased whale interest typically signals stronger market support, as these investors can significantly impact overall market sentiment.

As Ethereum's market movements are closely monitored, the upcoming weeks will be crucial in determining whether the current bullish trend can persist or if shifting market dynamics will result in further adjustments. The ability of Ethereum's bulls to maintain control over this support level will significantly influence its price trajectory. Should support hold, it may bolster investor confidence, creating a positive feedback loop that drives prices higher. Conversely, increased selling pressure and failure to maintain key support could pose challenges for Ethereum in reaching new highs. Upcoming market developments will be vital for traders and investors navigating this evolving landscape.