Ethereum Trader Earns Over $1.1 Million from Short Position in Two Days

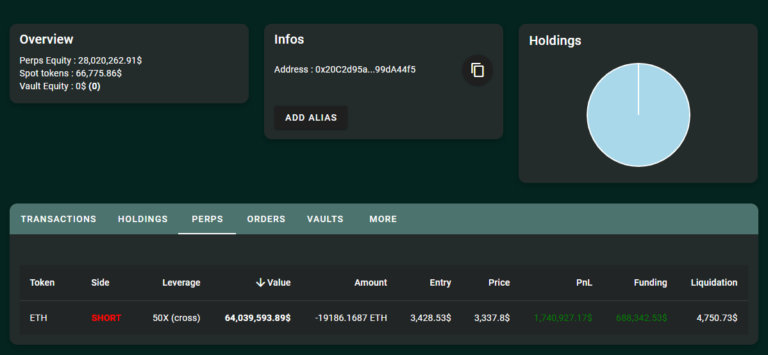

A crypto trader earned over $1.1 million in two days by shorting Ether (ETH) with 50x leverage. The position, initiated on December 24, involved shorting 19,186 Ether valued at over $64.5 million when Ether was priced at $3,428, according to blockchain data from Hypurrscan.

On-chain analytics platform Lookonchain reported that the initial position incurred a loss of $1.2 million on the first day; however, it later yielded substantial unrealized profits and $680,000 in funding fees. The liquidation price for the short position was set above $4,750, highlighting the trade's high-risk nature.

-

Source: hypurrscan

- High-reward trades come with significant risk. A trader in January 2024 lost $161,000 on an overleveraged position.

Hey @rafal_zaorski can I get a small loan of 100k$ I promise to give it back with interest in less than 3-6 months 😭

— Tarded Degen Gambler (@0xTDG) January 4, 2024

2024 Payoffs Big Crypto's Wins

2024 has seen notable trades and milestones within the cryptocurrency market. Bitcoin surpassed the $100,000 mark on December 6. Traders capitalized on the rise of memecoins like Pepe (PEPE), with one investor turning $27 into $52 million over 600 days.

In May, another trader transformed a $3,000 investment into $46 million during Pepe's valuation surge. These examples illustrate the unpredictable nature of crypto investments, resulting in both substantial profits and losses.

Ethereum On Historic Cycle — Is Q1 2025 Rally Coming?

Historically, Ethereum has experienced significant rallies after Bitcoin halving events. For instance, in Q1 2021, Ether increased over 300% in three months, outperforming Bitcoin. In early 2017, Ether rose by approximately 900%, driven by enthusiasm around decentralized finance and NFTs.

Despite these trends, Ethereum currently lacks a distinct bullish catalyst. Its average Q1 returns are 90%, yet skepticism exists about replicating past performance. Investors like James Fickel faced major losses, with $49 million wiped out this year due to betting on Ethereum's performance against Bitcoin.

This year, Ethereum has struggled against its peers, with the ETH/BTC pair declining by 35%, indicating decreased investor confidence in the altcoin.