42 0

Ethereum Trades Above $4,300 Amid Low Funding Rates and Market Health

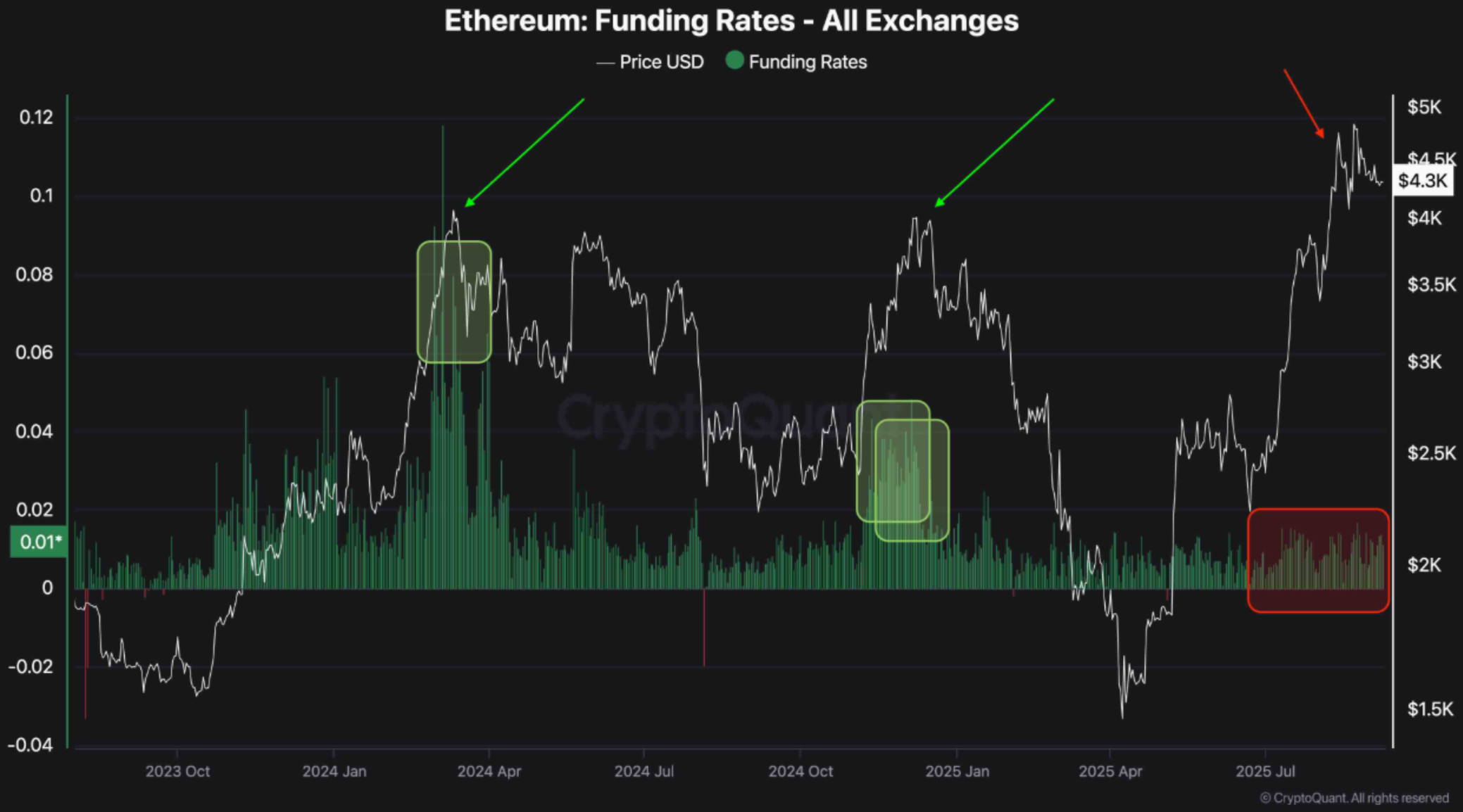

Ethereum (ETH) is currently priced above $4,300. Analysts note that while the cryptocurrency exhibits structural strength, low funding rates across exchanges indicate weak demand, potentially hindering breakout momentum.

Key Insights on Ethereum's Market Dynamics

- Funding rates for ETH are muted compared to previous highs.

- During early 2024, funding rates peaked at 0.8, leading to a price top due to excessive leverage.

- The late 2024 peak saw similar prices but with lower funding rates, indicating reduced speculative activity.

- In 2025, ETH reached an all-time high of $4,900 despite low funding rates, highlighting a less leveraged market.

- Current conditions suggest the market is more spot-driven and structurally healthier, but lacks aggressive demand.

- Analysts emphasize that new order flow is crucial for sustaining upward momentum.

Potential Correction Ahead?

- ETH is about 12% below its all-time high. Some analysts predict a possible drop to $3,900 before a rally.

- On-chain metrics indicate bullish potential; ETH exchange supply ratio recently hit 0.037, suggesting a supply crunch.

- For the first time, Ethereum's exchange balance turned negative, indicating token withdrawals exceed deposits.

- ETH is trading at $4,334, reflecting a 0.6% increase over the past 24 hours.