6 0

Ethereum Trading Below $1,900 Amid Increased Selling Pressure

Ethereum Faces Heavy Selling Pressure

Ethereum (ETH) is trading below $1,900, having recently dropped to a low of $1,750. This decline follows the loss of the crucial $2,000 support level, marking its lowest price since October 2023. Key points include:

- Market conditions are fragile, with weakened buying interest.

- If current support levels fail, further declines may occur.

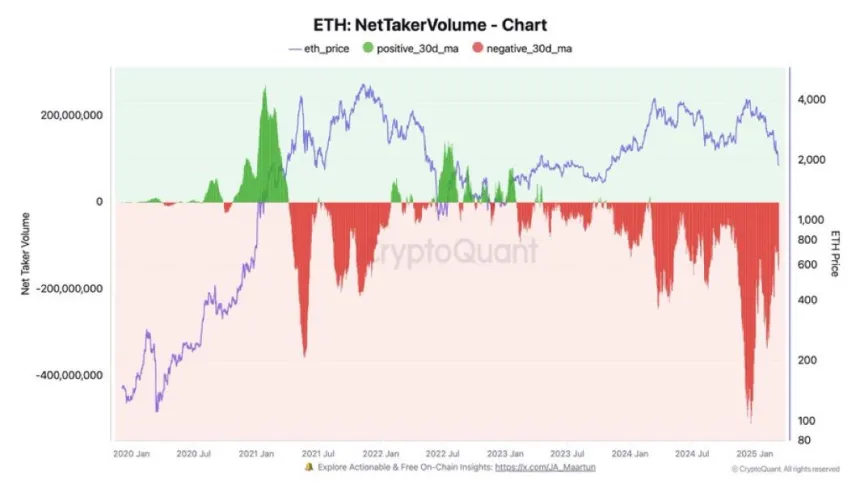

- On-chain data indicates strong selling pressure with low Net Taker Volume.

- Upcoming days are critical; stabilization above $1,900 could signal recovery.

- ETH has lost over 57% in value, struggling below multi-year support turned resistance.

Market Overview

The broader crypto market mirrors weaknesses in the U.S. stock market amid fears of a global trade war and uncertainty surrounding U.S. politics. Key observations include:

- Macroeconomic volatility has driven markets lower since November 2024.

- Investor confidence remains shaken, as the U.S. stock market hits lows not seen since September 2024.

- Analyst data shows historic lows in Ethereum’s Net Taker Volume, indicating ongoing selling dominance.

Current Trading Range

ETH is currently trading at $1,880, oscillating between $1,750 and $1,950. The situation highlights:

- Bulls need to push ETH above $2,000 for a potential recovery rally.

- A failure to hold above $1,750 may lead to deeper corrections.

- Traders are monitoring whether ETH can break out of this range or continue declining.