5 0

Ethereum Faces Volatility Amid Geopolitical Tensions and Technical Patterns

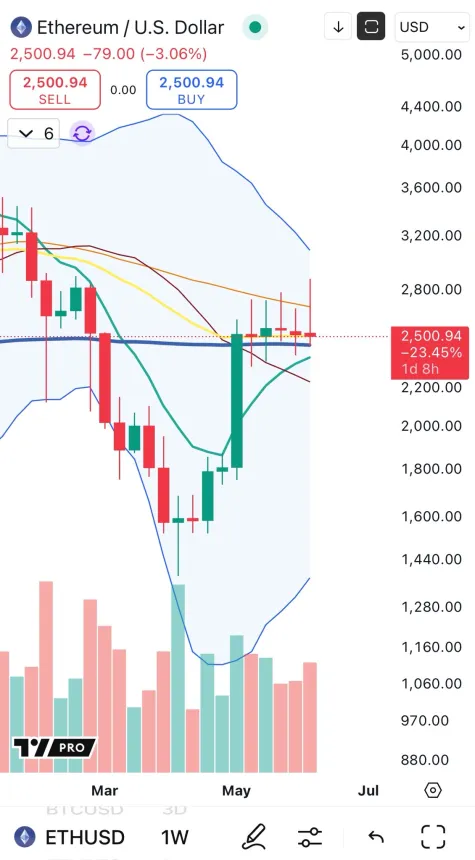

Ethereum Market Overview

- Ethereum is experiencing volatility due to geopolitical tensions, particularly the Israel-Iran conflict.

- After breaching the $2,800 resistance, ETH retraced sharply, indicating market hesitation.

- Current price action shows Ethereum testing support around $2,530 after a decline from local highs of $2,830.

- Analyst Big Cheds noted a technical pattern suggesting indecision and possible weakness at current levels.

- ETH has lost over 15% since last Wednesday but remains within its broader consolidation zone.

- A close above $2,800 could signal renewed bullish momentum; failure to maintain this level raises risks of dropping towards $2,500–$2,550.

- Rising US Treasury yields and ongoing geopolitical issues contribute to increased market volatility.

Outlook

- Bulls need to reclaim the $2,650–$2,770 resistance zone to revive bullish sentiment.

- A decisive break below $2,500 may lead to further declines toward the 50-day moving average near $2,380.