Ethereum Weekly Fees Increase by 18% Reaching $67 Million

The price of Ethereum declined by 2.08% over the past week, consistent with the performance of most altcoins. Despite challenges in breaking past $4,000, developments within its network have attracted investor attention.

Ethereum Weekly Fees Rise By 18% Amid DeFi Ecosystem Boom

A report from IntoTheBlock indicates that weekly Ethereum network fees increased by 17.9%, reaching approximately $67 million, the highest level since April. This rise is linked to ETH’s price adjustments as Bitcoin nears $100,000 and a surge in DeFi activity on the Ethereum blockchain.

DeFi lending has gained momentum, with traders utilizing Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) to borrow stablecoins. These wrapped assets enhance collateral utility by leveraging liquidity and stability in DeFi protocols while maintaining exposure to Bitcoin and Ethereum.

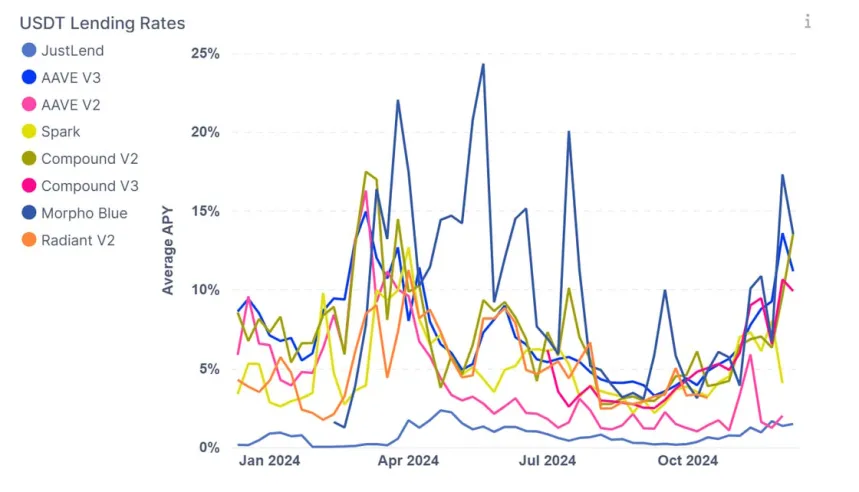

The demand for lending has pushed interest rates above 10% on average, with some platforms experiencing rates as high as 40%. These trends resemble dynamics seen during the 2022 bull market.

Aave, a major DeFi protocol on Ethereum with a total value locked (TVL) of $22.46 billion, recorded $500 million in net inflows in the last week due to this increased DeFi activity. While rising network engagement suggests growing interest, higher Ethereum fees may limit accessibility for smaller users, benefiting primarily those able to leverage high interest rates.

ETH Price Overview

Currently, Ethereum trades at $3,914.08, reflecting a slight decrease of 0.22% in the past day but a monthly increase of 21.39%. The immediate resistance remains around the $4,000 mark, which has hindered growth since early December. A successful break above this level could lead to a rise toward $4,900, its all-time high.

With a market capitalization of $471.16 billion, Ethereum is the second-largest cryptocurrency, comprising 12.9% of the total digital asset market.