Ethereum Weekly Transaction Volume Reaches $60 Billion Amid Bullish Momentum

Ethereum has rallied 35% since last Tuesday, marking a bullish breakout as it tests key supply levels for the first time since late July. Investor sentiment is optimistic, driven by increased on-chain activity.

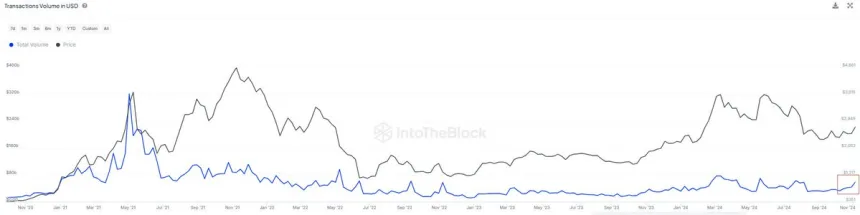

Data from IntoTheBlock indicates Ethereum's mainnet transaction volume reached its highest levels since July, signaling renewed interest in the network. This increase is often viewed as confirmation of a breakout, aligning with investor expectations for a rally toward Ethereum’s yearly highs.

ETH is at a critical juncture; maintaining strength above current levels may lead to further gains as the broader crypto market rallies alongside Bitcoin. The next few days will be significant for Ethereum as traders monitor whether the bullish sentiment can sustain and propel ETH into new price territory.

Ethereum Bullish Trend Begins

Ethereum has entered a bullish phase after eight months of selling pressure and accumulation by smart money. Following a period of stagnant price movement, ETH is rising, indicating a trend reversal that many analysts and investors have anticipated.

According to data from IntoTheBlock, Ethereum’s mainnet transaction volume surged to nearly $60 billion over the past week, the highest level since July. This spike suggests increased trading and accumulation of ETH.

Rising transaction volumes alongside price increases often indicate healthy demand and strong market confidence, supporting the potential for a sustained bullish trend.

The upcoming months are expected to be volatile as speculative interest grows, with many traders positioning for substantial gains. Analysts agree that Ethereum’s next major target is its yearly high of $4,000. A breakthrough at this level would confirm Ethereum’s bullish momentum and set the stage for potential new all-time highs.

ETH Consolidates Above $3,000

Ethereum is currently trading at $3,180, following a recent peak of $3,250. After a strong weekend rally, the price has paused, indicating a need for consolidation before another potential breakout. This sideways movement is crucial for establishing support and preparing for further gains, allowing buyers to gain momentum while absorbing short-term selling pressure.

Key technical levels suggest bullish sentiment will strengthen if ETH holds above $2,950, aligned with the 200-day moving average (MA). Maintaining this support level would indicate buyer control, setting up ETH for a possible rally toward $3,500 soon.

However, it may take a few days for ETH to build the necessary momentum for its next significant move as investors evaluate the recent rally and consider upcoming catalysts.

The market appears optimistic, with analysts noting that sustaining levels above the 200-day MA is critical for confirming the long-term bullish trend. ETH’s consolidation phase could serve as the foundation for continued upward movement.

Featured image from Dall-E, chart from TradingView