Ethereum Whales Accumulate 340,000 ETH Worth Over $1 Billion

Ethereum has experienced notable volatility recently, with substantial selling pressure following its inability to surpass yearly highs from December. This situation has prompted uncertainty among traders and investors as ETH consolidates below key resistance levels.

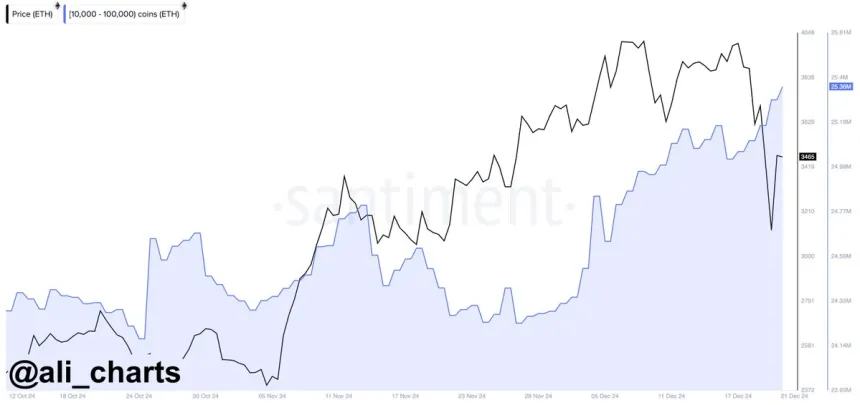

On-chain data indicates a potentially bullish scenario. Analyst Ali Martinez reported that Ethereum whales accumulated 340,000 ETH—valued over $1 billion—in the last 96 hours. This accumulation suggests major players recognize long-term value in Ethereum despite mixed short-term market sentiment.

Ongoing whale activity may signal an impending recovery for ETH, with large holders positioning themselves for future gains. Historically, such accumulation phases have often preceded significant price rallies due to increased demand and reduced supply.

Ethereum Whale Demand Keeps Rising

Throughout the year, Ethereum demand has been unstable, with selling pressure driving prices down from local highs. Each rally attempt faced resistance, indicating challenges in maintaining upward momentum. Nonetheless, Ethereum shows resilience during corrective phases, with large holders actively accumulating ETH.

Martinez shared data indicating a strong trend of whale accumulation. In the past 96 hours, whales purchased 340,000 Ethereum, valued at over $1 billion, reflecting confidence in Ethereum’s long-term potential. Such accumulation typically signals a market shift, with whales preparing for a possible breakout.

Analysts believe this whale-driven demand suggests a significant price increase in the coming weeks. The crypto community anticipates Ethereum will play a crucial role in the expected altseason next year, reinforcing its status as a leader among altcoins.

As Ethereum approaches this critical phase, market participants will monitor its ability to leverage current accumulation. Continued whale activity could enable Ethereum to reclaim local highs and potentially establish new milestones, strengthening its position in the crypto market.

ETH Holding Key Support

Currently priced at $3,320, Ethereum demonstrates resilience by maintaining above the critical 200-day moving average (MA) at $3,000. This level is seen as a key indicator of long-term market strength, suggesting Ethereum remains in a bullish structure despite recent volatility.

For Ethereum to regain momentum, bulls must push the price above the $3,550 resistance level and sustain it. A break above this zone would indicate a renewed upward trend and enhance the likelihood of testing higher levels. However, immediate movement may not occur as the market could enter a sideways consolidation phase.

This consolidation is typical following periods of high volatility, allowing the market to build a stable base for the next significant move. A strong consolidation phase above $3,000 would further validate the 200-day MA as a robust support level, increasing investor confidence.

Featured image from Dall-E, chart from TradingView