Ethereum Whales Purchase 6,000 ETH Amid Price Drop

Following a broader crypto market decline due to hawkish Federal Reserve commentary for 2025, Ethereum price dropped over 5%. Large Ethereum holders, known as whales, are seizing the opportunity by buying the dips.

Whale Activity

A notable Ethereum whale linked to Longling Capital has acquired 6,000 ETH during this price drop. This whale is recognized for its timely market moves, having generated $83 million in profits, according to LookonChain. Since May 8, 2023, the whale has purchased 75,400 ETH valued at $180.4 million at an average price of $2,392 and sold 50,800 ETH for $172.8 million at an average of $3,401 per ETH, demonstrating a strategy of buying low and selling high.

-

Source: LookonChain

Market Sentiment and Future Projections

Despite the recent price fall, analysts remain bullish on Ethereum. The ETH/BTC trading pair has been in a downtrend for over two years, trapped in a parallel channel since September 2022. Some technical indicators suggest a potential reversal may be forthcoming, according to analyst Venturefounder. A shift could occur if chart patterns like a double bottom or an inverse head-and-shoulders formation emerge.

-

Source: Venturefounder

Potential Price Recovery

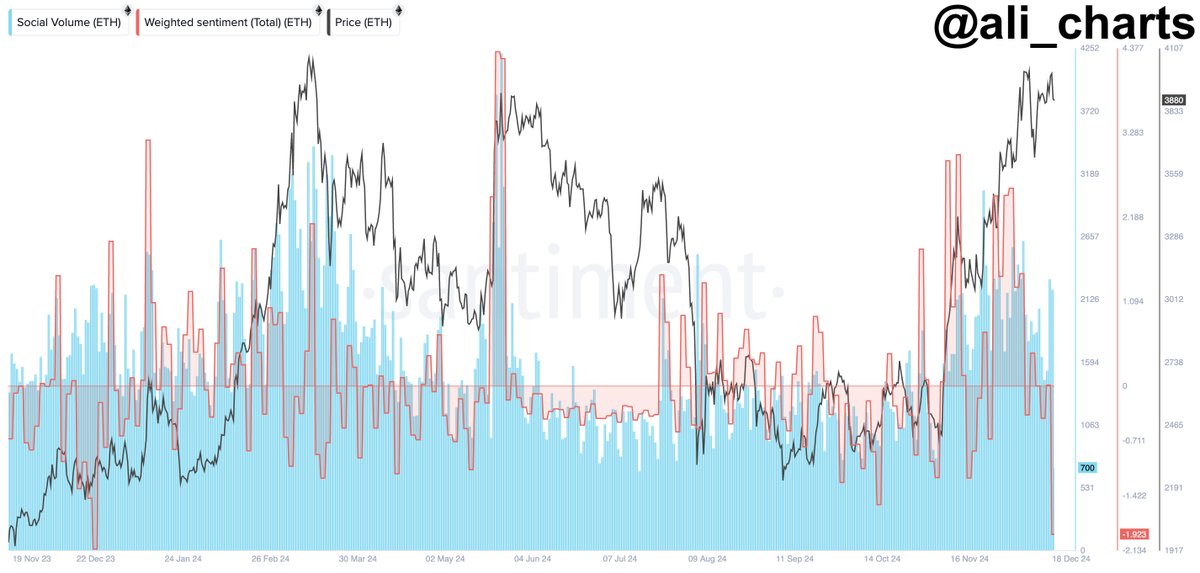

On-chain indicators suggest that an Ethereum price recovery may be imminent. Analyst Ali Martinez noted that Ethereum's social sentiment has reached its lowest levels since December 18, 2023, historically preceding significant price rallies. During the last comparable sentiment trough, Ethereum surged 30%. If a similar rebound occurs from a support level of $3,500, the price could rally to $4,500 and potentially reach new all-time highs.

-

Source: Ali charts

-

Source: IncomeSharks

Analyst IncomeSharks indicated that Ethereum remains in a bullish position with the Supertrend indicator unbroken amid recent market fluctuations, suggesting current support levels provide caution for bearish traders.