Ether’s Leverage Ratio Reaches 0.57, Exceeding Bitcoin’s 0.269

Bitcoin (BTC) attracts institutional attention, while Ethereum's ether (ETH) is favored by traders seeking to enhance returns through leverage. Ether's estimated leverage ratio reached a new high of 0.57, up from 0.37 at the start of Q4 2024, according to data from CryptoQuant.

The leverage ratio is calculated by dividing cumulative open interest in futures and perpetual contracts by the total number of ETH in exchange wallets offering futures trading. An increasing ratio indicates greater use of leverage, suggesting heightened risk-taking and speculation among traders. Leverage allows traders to control larger market positions with a smaller capital investment; for example, a 10:1 leverage ratio enables control of a $10,000 position with only a $1,000 margin deposit. This approach amplifies both potential profits and losses, increasing liquidation risks when markets move unfavorably, contributing to volatility.

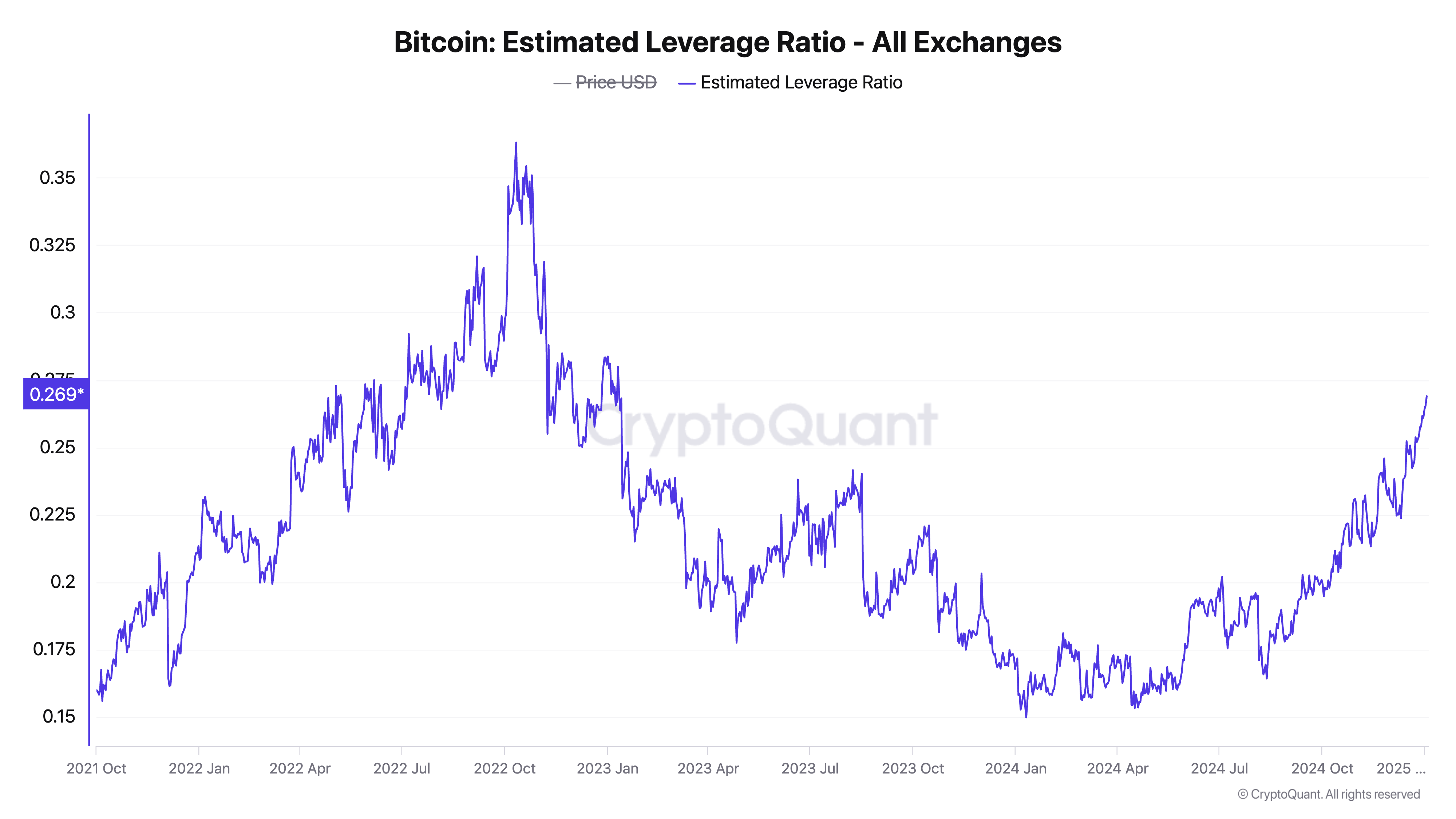

Ether's leverage ratio exceeding 0.5 signifies substantial leverage trading in the futures market relative to the actual coins available in exchange wallets. In contrast, Bitcoin's leverage ratio stands at 0.269, its highest since early 2023 but still below the October 2022 peak of 0.36. This disparity suggests that ether may exhibit twice the price volatility of Bitcoin in the near future.