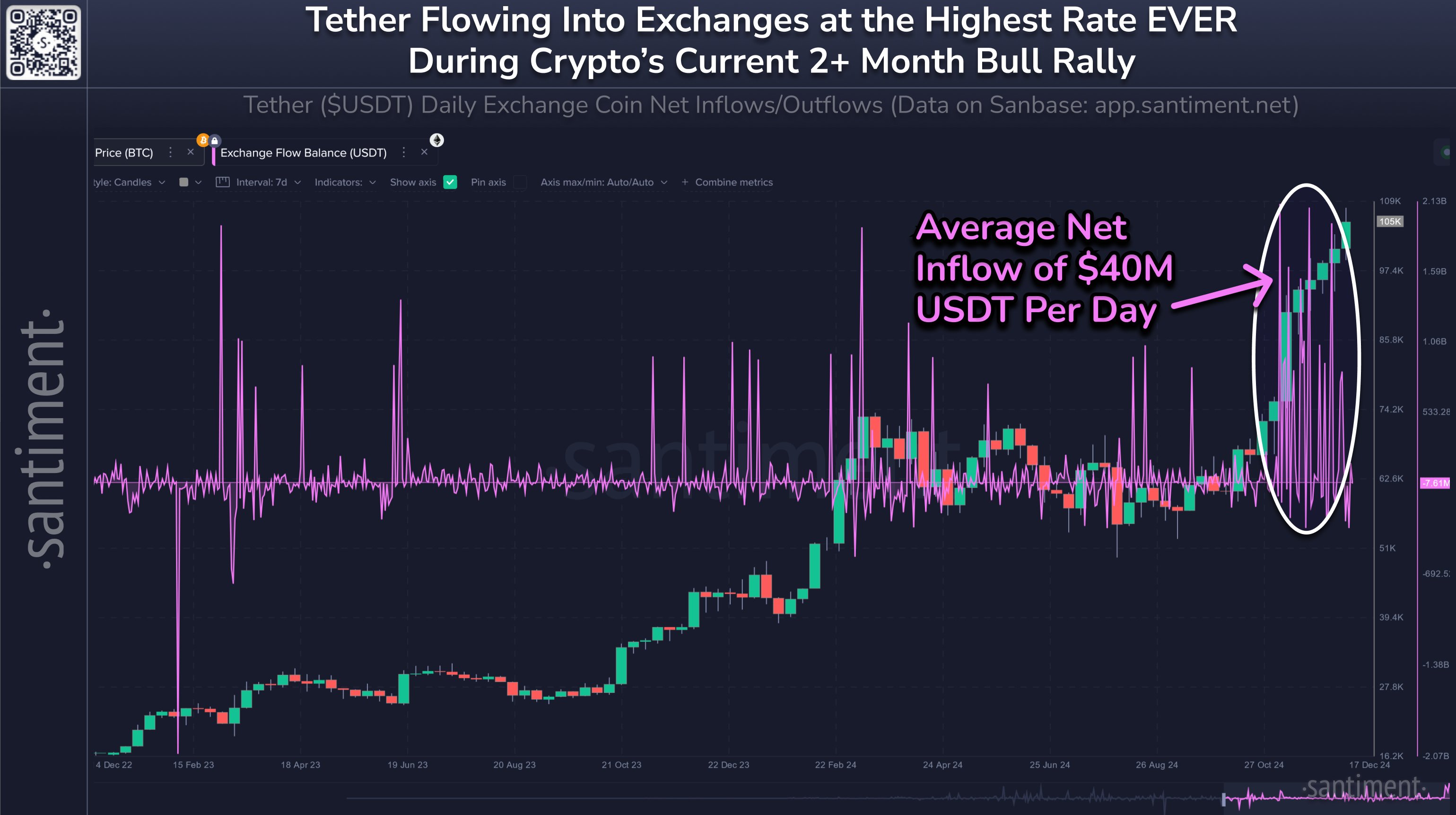

Exchanges See Net Average Inflows of $40 Million USDT Recently

On-chain data indicates significant movement of the stablecoin USDT to exchanges, potentially supporting a Bitcoin and broader cryptocurrency rally.

USDT Exchange Inflows Have Remained High Recently

The on-chain analytics firm Santiment reported an increase in the Exchange Flow Balance for Tether's USDT. The "Exchange Flow Balance" tracks the net amount of an asset entering or exiting centralized exchange wallets.

A positive metric indicates higher inflows than outflows, suggesting increased demand from investors for trading the cryptocurrency. Conversely, a negative metric suggests holders are withdrawing tokens, indicating market accumulation.

The chart below illustrates the trend in the Exchange Flow Balance for USDT over the past couple of years:

The graph shows several large positive spikes in USDT Exchange Flow Balance over the last month, indicating substantial deposits by large investors.

For assets like Bitcoin, a positive Exchange Flow Balance can signal potential selling intentions among holders. However, this does not apply to stablecoins. Investors typically use these fiat-tied tokens to mitigate volatility before eventually transferring to exchanges for trading in more volatile assets.

This transfer to exchanges does not impact USDT's value, which remains stable around $1. However, the asset they purchase does experience price fluctuations, making stablecoin inflows a bullish indicator for Bitcoin and other cryptocurrencies.

Over the past eight weeks, exchanges have received a net average of $40 million USDT, contributing to the current bull rally. Santiment notes that stablecoin 'dry powder' is expected to continue flowing into the market through late 2024.

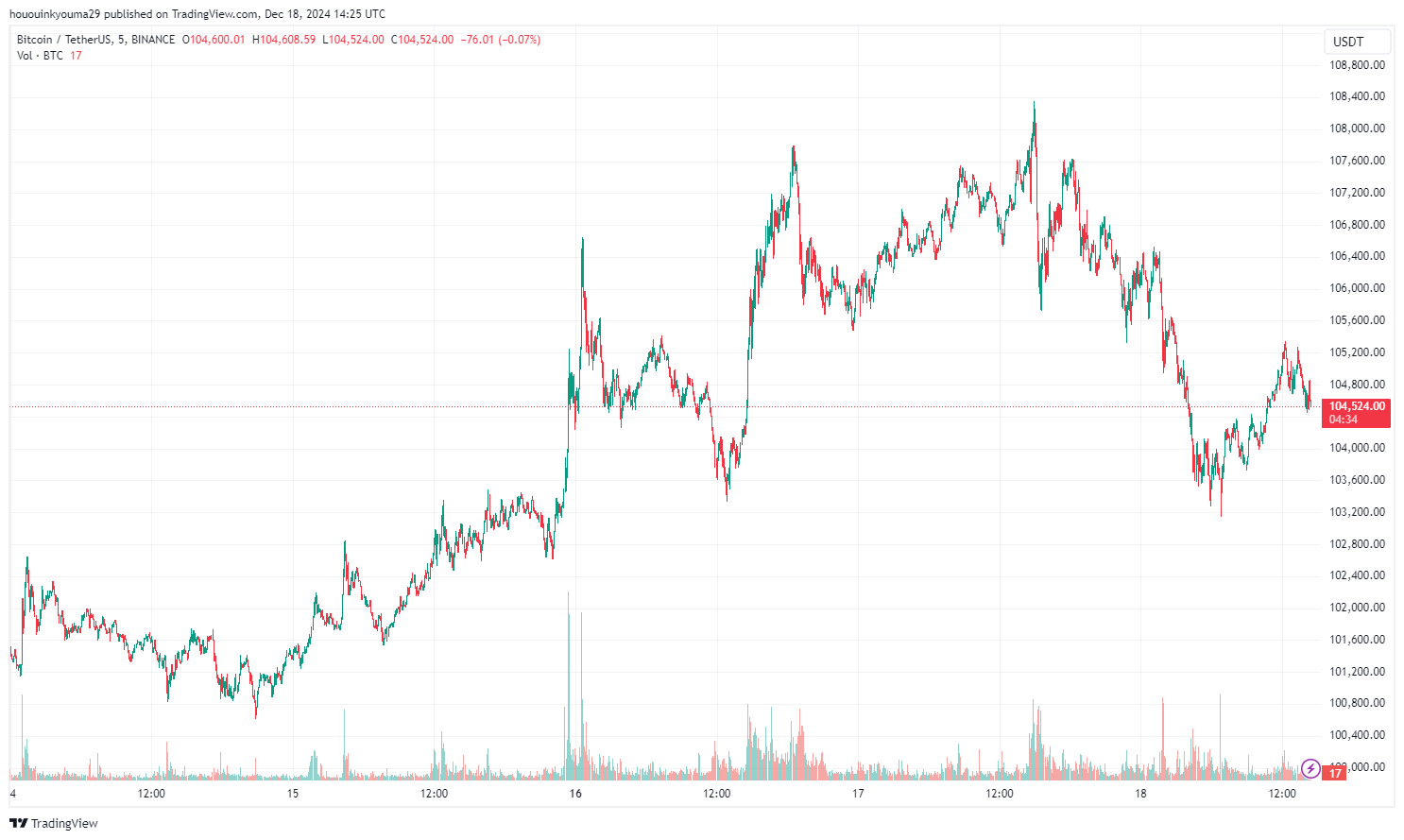

Bitcoin Price

Bitcoin reached a new all-time high (ATH) exceeding $108,000 but has since retraced to around $104,500.