Updated 6 December

Fed Maintains 70% Odds of Cutting Rates Despite Strong Economic Indicators

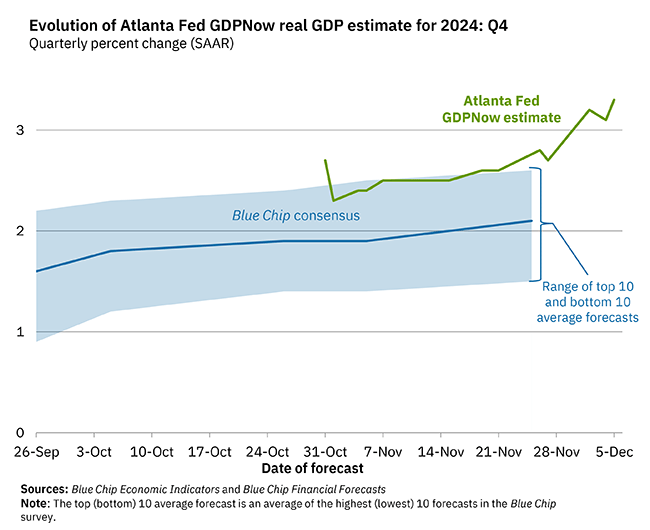

There is confusion regarding the Federal Reserve's potential rate cuts despite strong economic indicators. The Atlanta Fed GDPNow forecasts a 3.3% real GDP growth rate for Q4, indicating acceleration:

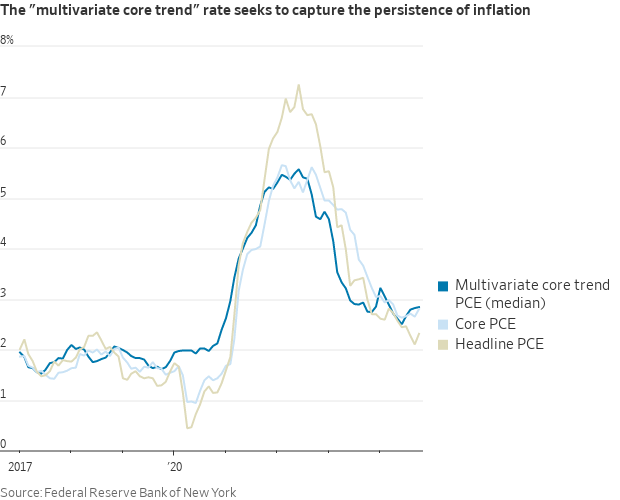

Inflation appears to be rebounding after reaching a low point:

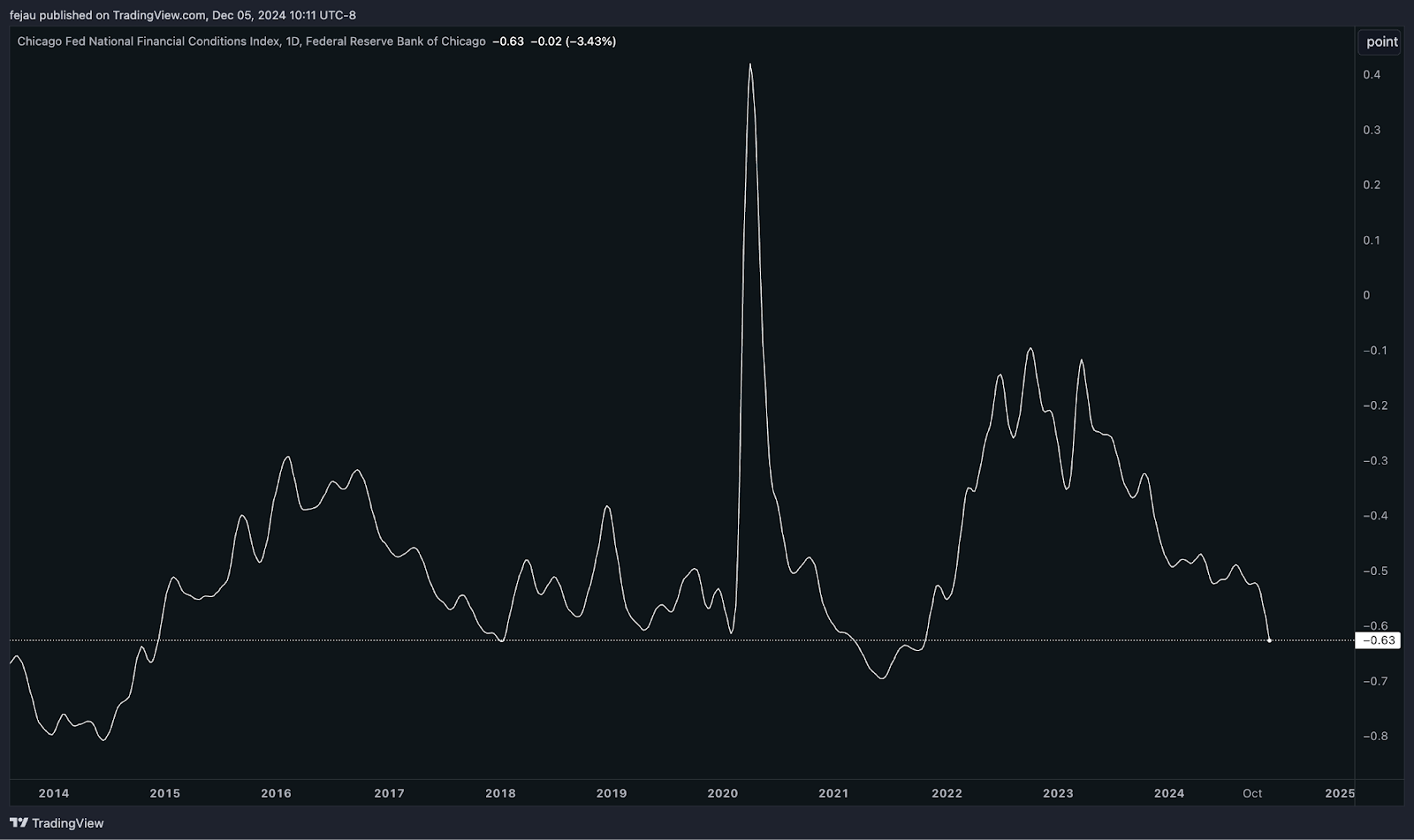

Financial conditions are nearly as loose as in the 2021 era:

Despite these metrics, there is a 70% probability that the FOMC will cut rates in December. This guidance is consistent with previous market expectations, and reversing it could create instability.

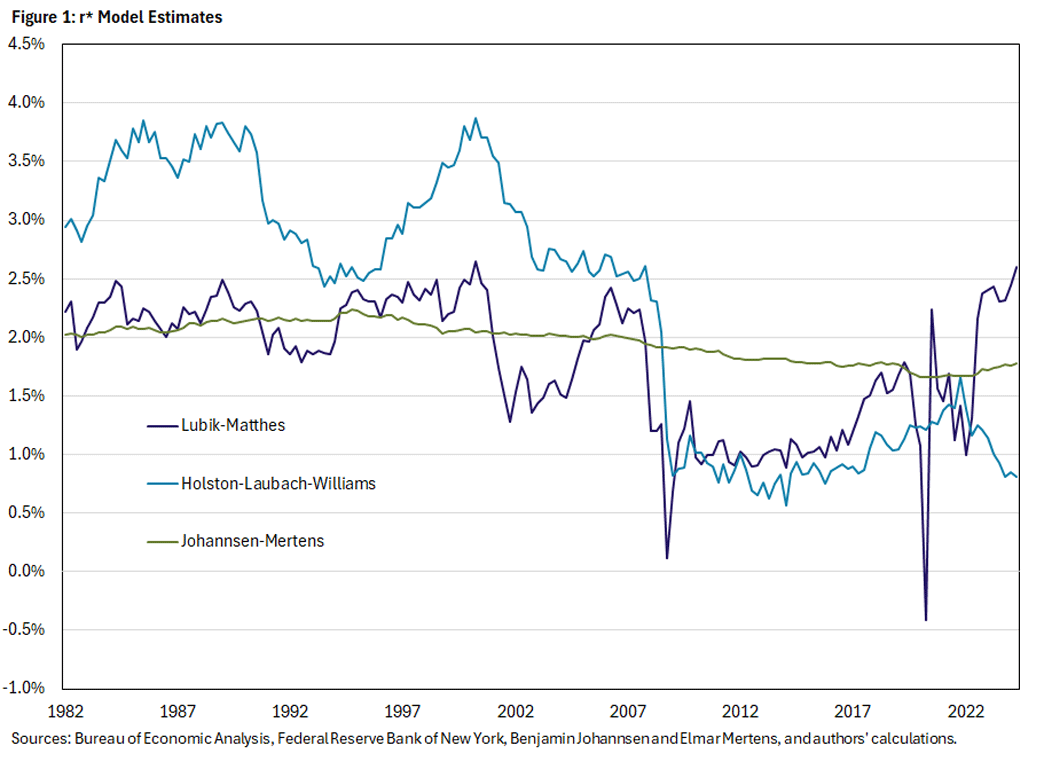

The rationale behind this decision relates to r* — the neutral interest rate — which cannot be directly measured. Policymakers use models like the Lubik model and the Williams model for estimation. The Lubik model is more dynamic, while the Williams model relies on traditional macroeconomic approaches and is favored within the Fed due to its creator's position as NY Fed president.

The Lubik model indicates a significant increase in r*, while the Williams model remains at a low level:

Due to reliance on the Williams model, the FOMC perceives monetary policy as restrictive, suggesting a cut to 4% would still maintain a restrictive stance. However, the Lubik model suggests that policy may already be neutral.

Current market signals indicate an accommodating environment, challenging the accuracy of the Williams model. Discussions among FOMC members about the neutral rate suggest a shift in perspective, with some preferring to assess economic reactions before making decisions. Given the ongoing market highs, arguments for restrictive policy are weak. Still, a December rate cut remains likely due to adherence to the Williams model.