Updated 31 January

FED Maintains Interest Rates at 4.25% to 4.50% Amid Stable Labor Market

The Federal Reserve has maintained interest rates at 4.25% to 4.50%, following three consecutive cuts. Chair Jerome Powell indicated no immediate changes to policy, emphasizing a less restrictive approach.

Unemployment rates remain stable, and labor market conditions are strong. Notably, Powell's comments suggest a pro-crypto stance, allowing banks to offer crypto services while managing associated risks.

Key points include:

- The Fed's wait-and-see approach until inflation shows signs of cooling, targeting 2% inflation.

- Powell's remarks contrast sharply with previous regulatory hostility towards crypto under the Biden administration.

- An investigation by the US Senate Banking Committee into past 'debanking' practices is scheduled for February 5.

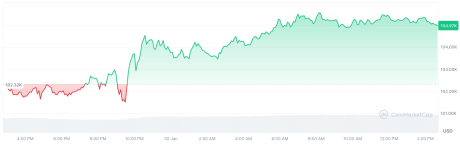

- Following Powell's statements, Bitcoin experienced significant upward movement, surpassing $105K, nearing its all-time high of approximately $109K.

Powell noted the Fed's cautious outlook regarding potential new Trump administration policies, signaling a shift toward supporting crypto banking.

This environment may present an advantageous period for crypto investors, especially with developments in projects like Best Wallet Token. The token is part of a decentralized wallet aiming for substantial growth in the non-custodial market.

Current trends indicate a possible bullish trajectory for crypto assets amidst changing regulatory landscapes.