20 0

Fed’s QT Shift Expected to Spark Crypto Market Rally

Market expert VirtualBacon highlights a potential shift in Federal Reserve (Fed) liquidity policy as the most significant event for the crypto industry this year. After 18 months of quantitative tightening (QT), the Fed may pause QT and possibly initiate stealth quantitative easing (QE).

Impact on Crypto Market

- VirtualBacon links Fed liquidity pivots to altcoin cycles.

- In 2019, the end of QT led to an altcoin rally; in 2022, QT resulted in altcoin peaks.

- The anticipated end of QT in 2025 might trigger another altcoin surge.

- The Fed's move away from balance sheet reduction language could signal QE.

CME FedWatch Tool and Rate Cuts

- Goldman Sachs, Bank of America, and Evercore predict QT ending soon.

- Indicators suggest market distress similar to 2019's repo crisis.

- CME FedWatch tool shows a 96.7% probability of a rate cut this month and 87.9% in December.

- Powell hints QT will conclude "in the coming months."

M2 Money Supply and Bitcoin

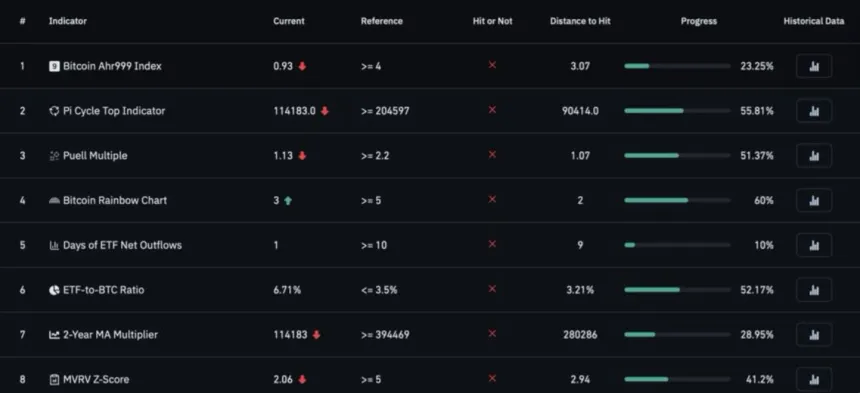

- VirtualBacon states Bitcoin hasn't reached its peak; none of the 30 bull market indicators have activated.

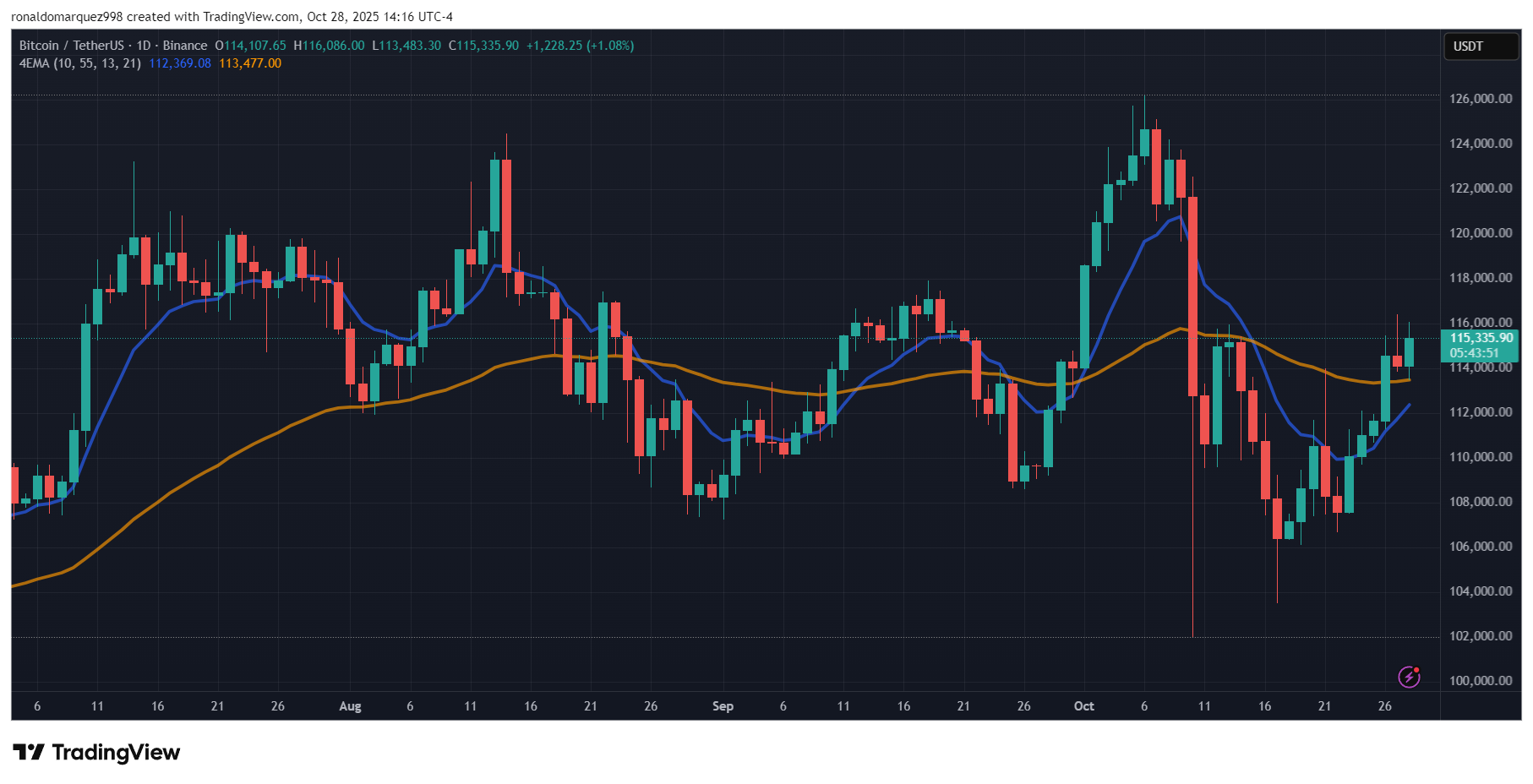

- Global M2 money supply rise historically leads Bitcoin prices by 10-12 weeks.

- This suggests Bitcoin's next surge is forthcoming, with a new altcoin season possible post-Fed pivot.