9 0

Fidelity Lists Solana for US Clients as Hong Kong Approves SOL ETF

Solana (#SOL) received significant institutional support when Fidelity, managing $5.8 trillion in assets, listed SOL for trading alongside Bitcoin (#BTC) and Ethereum (#ETH).

- Fidelity's inclusion of SOL reflects its strategy to broaden digital asset access for brokerage clients.

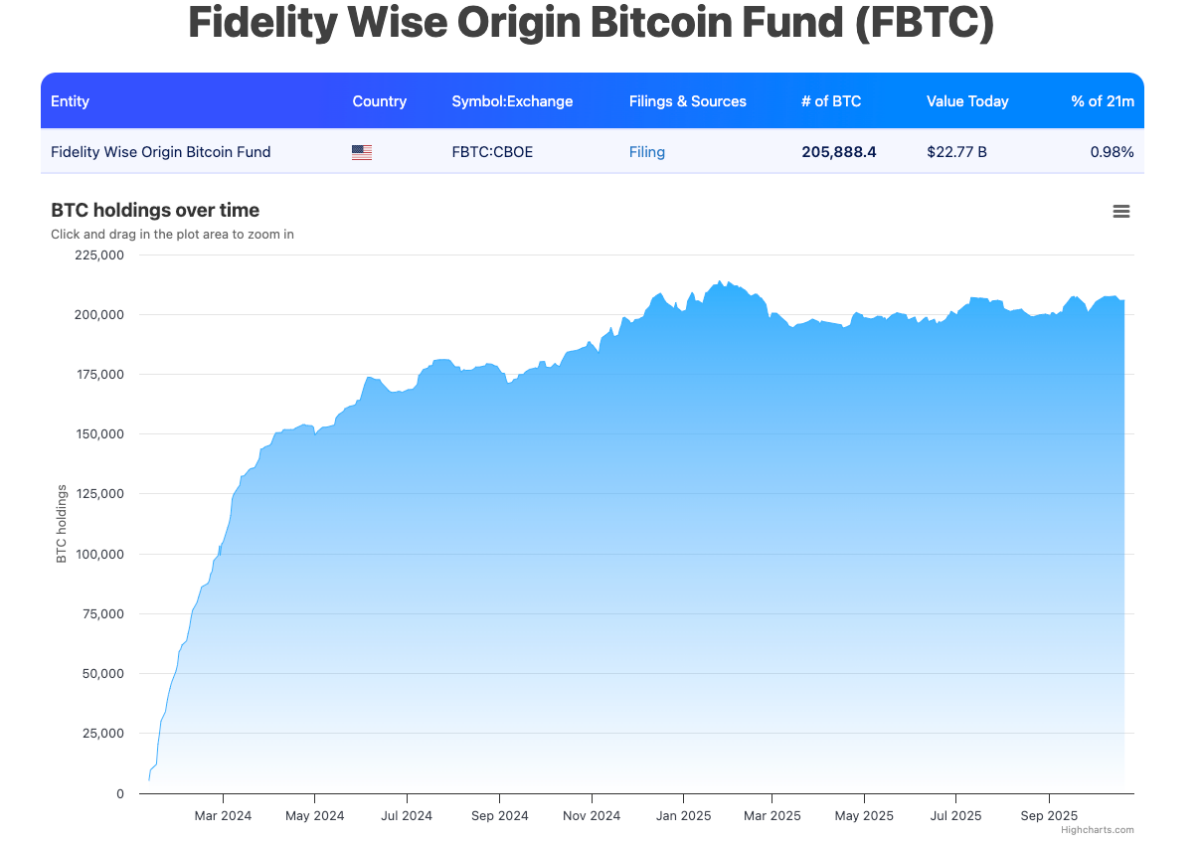

- Fidelity Wise Origin Bitcoin Fund holds 205,888.4 BTC, valued at around $22.77 billion, representing 0.98% of Bitcoin’s total supply.

Institutional Developments for Solana

- Hong Kong's Securities and Futures Commission approved the first Solana spot ETF by ChinaAMC, set to begin trading on October 27.

- This positions Hong Kong ahead of the US in offering regulated institutional Solana exposure, with a 99% predicted approval odds for a US Solana ETF.

- Solana's market responded positively, with a 6% increase intraday, rising from just below $180 to $192.

- Solana outperformed other top 10 cryptocurrencies following Fidelity's listing and Hong Kong's ETF approval.

Pepe Node Presale

- Speculative trading on projects like Pepe Node (PEPENODE) increased due to anticipated SOL demand.

- Pepe Node allows users to manage virtual meme coin mining rigs and earn network participation rewards.

- The presale is priced at $0.0011 and has raised over $1.9 million of its $2 million target.