Financial Conditions Tightened Despite Fed’s 50 Basis Points Rate Cut

This is a segment from the Forward Guidance newsletter.

Since the Fed's 50 basis points rate cut in September, financial conditions have tightened instead of loosening. Here’s an analysis of how this occurred.

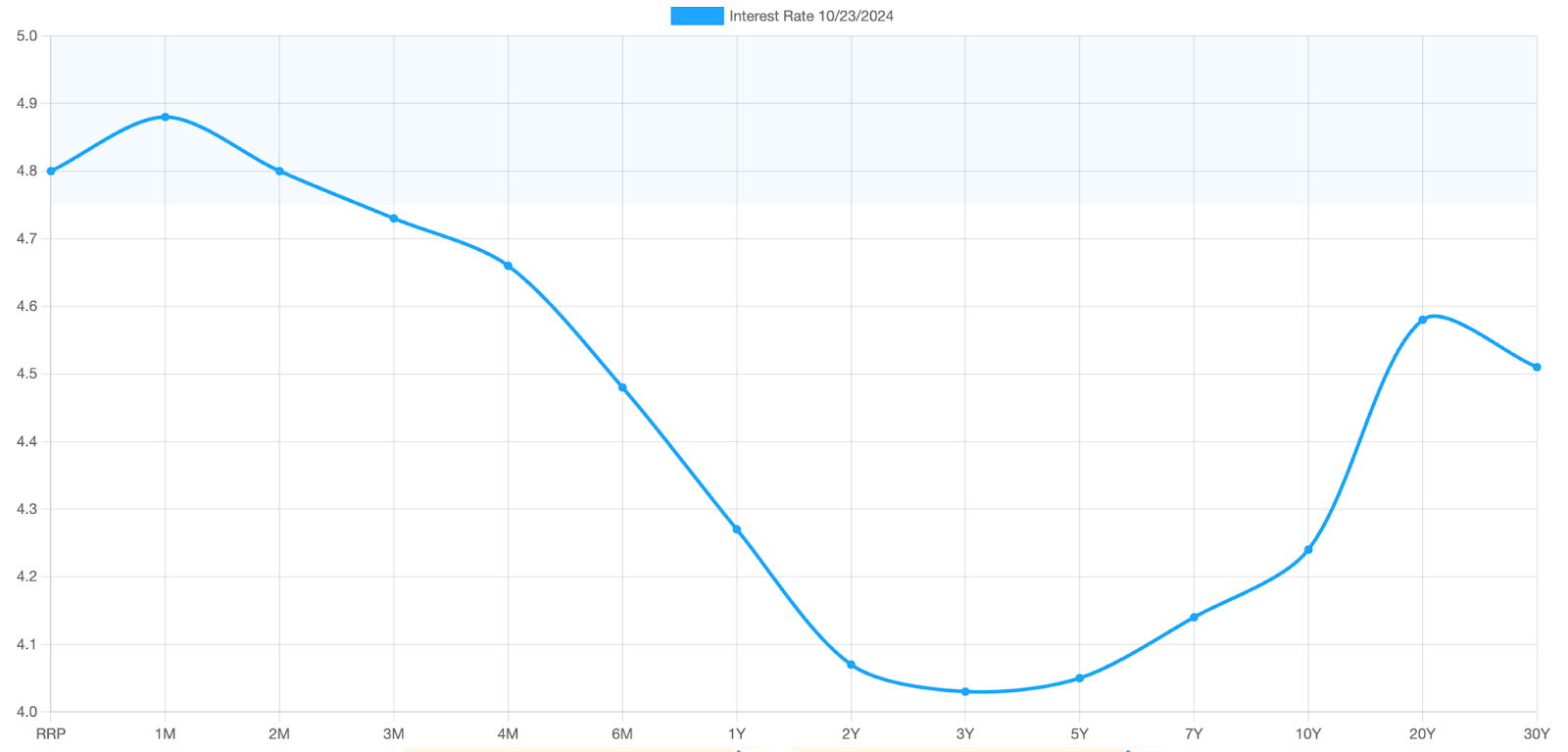

1. The Rates Complex

The FOMC lowers interest rates by adjusting the federal funds rate, impacting the yield curve. The control over long-duration rates diminishes as market forces play a larger role:

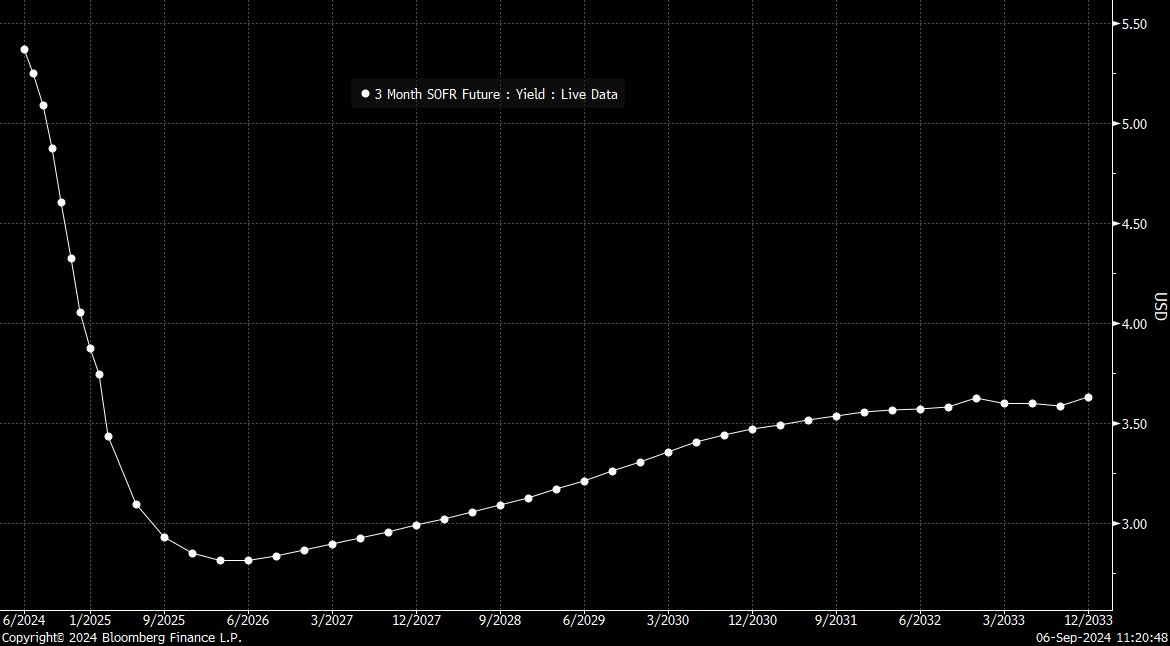

2. Priced for Aggressive Slowdown

The FOMC uses guidance to influence long-duration rates. Market reactions to soft economic data indicated expectations for significant rate cuts, anticipating the fed funds rate at 3% by mid-2025. This led to lower long-term yields reflecting recessionary pricing:

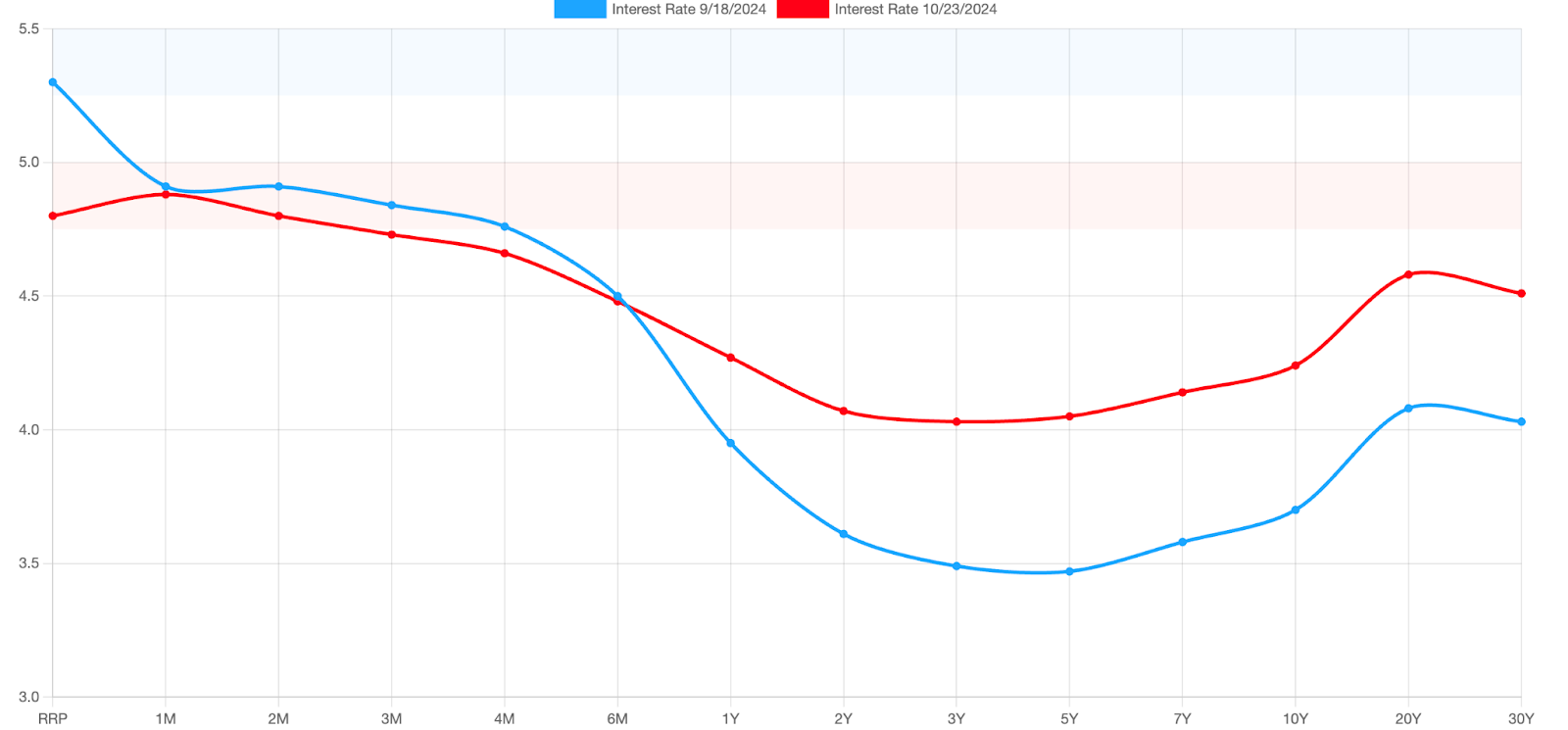

3. The 50bps Cut as a Trigger

The Fed's 50bps cut was only partially expected. This move alleviated concerns about delaying action and contributed to rising yields across most maturities on the yield curve following the cut:

As a result, despite the rate cut, most of the yield curve increased significantly.

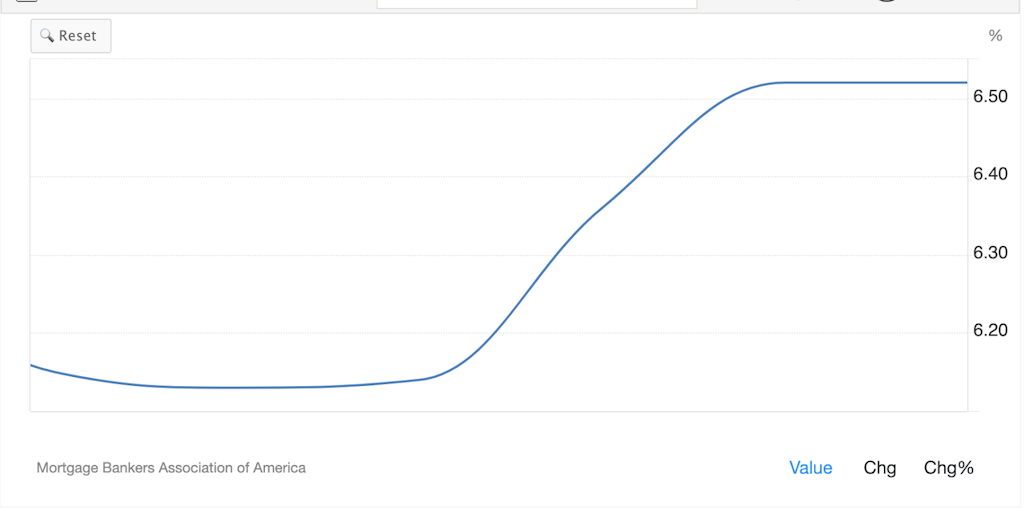

4. The Economy Operates on the Long End

Long-term borrowing dominates the economy. Increasing long bond yields tighten financial conditions. Recent increases in term premia indicate a higher opportunity cost for borrowing long-term:

Additionally, 30-year mortgage rates rose post-cut, contrasting expectations that rate cuts would lower mortgage costs:

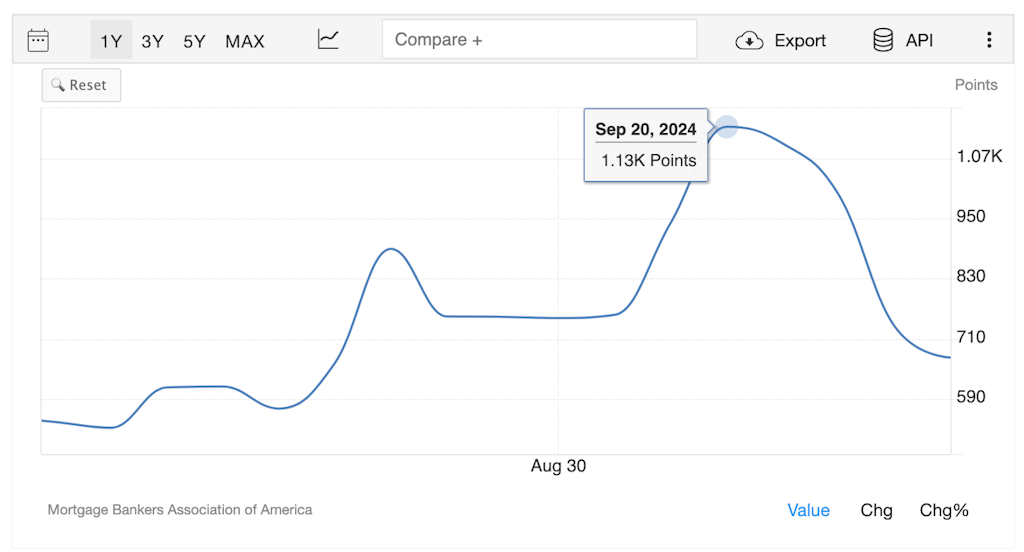

This resulted in a peak in mortgage refinancing activity during the week of the FOMC cut, which has since declined due to rising mortgage rates:

This analysis illustrates that aggregate borrowing costs have risen despite the federal funds rate cut, emphasizing the importance of examining the broader economy beyond the overnight rate.