Updated 20 December

FOMC Cuts Rates by 25bps Amid Market Expectations of Hawkish Stance

This is a segment from the Forward Guidance newsletter.

The Federal Reserve cut rates by 25 basis points recently, resulting in market volatility. Despite initial expectations of a Santa rally, the reaction was unexpected.

Expectations

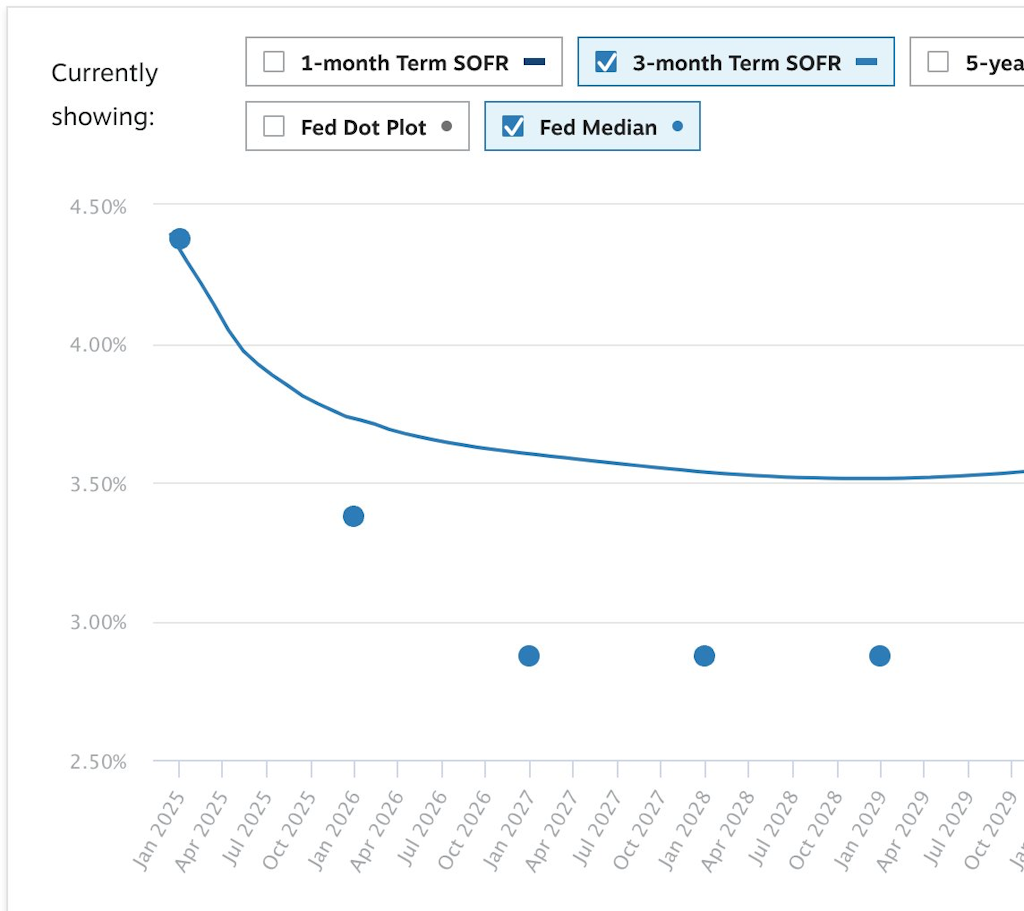

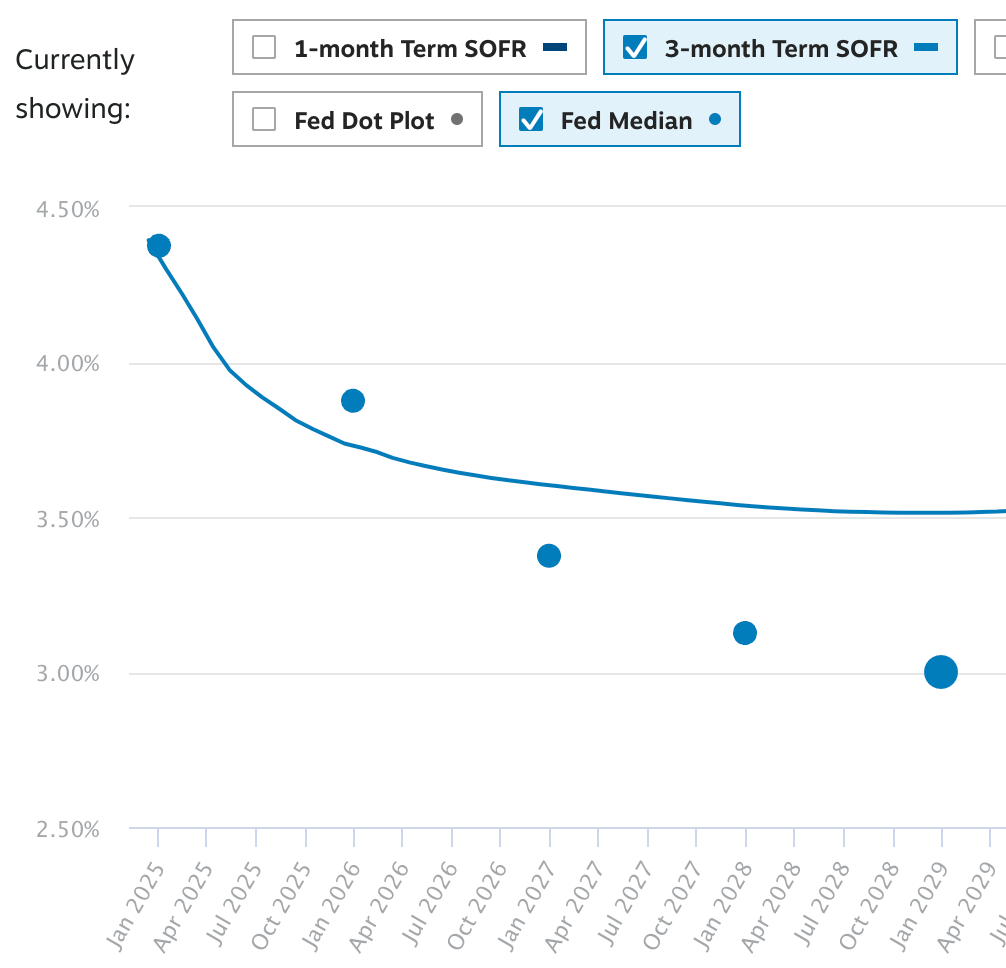

Prior to the FOMC meeting, the SOFR curve indicated a significant deviation from the Fed’s September economic projections. This shift reflected increased economic strength and resilience in the labor market, suggesting fewer rate cuts than previously anticipated. In 2025, the market expected approximately three rate cuts. The FOMC surprised the market by forecasting only two cuts while raising the expected fed funds rate to 3.9% from 3.4%.

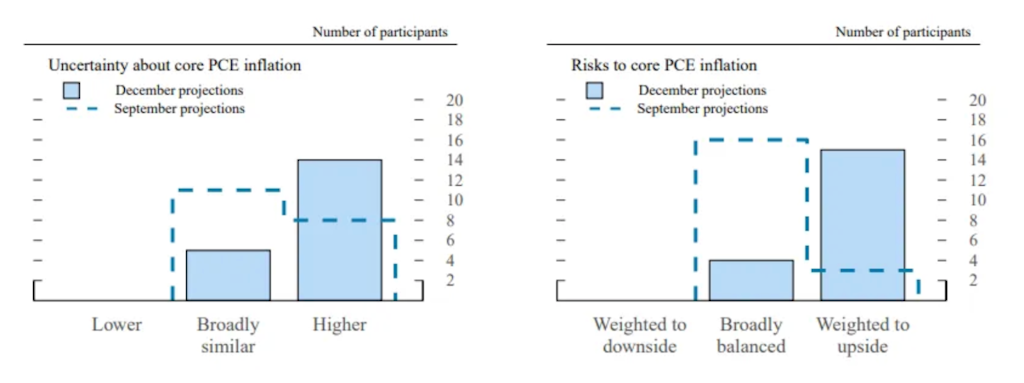

This adjustment was largely influenced by heightened uncertainty regarding inflation over the next year:

Positioning

Three key positioning dynamics contributed to the market's reaction. First, with low VIX levels ahead of the event, many traders were long. Second, widespread expectations for a seasonal rally led to increased investments in high beta risk assets, predicated on continued dovishness from the Fed. Lastly, the largest options expiry in history created significant open interest, prompting dealers to hedge delta exposure, which amplified market moves.

Market movements are typically influenced by a combination of factors rather than a single cause, leading to aggressive reactions as observed recently.