6 0

Forward Industries Authorizes $1 Billion Buyback Amid 30% Stock Drop

Forward Industries Share Repurchase Program

- Forward Industries has launched a $1 billion share repurchase program effective until September 2027.

- The program allows the company to buy back its own shares through various methods, such as open-market purchases and block trades.

- This move is intended to enhance shareholder value by reducing outstanding shares and potentially increasing earnings per share.

Market Reaction

- The announcement coincided with a significant drop in Forward Industries' stock price, falling approximately 30% on heavy trading volumes.

- This volatility follows a previous rally driven by the company's strategic focus on Solana.

Solana Treasury Strategy

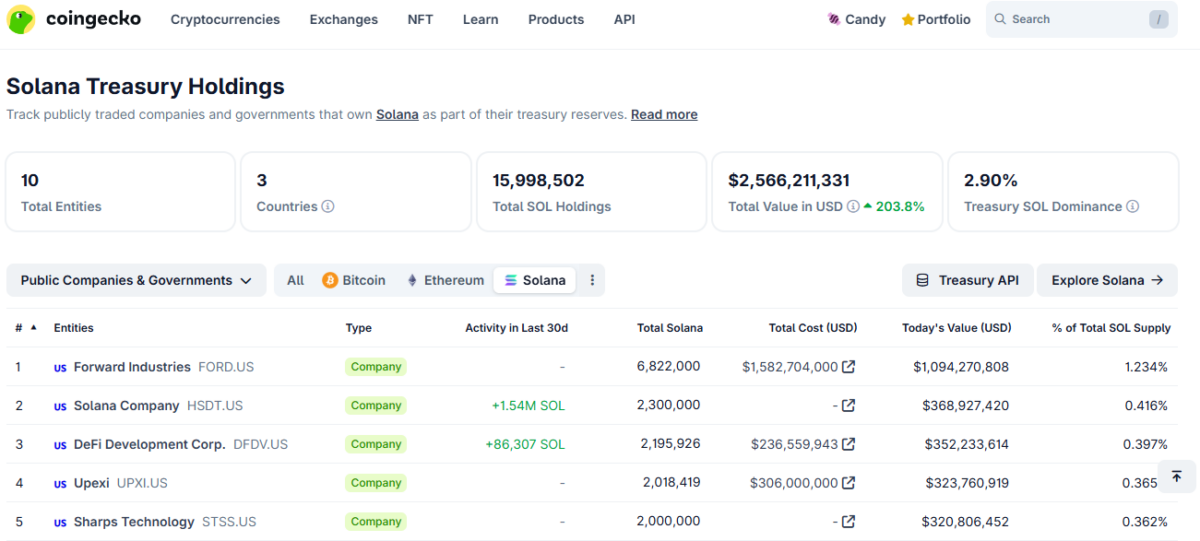

- Forward Industries has pivoted to a Solana-focused treasury model, accumulating over 6.8 million SOL tokens valued at more than $1.5 billion.

- The holdings generate a staking yield of around 7%, contributing to revenue for the company and shareholders.

- The strategy includes partnerships with major entities like Galaxy Digital and Multicoin Capital.

Investor Sentiment

- Despite the buyback plan, investor sentiment appears cautious due to potential dilution from recent private placements.

- Management aims to support market value amid short-term price fluctuations.