Franklin Templeton Launches Benji Tokenization Platform on Ethereum

Franklin Templeton is launching its Benji tokenization platform on the Ethereum network, following launches on Aptos, Avalanche, Arbitrum, and Base this year. Previously, it was only available on Stellar and Polygon.

Sandy Kaul from Franklin Templeton stated that launching on Ethereum is a significant milestone for developing innovative blockchain solutions for clients. The company aims to utilize Ethereum's Virtual Machine and smart contract functionality to enhance tokenized funds.

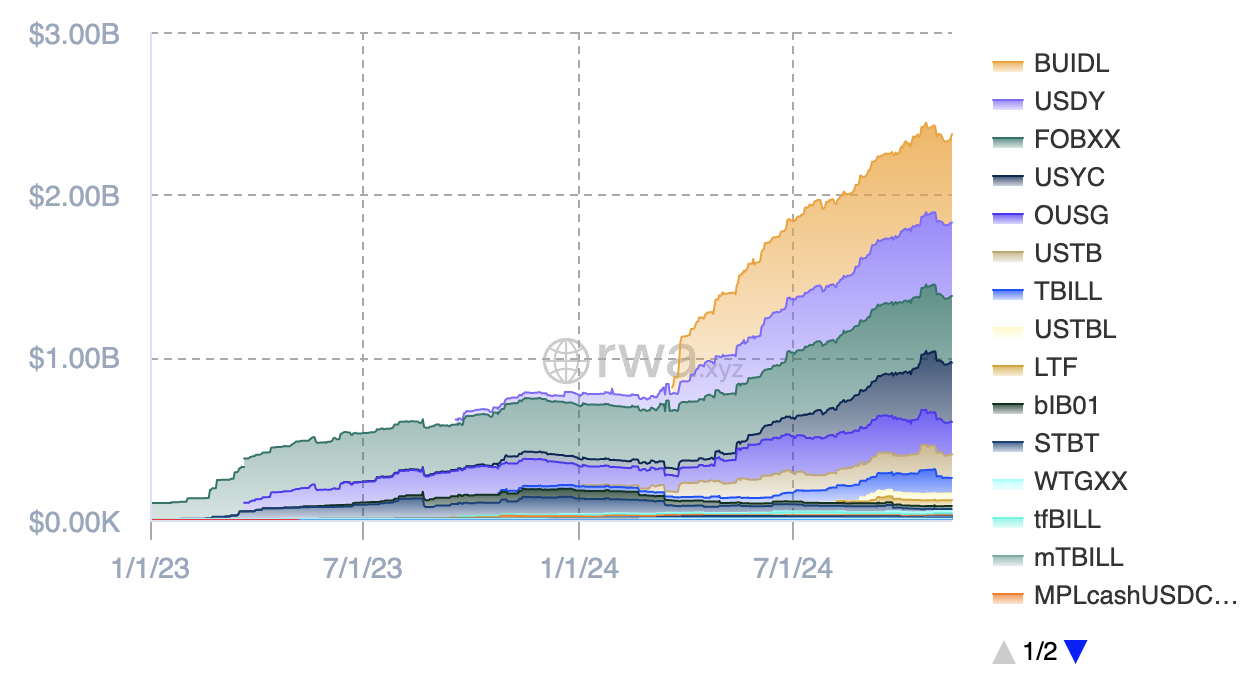

Data from rwa.xyz indicates that tokenized treasuries have increased nearly 2% in the past week, raising their total market cap to over $2.37 billion. Franklin’s on-chain market fund is valued at $409 million.

Franklin’s fund ranks as the third largest, following BlackRock’s BUIDL and Ondo’s USDY.

BUIDL is also expanding to different chains, now available on Aptos, Optimism’s OP Mainnet, Polygon, Arbitrum, and Avalanche. Securitize CEO Carlos Domingo noted that this expansion signifies maturity in the tokenized fund space. Franklin’s fund has operated since 2021 and was the first registered money market fund utilizing blockchain for transaction recording.

BlackRock’s entry into crypto gained momentum this year with the launch of bitcoin ETFs in January and BUIDL shortly thereafter. Domingo mentioned that this marks the beginning for BUIDL, which plans to introduce more features and is now issuing the same asset across multiple chains.

The tokenized fund sector is experiencing rapid growth.