FTX Token (FTT) Surges 36% Following Reorganization Plan Announcement

FTT, the native cryptocurrency of bankrupt crypto exchange FTX, increased by 36% within 24 hours, reaching $2.96. This price rally follows FTX's announcement of its reorganization plan set to begin in January 2025.

On November 21, FTX confirmed court approval for its reorganization plan. Debtors aim to finalize agreements with fund distributors in December and initiate claimant reimbursements in January 2025.

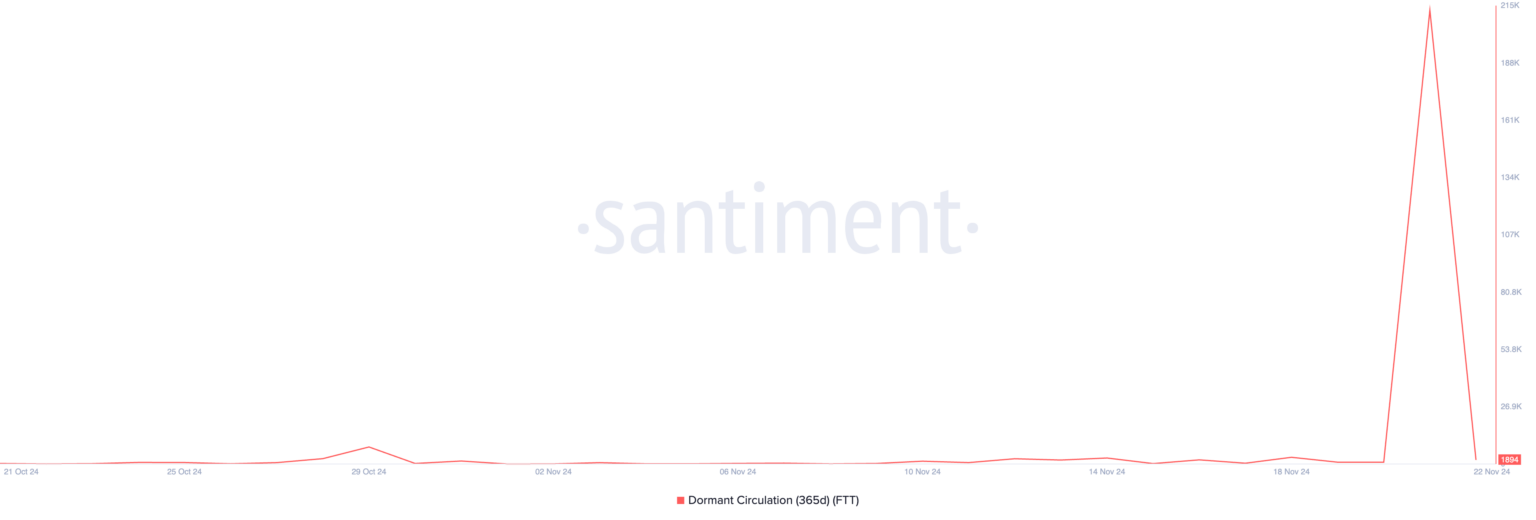

This announcement led to a surge in FTT trading activity, with several previously inactive tokens being traded. The on-chain metric, Dormant Circulation, which tracks unique coin transactions after 365 days of inactivity, rose to a 30-day high of 213,350 following the announcement.

-

Photo: Santiment

- The increase in Dormant Circulation may indicate that holders are preparing to sell, potentially putting downward pressure on the price. Conversely, it could also suggest that long-term holders are repositioning assets in anticipation of further gains.

FTX Token (FTT) Funding Rate and Price Prediction

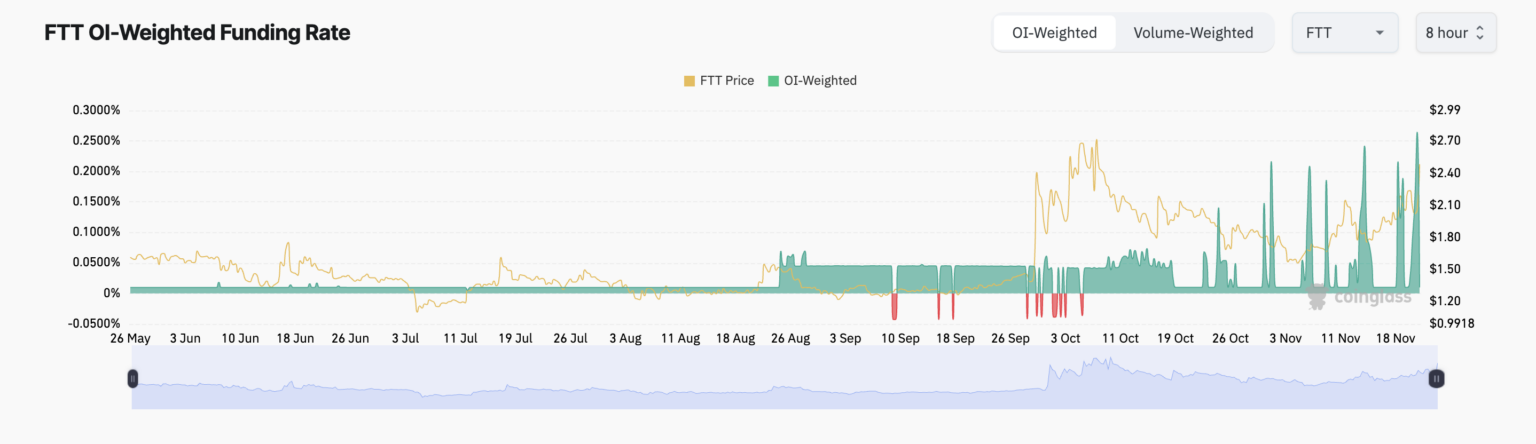

The current positive funding rate for FTT is 0.010%, indicating that futures traders anticipate further growth. Following the recent announcement, the funding rate peaked at 0.26% before declining.

-

Photo: Coinglass

- The funding rate represents payments between long and short positions in perpetual futures contracts, aligning prices with the spot market. A positive funding rate indicates bullish sentiment as more traders are betting on price increases than declines.

Currently, FTT trades at $2.56. If bullish momentum continues, it may break resistance at $2.69 and rise towards $3, with potential to reach a 2024 high of $3.43.

-

Photo: TradingView

- If dormant coins are moved to exchanges, this may exert downward pressure on FTT's price, potentially dropping it to support at $2.47. If this level fails to hold, further declines to $2.24 may occur.