28 March 2025

2 0

GameStop Stock Drops 22% Following Bitcoin Reserve Announcement

GameStop Corp (NYSE: GME) stock fell over 22% on March 27, following the announcement of plans to build Bitcoin reserves. Key points include:

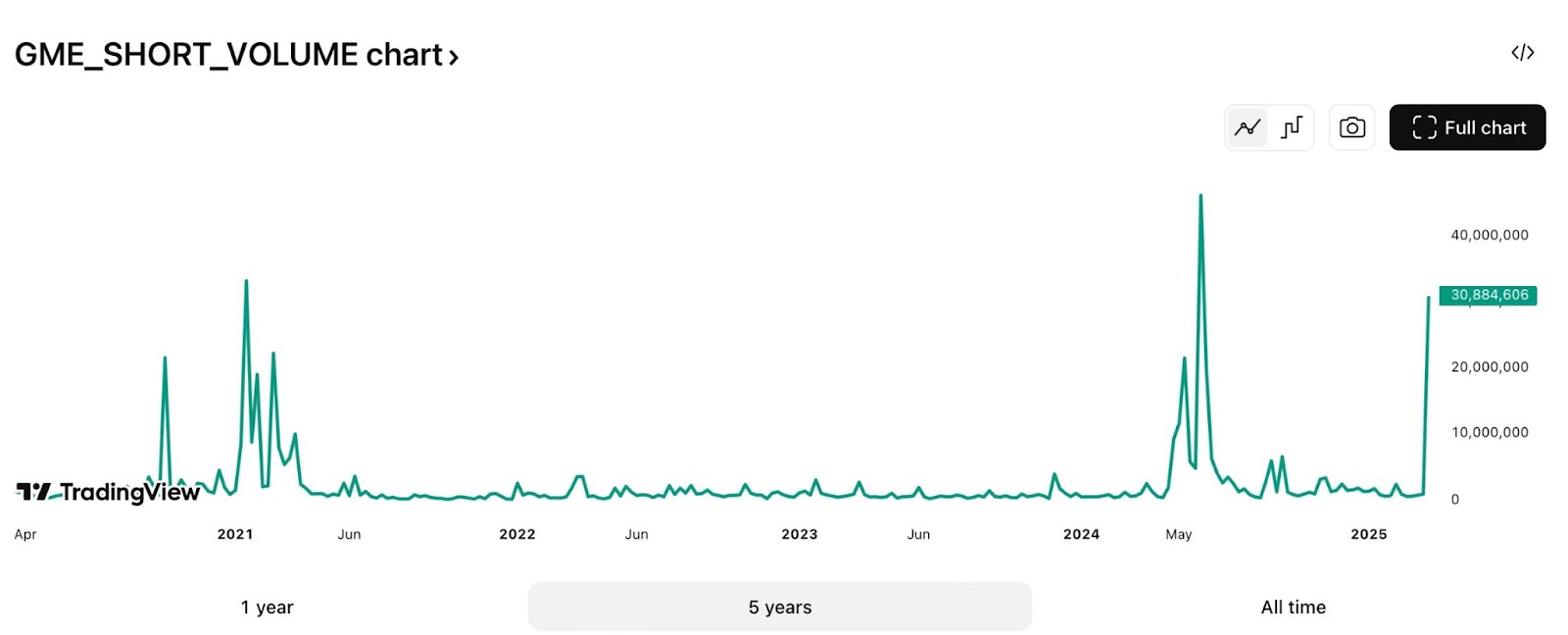

- GME trading volumes surged, prompting the NYSE to impose a Short Sale Restriction (SSR) after the price drop exceeded 10%.

- The stock lost 12% of gains made after the Bitcoin reserve announcement, closing at $22.09.

- Short sales volume increased by 234%, reaching 30.85 million shares on March 27, approaching January 2021 levels.

- GameStop plans to allocate $1.3 billion from its $4.7 billion cash reserve for Bitcoin purchases.

- Analysts suggest the stock decline is linked to the issuance of convertible notes, which often leads to hedging activities.

- Bitcoin prices also experienced selling pressure, decreasing 1.7% and falling below $86,000.