14 March 2025

26 8

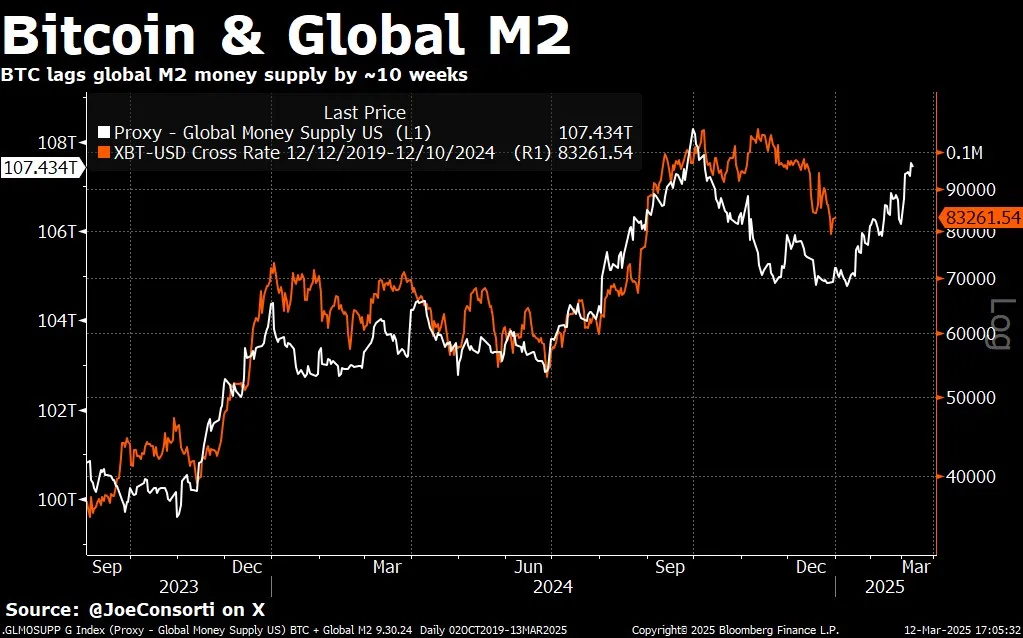

Global M2 Correlation With Bitcoin Strengthens Amid Price Fluctuations

Bitcoin's correlation with global M2 money supply has tightened, influencing its market trajectory. Recent price trends show Bitcoin aligning with M2's decline, typically with a 70-day lag. Key points include:

- Bitcoin's price fell to $78,000, closely tracking the projected M2 path.

- Global M2 has softened, affected by the strong US dollar; Bitcoin's price remains tied to liquidity fluctuations.

- Analyst Joe Consorti notes that this relationship guides understanding of macroeconomic forces affecting Bitcoin.

The announcement of the US Strategic Bitcoin Reserve (SBR) led to an 8.5% price drop, attributed to short-term profit-taking and market inefficiencies. Key details include:

- Executive Order 14233 mandates growth of Bitcoin holdings without new taxpayer costs or oversight.

- This contrasts with earlier government adoptions, which previously boosted prices.

- Market reaction indicates a failure to account for long-term implications.

Despite the SBR dip, Bitcoin may be forming a local bottom, having bounced back from $77,000 and showing reversal signals on the weekly chart. Consorti highlights:

- Hammer candlesticks at cycle-defining support levels suggest potential price reversals.

- Historical patterns indicate similar price structures precede significant upward movements.

- Bitcoin's dominance is rising even as altcoin skepticism increases; ETH/BTC hit a low of 0.0227.

Institutional demand for Ethereum has decreased significantly, with a 56.8% drop in its AUM ratio compared to Bitcoin. Current BTC trading stands at $82,875.