5 0

Gold Surpasses $30 Trillion, Bitcoin Drops Amid U.S.-China Tensions

Gold has surpassed Bitcoin as a reserve asset, reaching new highs at $4,358 per ounce and achieving a global valuation of over $30 trillion. This marks an increase of more than 60% in 2025 alone, highlighting its demand as a safe-haven asset amid economic uncertainties.

- Gold's total valuation now exceeds Nvidia by $25 trillion.

- Crypto investors are buying tokenized gold amidst these gains.

- The U.S.-China tariff tensions are contributing to Bitcoin's selling pressure.

Bitcoin's Struggles Amid Economic Tensions

Bitcoin's price dropped by 3%, falling below $108,000 due to renewed U.S.-China trade tensions. This mirrors a similar situation earlier this year that led to a 30% decline in Bitcoin's value.

- Current drop is about 13% from the recent high.

- A continued correction could push Bitcoin down to $90,000.

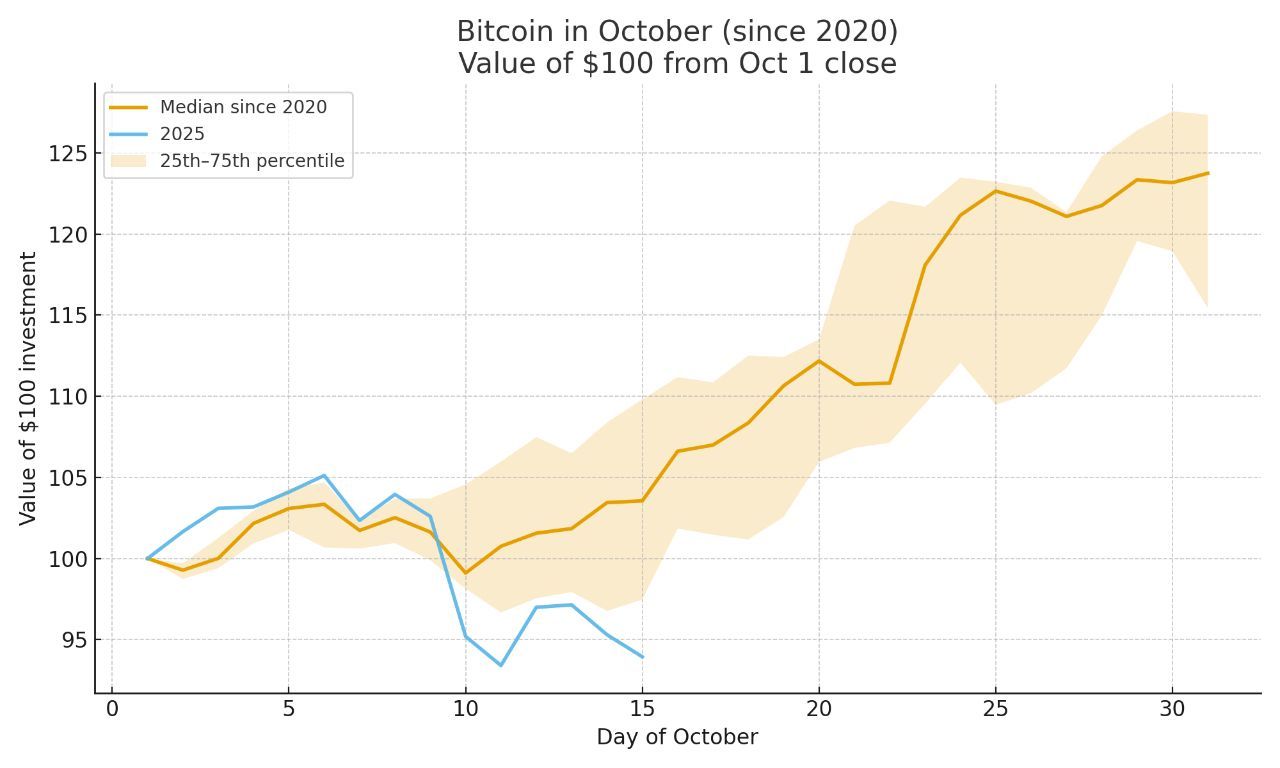

- Despite current challenges, some analysts remain optimistic about a potential late October rally.

- On-chain data indicates declining exchange reserves but increasing stablecoin liquidity, suggesting possible price surges later in the month.