4 0

Grayscale Stakes 857,600 Ethereum Worth $3.83B Amid Institutional Confidence

Ethereum Market Overview

- Ethereum's price is fluctuating between key resistance and support zones, showing market uncertainty.

- On-chain data indicates that large holders and institutions are accumulating ETH, suggesting the current volatility is seen as an opportunity.

- Staking activity remains strong, reflecting confidence in Ethereum’s network security and its role in decentralized finance.

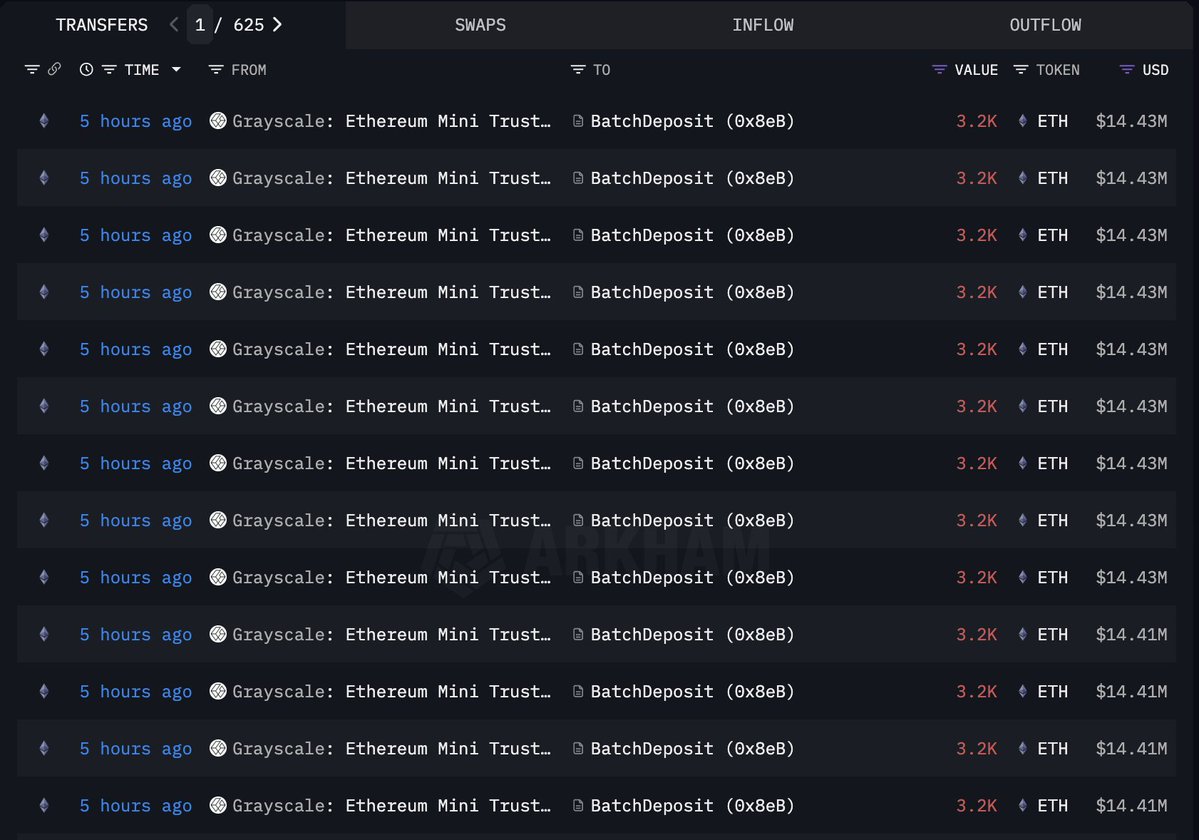

Grayscale's Major Staking Move

- Grayscale has staked an additional 857,600 ETH, valued at approximately $3.83 billion, highlighting institutional confidence in Ethereum’s long-term potential.

- This move reduces the circulating supply of ETH, adding to deflationary pressure amid high network activity.

- The scale of staking reveals growing institutional participation in Ethereum, viewing it as critical digital infrastructure.

Current Price Action

- Ethereum is trading around $4,340 after a volatile session, stabilizing near its 200-period moving average.

- Bulls aim to maintain prices above the $4,300–$4,250 range to potentially reclaim the $4,500 zone.

- If selling pressure increases and ETH falls below $4,200, a correction towards $4,000 or $3,850 is possible.

Conclusion

- Despite short-term fluctuations, Ethereum shows resilience backed by substantial on-chain accumulation and institutional staking.

- This positions Ethereum robustly within DeFi and Web3 ecosystems, potentially leading to a significant breakout supported by long-term capital investments.