4 0

Grayscale Prepares to Stake Massive Ethereum Holdings, Potential Market Impact

Institutional staking may experience a major shift as reports suggest Grayscale is preparing to stake its Ethereum holdings. This development could significantly impact the ETH market.

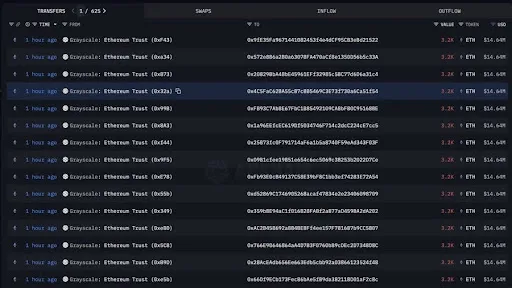

- Grayscale, one of the largest crypto asset managers, is reportedly moving over 40,000 ETH in preparation for staking.

- If confirmed, this move marks Grayscale as the first US-based ETH ETF sponsor to offer staking, amidst ongoing discussions with the SEC.

Market analyst TheKingfisher warns that the ETH GEX+ chart indicates potential volatility, with professional traders positioned short gamma at current implied volatility levels. This suggests possible sudden price swings.

- The current market environment may present opportunities for investors who can manage risk effectively, as dealer hedging becomes more aggressive.

The Gateway To Price Discovery

Ethereum's price is consolidating between $4,000 and its previous all-time high. A weekly close above its all-time high could lead to significant price moves, based on historical patterns.

- MilkRoadDaily notes that a similar past event saw ETH increase by 240%, potentially projecting a new target around $16,500 if history repeats.