9 0

Crypto Projects Struggle to Justify Layer 1 Valuations Amid Identity Crisis

Startups often attempt to portray themselves as "tech firms" to achieve higher valuations, but few succeed in matching the fundamentals of true tech companies. Many traditional institutions rebranded as fintechs without achieving corresponding market multiples.

Key points include:

- Examples like WeWork and Goldman Sachs' Marcus illustrate failures in this strategy.

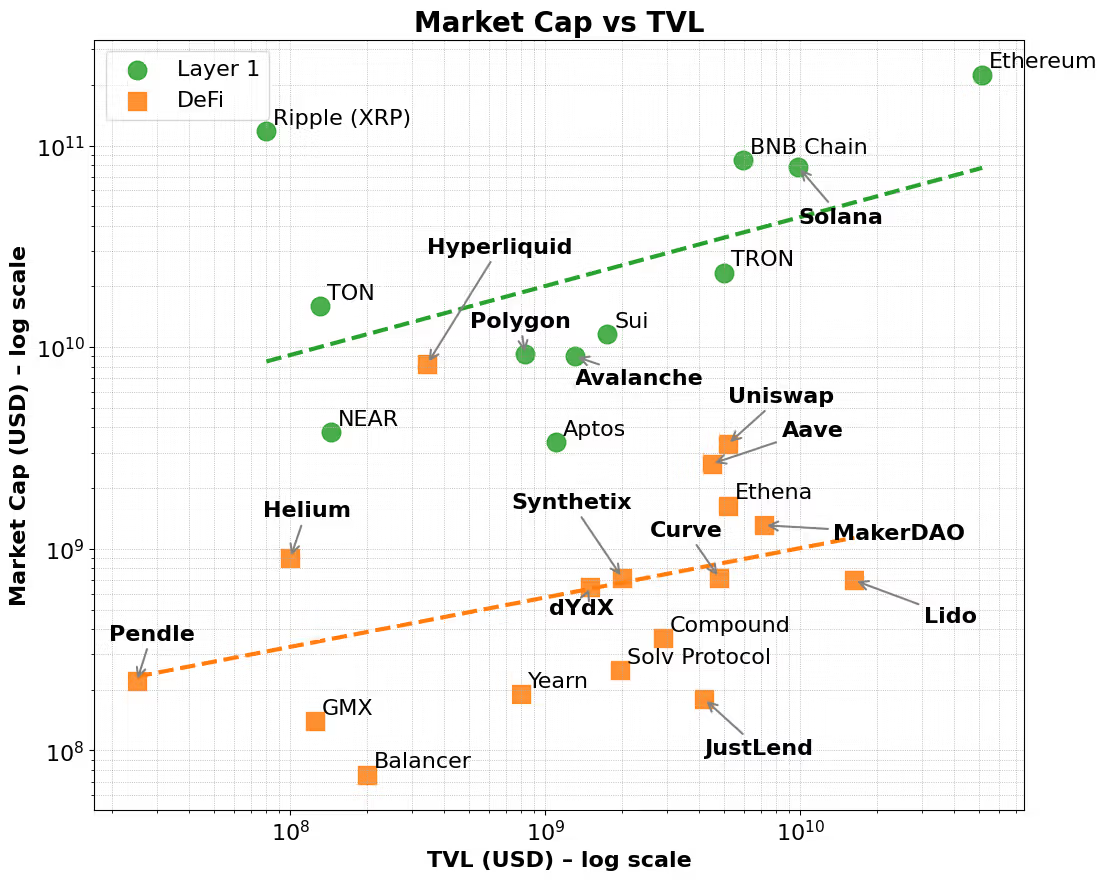

- Crypto faces a similar identity crisis, with DeFi protocols seeking Layer 1 valuations despite lacking essential infrastructure qualities.

- Layer 1 networks such as Ethereum and Solana command higher multiples due to their broader market narrative and ecosystem growth potential.

- Many DeFi protocols struggle to achieve comparable market capitalizations despite strong Total Value Locked (TVL).

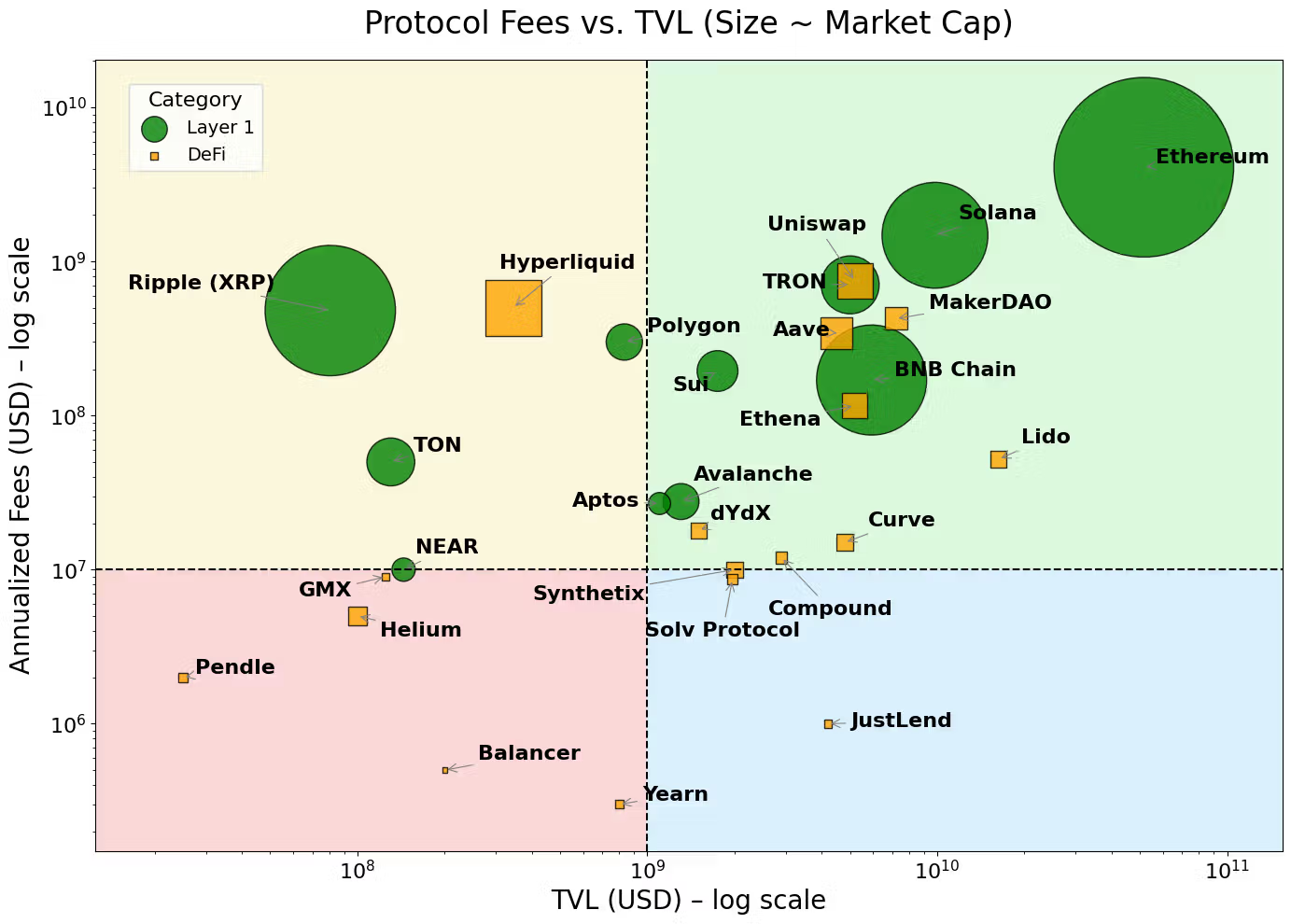

- Layer 1s benefit from mechanisms that create network effects and incentivize developers and users.

- Appchains, which integrate application logic and settlement layers, promise better fee capture and user experience, though many simply rebrand existing protocols without meaningful differentiation.

- RWA protocols risk falling into the same trap by positioning as infrastructure without proven user adoption or functionality.

- The path forward requires focusing on real economic activity and sustainable fee generation rather than claiming infrastructure status.

- Successful examples include established protocols evolving towards appchain models while maintaining strong ecosystems.

- The crypto industry needs better products rather than more Layer 1s to attract investor interest.

As the market matures, the emphasis will be on protocols demonstrating clear value propositions and sustainable economics.

Figure 1. Market Cap vs TVL for DeFi and Layer 1s

Figure 2. Layer 1s are clustered around higher fees and dApps around lower fees