Bitcoin S2F Reversion Metric Signals Optimal Profit-Taking Strategies

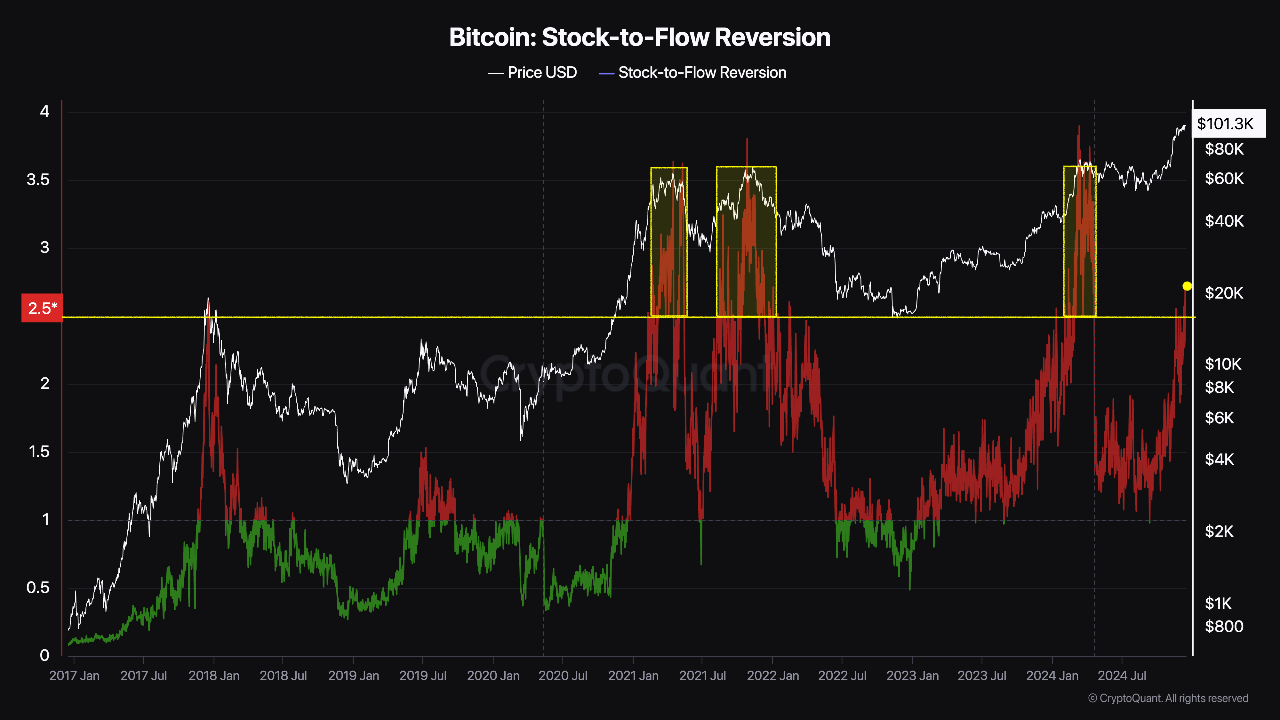

Bitcoin's recent price momentum has led to renewed interest in key metrics for market timing. The Stock-to-Flow (S2F) reversion metric, analyzed by CryptoQuant's Darkfost, is significant for Bitcoin investors.

When Should Cash In Your Bitcoin Profits?

Darkfost identified September 11 as a critical date when the S2F reversion metric fell below 1, indicating a buy opportunity at $57,000. A value above 2.5 historically suggests a favorable time for moderate profit-taking, while a level above 3 often indicates market overheating, signaling larger profit-taking strategies.

Darkfost recommends a two-step strategy: secure smaller gains at 2.5 and larger profits above 3. He noted:

A prudent strategy when using this indicator is to take moderate profits once the S2F reversion ratio hits 2.5 and to secure larger profits when the ratio exceeds 3, thereby balancing risk and reward effectively.

BTC Market Performance

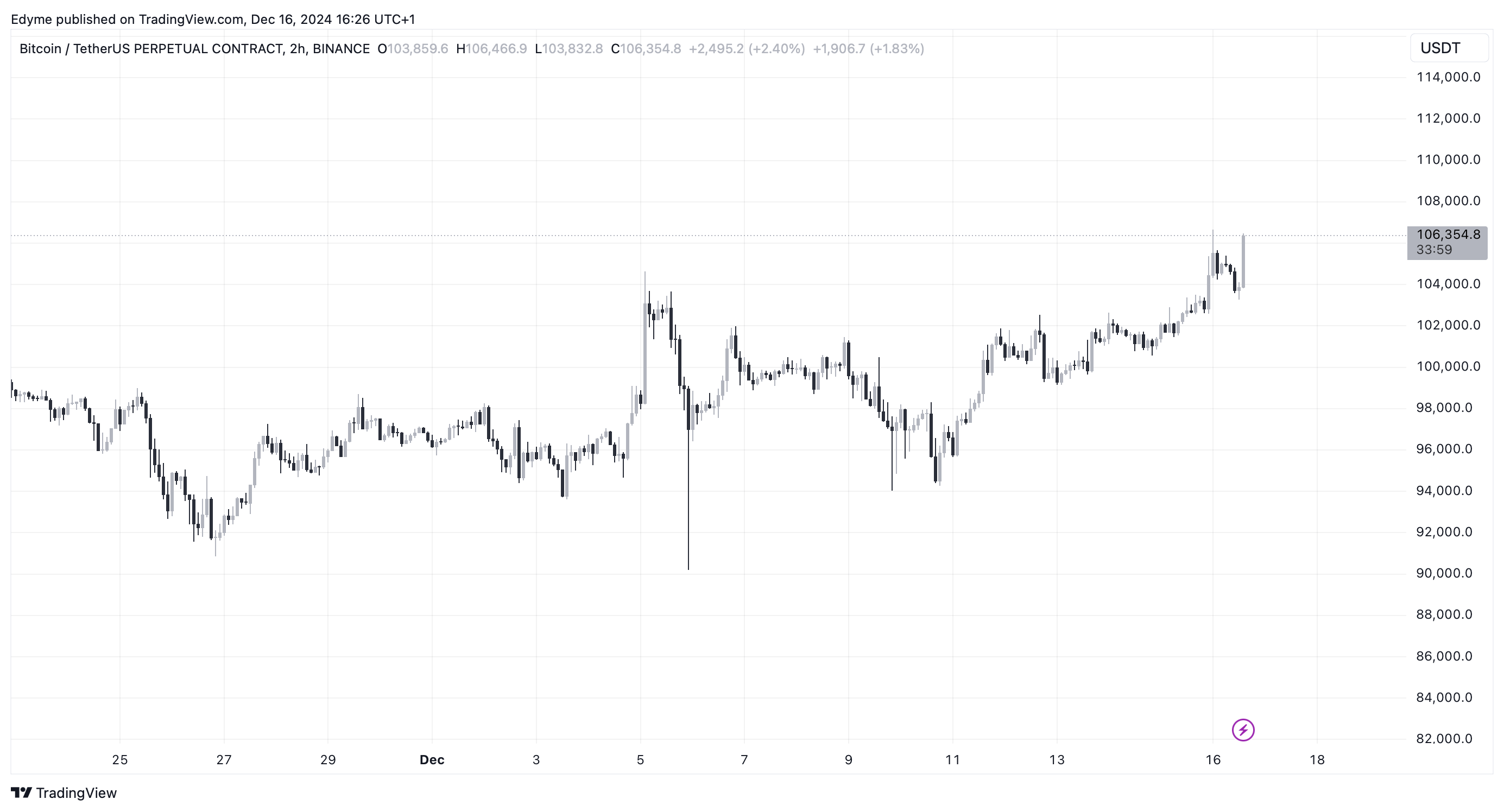

Despite Darkfost's suggestions, Bitcoin continues its upward momentum, reaching a new all-time high of $106,352 on Monday. Currently, BTC trades at $105,942, up over 3% in the past day and more than 10% in the last two weeks.

As of today, Bitcoin's market capitalization exceeds $2 trillion. However, daily trading volume has declined; currently at $97.4 billion, down from over $140 billion on December 10 despite the recent price surge.

Featured image created with DALL-E, Chart from TradingView