8 0

Private Credit Tokenization Surpasses $12.9 Billion in Onchain Assets

BlackRock CEO Larry Fink stated in a recent investor letter that all traditional assets can be tokenized, which could revolutionize investing by enabling instant transactions and reinvesting immobilized funds into the economy.

Key points include:

- Private credit leads asset tokenization with $12.9 billion onchain, surpassing tokenized T-bills ($6.2 billion), commodities ($1.4 billion), and equities ($484 million).

- The global private credit market is valued at approximately $2 trillion and projected to grow to $3 trillion by 2028.

- Traditional private credit faces issues of limited access for accredited investors and illiquidity due to lack of public markets.

- Blockchain technology can address these challenges, making private credit more accessible and transparent.

DeFi Onchain Credit Overview

- Figure dominates DeFi private credit with $9.9 billion in active loans, utilizing the Provenance blockchain.

- Tradable has tokenized $1.8 billion in various institutional-grade private credit positions on ZKsync L2 chain.

- Maple Finance offers retail access to private credit yields through its pooled model, overseen by pool delegates.

- Onchain private credit is still perceived as securities, restricting retail investor participation due to regulatory frameworks.

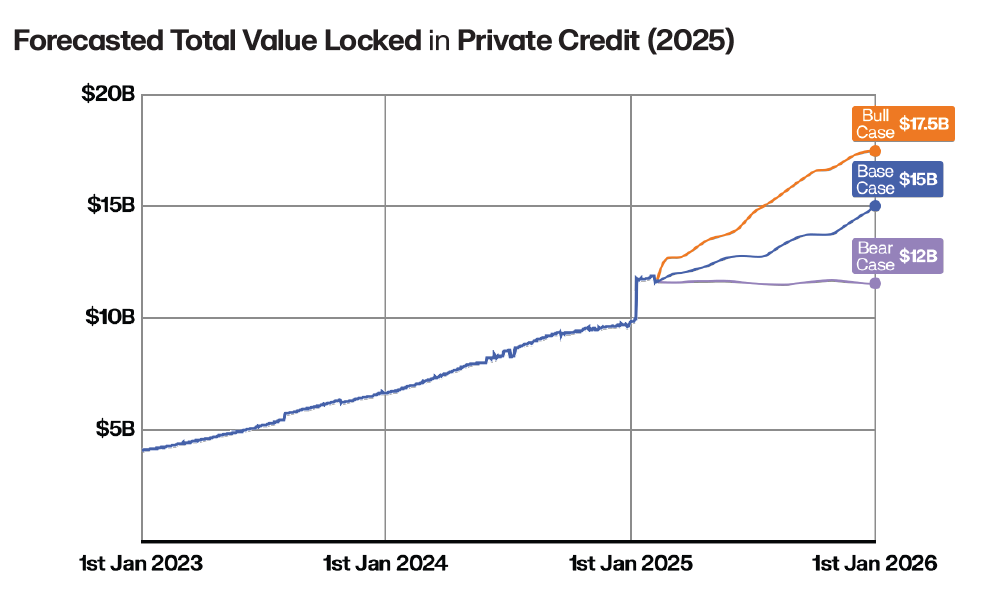

- Keyrock estimates onchain private credit could grow to $15-17.5 billion by 2026.