Updated 24 December

Key Metrics Indicate User Engagement Trends for SOL, ETH, and Other Chains in 2025

Web3 is inundated with metrics that often obscure vital aspects such as user engagement quality and growth potential. As the industry matures, data-driven signals of success have become essential.

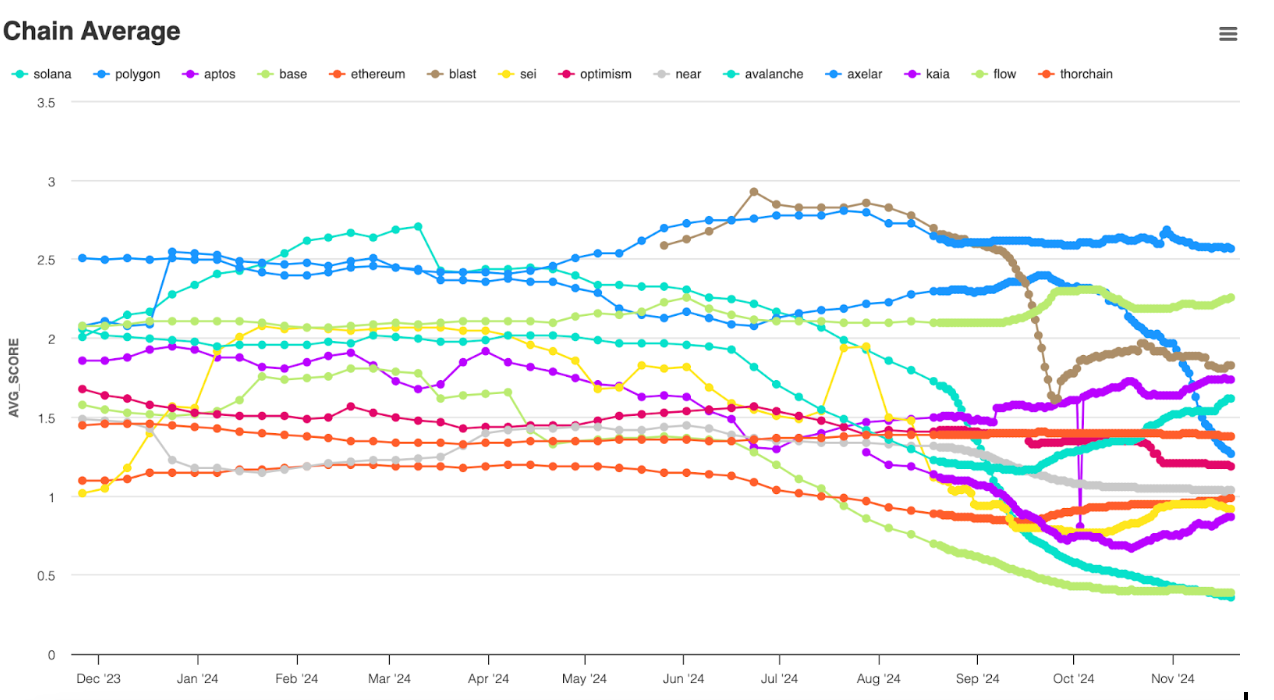

The tools to analyze these metrics exist. By aggregating multiple on-chain metrics into a “health index” score reflecting overall user engagement quality, we can identify chains that are thriving and positioned for long-term growth. This analysis focuses on current leading chains and expectations for 2025.

Assessing User Quality Using Aggregated Data

To create a sustainable on-chain ecosystem, it is crucial to consider broader contexts rather than optimizing single user actions. A promising method involves categorizing user behaviors into five core areas:

- Transaction Activity: Includes spot trades and smart contract interactions.

- Token Accumulation: Involves medium-to-long-term investment behaviors.

- DeFi Engagement: Covers staking, lending, and liquidity provision activities.

- NFT Activity: Encompasses minting, trading, and utility-driven interactions.

- Governance Participation: Measures contributions to DAO or protocol governance.

These metrics should be weighted and combined using a Bayesian model to generate a comprehensive score. This approach incorporates prior knowledge and actual on-chain activity, making the scores more difficult to manipulate and providing actionable insights.

What the Data Reveals About 2024

This analytical framework offers new perspectives on chain user activity. Notable findings include:

Solana (top light blue line) attracted many high-quality users early in the year, but engagement quality has since declined. This drop aligns with SOL’s price spike and ongoing memecoin activity, indicating that repetitive actions yield diminishing returns.

Ethereum supporters (bottom orange line) anticipated significant changes due to ETH ETFs; however, Ethereum’s stable user score indicates limited ecosystem participation beyond initial developments.

Axelar (dark blue line), despite its smaller size by TVL, demonstrated active user engagement across various on-chain activities, highlighting its potential for growth without reliance on market cap or trading volume alone.

These scores are most effective for tracking changes in user activity quality over time rather than cross-chain comparisons.

Predictions for 2025

Looking ahead, Solana must retain its casual user base and broaden their on-chain interactions to avoid a downturn once memecoin interest wanes. Early 2024 data suggests a resilient core user group will persist regardless of short-term market fluctuations.

Axelar successfully attracted a diverse user base engaged in sustained activities, presenting challenges for scaling while maintaining user quality. Building strategic partnerships and improving user onboarding will be critical for its growth.

With Ethereum’s fragmentation shifting users to faster L2 solutions, mainnet activity may consolidate around core functions like staking and governance. This specialization could affect scoring systems that favor wide-ranging engagement.

A Better Approach to On-Chain Growth

Web3 has historically prioritized the wrong metrics, hindering aggregate data analysis. In 2025, success will favor those who adopt multivariate measures focused on user quality.

On-chain intelligence platforms can enhance investor insights by integrating new scoring methods. Web3 developers can leverage these scores to prioritize initiatives that drive user engagement and value creation, fostering a shift from hype-driven narratives to data-backed strategies that maximize Web3's potential moving forward.