0 0

BULLISH 📈 : Hong Kong Grants Stablecoin Sandbox Access While Bitcoin Hyper Soars

Hong Kong is positioning itself as a global crypto hub, advancing its stablecoin issuer sandbox through the Hong Kong Monetary Authority (HKMA). This includes testing by subsidiaries of Chinese e-commerce giants and banks like Standard Chartered.

- Stablecoins are being integrated into the regulated banking sector in Hong Kong, potentially allowing billions in institutional liquidity to flow on-chain.

- Bitcoin's current infrastructure poses challenges for high-frequency settlements due to slow block times.

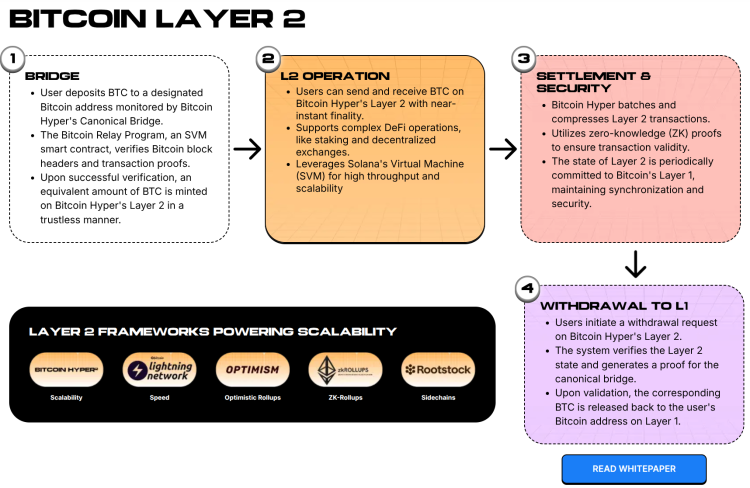

- The market is seeing a shift towards Layer 2 solutions to address these scalability issues.

Bitcoin Hyper ($HYPER) Developments

- Bitcoin Hyper is introducing a Bitcoin Layer 2 solution integrated with Solana Virtual Machine (SVM) to enhance transaction speed.

- This architecture allows complex DeFi applications and fast stablecoin payments within the Bitcoin ecosystem.

- It enables $BTC to be used as a high-velocity asset via a decentralized canonical bridge.

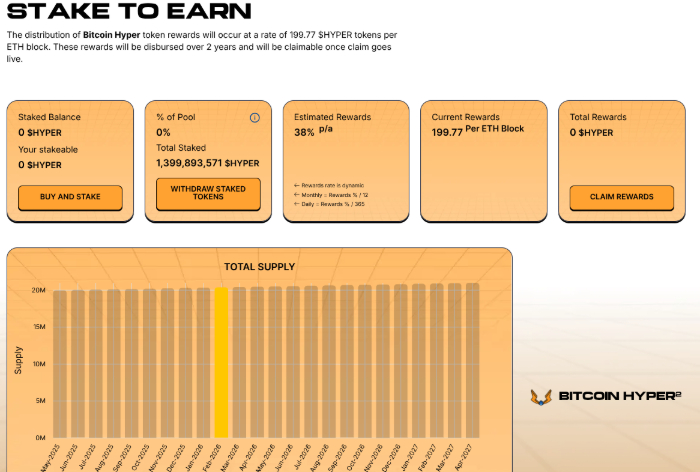

Bitcoin Hyper has seen significant community engagement, raising over $31M in presales. Tokens are priced at $0.013675, reflecting potential growth in the programmable Bitcoin economy.

- The project offers high APY incentives of 38% with immediate staking available post-TGE and a 7-day vesting period for presale stakers.

- Rewards are provided for community governance participation to ensure long-term network stability.

This reflects a trend towards Layer 2 solutions that make Bitcoin more usable for the global financial system, aligning with Hong Kong's push for stablecoin integration.