Injective Integrates Fetch.ai and ASI Community with 100% Voting Approval

Injective, a DeFi-focused protocol, has made significant advancements recently, highlighting its high throughput and low fees while safeguarding traders from maximal extractive value (MEV) bots. The platform has also formed important partnerships.

Injective Integrates With Fetch.ai And ASI

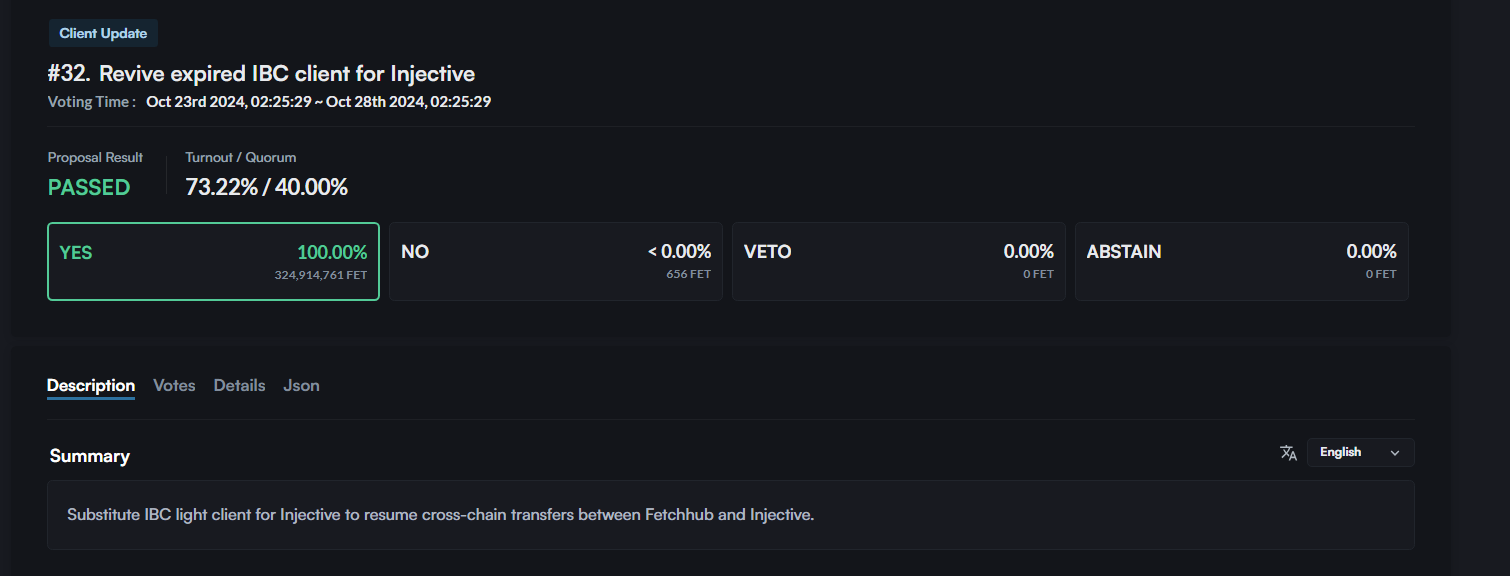

This week, the proposal by Fetch.ai and the Artificial Superintelligence Alliance (ASI) community to integrate with Injective received unanimous approval. The proposal passed with 100% of the votes in favor.

Voting data shows over 324 million FET supported the initiative, while only 656 FET opposed it. No abstentions or vetoes were recorded. Voting commenced on October 23 and concluded five days later on October 28.

The proposal aims to revive the expired IBC client for Injective. This integration allows Fetch.ai, now part of the ASI Alliance, to leverage AI capabilities within the Injective DeFi ecosystem.

As a result, users will have access to enhanced AI-enabled tools for trading, alongside better liquidity management and asset allocation.

Despite this collaboration, Injective and ASI will maintain independent operations. The integration does not constitute a merger but enables Injective to utilize ASI's AI capabilities.

Why Is INJ Down?

Despite the positive developments, INJ prices have declined. An analysis of the daily chart indicates that Injective bulls have not yet fully recovered losses from October 25. Although there were higher highs over the weekend and early in the week, sellers remain dominant.

Currently, INJ is down 20% from October highs, consolidating around the $10 level. Resistance is identified at $25, while support lies at $15. A return of bullish momentum in Q1 2024 could lead to increased activity if buyers surpass the $25 threshold.

In addition to improving crypto sentiment and rising total value locked (TVL) across DeFi, INJ may benefit from Injective's core feature.

The protocol boasts the highest revenue-to-fully diluted valuation (FDV) ratio, outperforming Ethereum. This metric indicates an effective revenue generation mechanism that could positively influence prices.