29 0

Ink Foundation to Launch INK Token with Aave-Powered Liquidity Protocol

The Ink Foundation is launching its native token INK to develop on-chain capital markets with a liquidity-first strategy. Key details include:

- Token will launch on a DeFi lending and trading protocol built on Aave.

- Distribution starts with an airdrop for early users.

- INK has a hard cap of 1 billion tokens, with no governance changes allowed on supply.

- Layer 2 governance will remain separate from the token.

- First utility is a liquidity protocol for lending and capital deployment.

- Airdrops will be managed by a subsidiary to prevent farming.

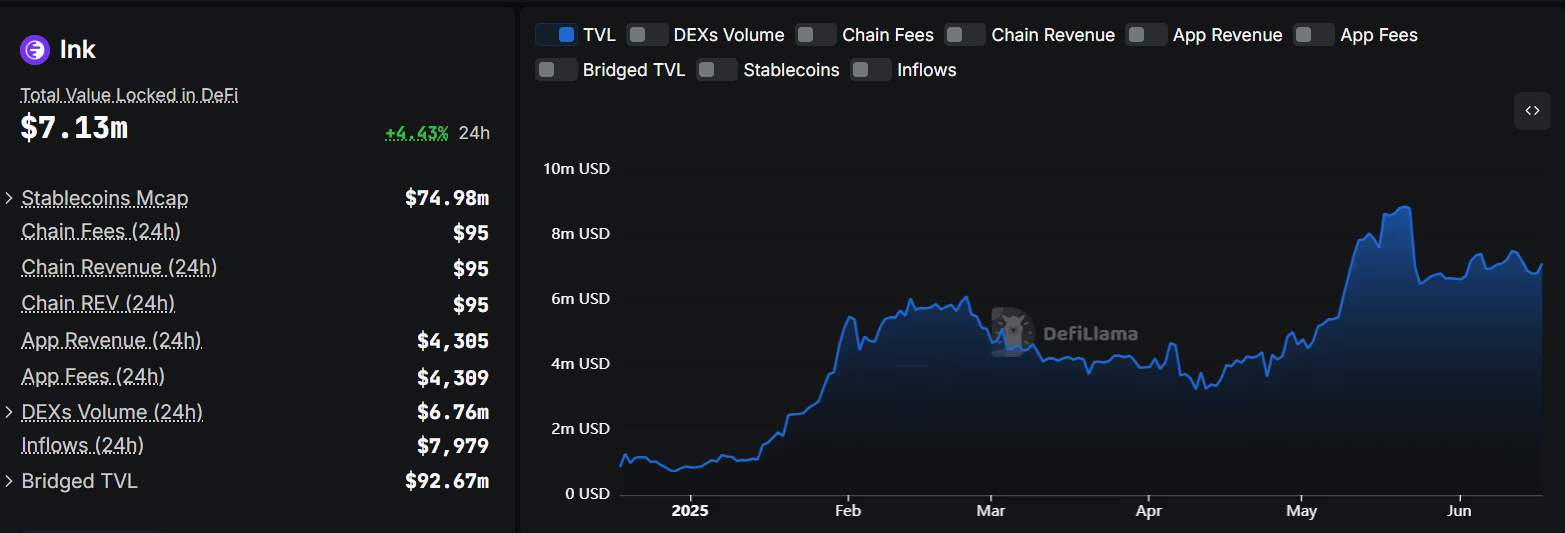

Despite these efforts, INK enters a competitive market where new tokens often experience price declines after launch. Recent examples include Linea, Blast, Celestia, and Berachain, which faced sustained selling pressure. Currently, Ink's DeFi stack holds over $7 million in total value locked but reported only $93 in revenue within the last 24 hours, indicating limited usage.

By linking its token to a functioning product at launch, Ink aims to differentiate itself from the trend of poor token launches.